Many of us receive our salary slip every month, open the email, take a quick glance (maybe at the net pay), and then forget about it. But have you ever wondered what this piece of paper or PDF actually means?

Whether you’re a fresher joining your first job or someone with years of experience, understanding your salary slip is crucial not just to know how much you’re earning, but to also make better financial decisions.

Why it matters, what it contains, and how it impacts your life. And yes, we’ll break down those confusing terms like HRA, PF, and TDS with relatable examples.

What is a Salary Slip?

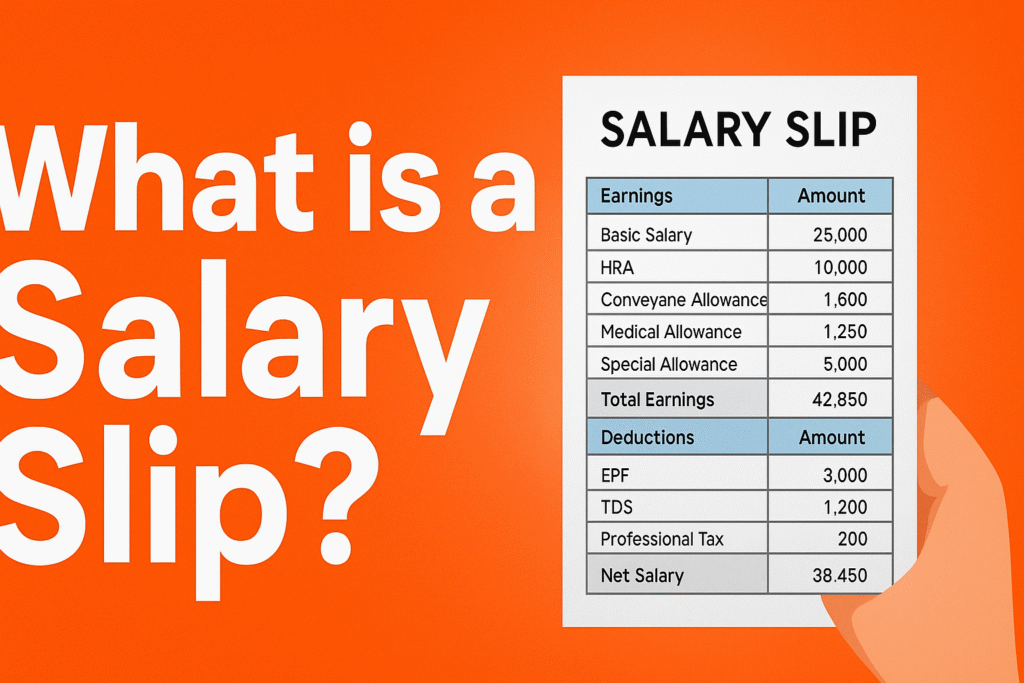

A salary slip (also known as a payslip) is an official document issued by an employer every month to an employee. It contains a detailed breakdown of your earnings, deductions, and the net salary you take home.

Think of it as your monthly salary report card. It tells you:

- How much your employer is paying you

- What benefits or allowances you’re getting

- What deductions are being made (tax, PF, etc.)

- How much money is actually credited to your account

It may be printed or sent digitally, but its importance remains the same.

Why is a Salary Slip Important?

Let’s not underestimate this humble document. It plays a bigger role in your life than you might think. Here’s how:

1. For Loans and Credit Cards

Banks love salary slips. They use them to check your income when you apply for:

- Home loans

- Personal loans

- Car loans

- Credit cards

A salary slip proves your repayment capacity

Ravi, a software engineer in Bangalore, wanted to buy his first car. When he applied for a car loan, the bank asked for his last 3 months’ salary slips. These slips helped the bank verify his income and approve the loan quickly.

2. For Income Tax Filing

Salary slips show the exact tax deductions (TDS) made by your employer. It helps you:

- Cross-check with Form 16

- Plan your investments

- Save tax efficiently

3. For Future Jobs

When switching jobs, companies ask for your last drawn salary proof. Your salary slip is the most authentic proof.

Sneha got a new job offer with a 30% hike. But HR asked her to submit her latest salary slip to calculate the final CTC. Without it, her joining process would have been delayed.

4. For Personal Budgeting

Knowing how much you earn after deductions helps you plan better. You can set budgets for:

- Rent

- Savings

- EMI

- Lifestyle expenses

Components of a Salary Slip: What It Contains

Let’s open up a typical salary slip and see what it actually includes. It’s divided into two major sections:

Earnings (Additions)

- Basic Salary

- The fixed portion of your salary.

- Usually 30-40% of your total CTC.

- Basis for calculating HRA, PF, gratuity, etc.

- House Rent Allowance (HRA)

- Provided if you live in a rented house.

- Can be used to claim income tax benefits.

- Dearness Allowance (DA)

- Mainly for government employees.

- Helps cope with inflation.

- Conveyance Allowance

- Provided to cover travel expenses from home to office.

- Medical Allowance

- To cover medical expenses (fixed amount).

- Special Allowance / Other Allowances

- The balancing figure to meet your total salary.

- Taxable unless specified otherwise.

- Bonus or Incentives

- Variable, based on performance.

Deductions

- Employee Provident Fund (EPF)

- 12% of your basic pay is deducted.

- Employer contributes an equal amount.

- It helps you build retirement savings.

- Professional Tax

- A small monthly tax collected by the state government (only in some states like Maharashtra, Karnataka, etc.)

- Income Tax / TDS

- Based on your salary slab.

- Deducted monthly if your salary crosses the exemption limit.

- ESIC (Employee State Insurance)

- Applicable if your salary is less than ₹21,000 (mostly in manufacturing or lower-wage jobs).

Net Salary = Earnings – Deductions

This is what gets credited to your bank account.

👉 Example:

If your earnings total ₹60,000 and deductions are ₹8,000, your net salary will be ₹52,000.

Digital vs. Physical Salary Slips

In today’s digital world, most companies email you the salary slip or make it downloadable from an HR portal. It is equally valid as a printed version. You can:

- Download it in PDF format

- Save it for future reference

- Submit it wherever required

Download this article

376079 643779great work Exceptional weblog here! Also your internet website a great deal up fast! What web host are you the usage of? Can I get your associate link on your host? I want my web site loaded up as rapidly as yours lol 342400

446248 597160Woh I like your content , saved to bookmarks ! . 301033

142220 283841I was examining some of your content material on this internet site and I believe this website is rattling instructive! Keep putting up. 275320

652148 601652This web site is my inhalation, genuinely great layout and Perfect written content. 425460

949170 762082This constantly amazes me exactly how blog owners for example yourself can discover the time and also the commitment to maintain on composing amazing weblog posts. Your website isexcellent and 1 of my own ought to read blogs. I just want to thank you. 812544

w37b5q

Everyone loves what you guys are usually up too. This sort of clever work and exposure! Keep up the terrific works guys I’ve you guys to our blogroll.

815768 693798Merely wanna state that this is quite beneficial , Thanks for taking your time to write this. 765762

fcftmn

xwhucw

207699 48185Thanks for blogging and i enjoy the blog posting so no public comments.,,,,,,,,,,, 466472

92938 650123 There is noticeably a bundle to know about this. I assume you created certain good points in attributes also. 418581

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

F*ckin’ remarkable things here. I’m very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you please drop me a e-mail?

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Nhà cái slot365 casino cung cấp dịch vụ cá cược thể thao đỉnh cao, cho phép bạn đặt cược vào nhiều môn thể thao khác nhau như bóng đá, bóng rổ, tennis và nhiều môn khác.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

BetPK22, haven’t heard of it… But seeing the logo now, can remember seeing the ads around. I might try it out, seems fine for a lazy Sunday. Maybe you’ll like it too?: betpk22

Thanks for the post, how can I make is so that I receive an alert email whenever you write a fresh update?

181867 443999Hey there. I want to to ask a bit somethingis this a wordpress internet log as we are preparing to be transferring more than to WP. Additionally did you make this template all by yourself? Many thanks. 667825

купить дайсон стайлер с насадками для волос цена официальный сайт [url=http://fen-d-3.ru]http://fen-d-3.ru[/url] .

покупка курсовых работ [url=http://kupit-kursovuyu-21.ru]http://kupit-kursovuyu-21.ru[/url] .

написать курсовую работу на заказ в москве [url=http://kupit-kursovuyu-23.ru/]http://kupit-kursovuyu-23.ru/[/url] .

курсовая работа недорого [url=https://kupit-kursovuyu-28.ru/]курсовая работа недорого[/url] .

dyson сайт официальный в россии [url=fen-d-3.ru]fen-d-3.ru[/url] .

курсовая работа на заказ цена [url=https://kupit-kursovuyu-21.ru]https://kupit-kursovuyu-21.ru[/url] .

курсовой проект цена [url=https://kupit-kursovuyu-23.ru/]kupit-kursovuyu-23.ru[/url] .

курсовая заказать недорого [url=http://www.kupit-kursovuyu-28.ru]http://www.kupit-kursovuyu-28.ru[/url] .

помощь студентам контрольные [url=https://kupit-kursovuyu-22.ru/]https://kupit-kursovuyu-22.ru/[/url] .

фен купить дайсон официальный [url=https://fen-d-3.ru/]фен купить дайсон официальный[/url] .

курсовой проект купить цена [url=https://kupit-kursovuyu-21.ru]https://kupit-kursovuyu-21.ru[/url] .

курсовые купить [url=https://kupit-kursovuyu-23.ru]https://kupit-kursovuyu-23.ru[/url] .

дайсон официальный сайт интернет магазин [url=http://www.fen-d-3.ru]http://www.fen-d-3.ru[/url] .

заказать качественную курсовую [url=https://kupit-kursovuyu-22.ru/]kupit-kursovuyu-22.ru[/url] .

курсовые заказ [url=https://kupit-kursovuyu-21.ru/]https://kupit-kursovuyu-21.ru/[/url] .

где можно заказать курсовую [url=https://kupit-kursovuyu-23.ru/]https://kupit-kursovuyu-23.ru/[/url] .

купить курсовая работа [url=kupit-kursovuyu-22.ru]kupit-kursovuyu-22.ru[/url] .

заказать дипломную работу в москве [url=http://www.kupit-kursovuyu-22.ru]http://www.kupit-kursovuyu-22.ru[/url] .

купить фен dyson оригинал [url=stajler-d-1.ru]купить фен dyson оригинал[/url] .

дайсон купить стайлер официальный сайт [url=www.stajler-d-2.ru/]www.stajler-d-2.ru/[/url] .

купить фен дайсон оригинал в москве официальный сайт [url=https://stajler-d.ru]https://stajler-d.ru[/url] .

дайсон официальный сайт фен [url=http://stajler-d-2.ru/]http://stajler-d-2.ru/[/url] .

dyson фен оригинал купить [url=www.stajler-d-1.ru/]dyson фен оригинал купить[/url] .

дайсон купить стайлер для волос с насадками цена официальный сайт [url=https://stajler-d.ru]https://stajler-d.ru[/url] .

дайсон сайт официальный [url=www.stajler-d-2.ru]www.stajler-d-2.ru[/url] .

стайлер дайсон для волос с насадками купить официальный сайт цена [url=www.stajler-d-1.ru/]www.stajler-d-1.ru/[/url] .

фен дайсон официальный сайт [url=https://stajler-d.ru/]https://stajler-d.ru/[/url] .

дайсон фен купить официальный сайт [url=www.stajler-d-2.ru]дайсон фен купить официальный сайт[/url] .

купить дайсон стайлер с насадками для волос официальный сайт цена [url=www.stajler-d-1.ru/]www.stajler-d-1.ru/[/url] .

стайлер для волос дайсон с насадками официальный сайт купить цена [url=https://stajler-d.ru/]stajler-d.ru[/url] .

официальный сайт дайсон в россии каталог цены [url=http://fen-dn-kupit-1.ru/]http://fen-dn-kupit-1.ru/[/url] .

купить дайсон стайлер для волос официальный сайт цена с насадками [url=http://fen-dn-kupit-1.ru/]http://fen-dn-kupit-1.ru/[/url] .

стайлер для волос дайсон цена с насадками официальный сайт купить [url=https://www.fen-dn-kupit-1.ru]https://www.fen-dn-kupit-1.ru[/url] .

дайсон фен купить в москве оригинал [url=www.fen-dn-kupit-1.ru]дайсон фен купить в москве оригинал[/url] .

мелбет скачать приложение [url=https://studio-pulse.ru/]мелбет скачать приложение[/url] .

школьное образование онлайн [url=www.shkola-onlajn1.ru]www.shkola-onlajn1.ru[/url] .

мелбет промокод при регистрации [url=https://studio-pulse.ru/]мелбет промокод при регистрации[/url] .

дистанционное школьное образование [url=www.shkola-onlajn1.ru/]www.shkola-onlajn1.ru/[/url] .

melbet промокод при регистрации [url=https://studio-pulse.ru/]melbet промокод при регистрации[/url] .

ломоносов скул [url=http://www.shkola-onlajn1.ru]http://www.shkola-onlajn1.ru[/url] .

мелбет казино скачать на андроид [url=https://studio-pulse.ru/]мелбет казино скачать на андроид[/url] .

класс с учениками [url=https://shkola-onlajn1.ru/]https://shkola-onlajn1.ru/[/url] .

потолочник отзывы [url=natyazhnye-potolki-samara-5.ru]natyazhnye-potolki-samara-5.ru[/url] .

натяжные потолки потолочкин отзывы нижний новгород [url=http://natyazhnye-potolki-nizhniy-novgorod-4.ru]http://natyazhnye-potolki-nizhniy-novgorod-4.ru[/url] .

световые линии натяжные на потолки ру сайт [url=www.natyazhnye-potolki-samara-5.ru/]www.natyazhnye-potolki-samara-5.ru/[/url] .

потолочкин натяжные потолки отзывы [url=http://www.natyazhnye-potolki-nizhniy-novgorod-4.ru]http://www.natyazhnye-potolki-nizhniy-novgorod-4.ru[/url] .

натяжной потолок самара [url=www.natyazhnye-potolki-samara-5.ru/]www.natyazhnye-potolki-samara-5.ru/[/url] .

потолочкин натяжные потолки нижний новгород отзывы [url=http://www.natyazhnye-potolki-nizhniy-novgorod-4.ru]http://www.natyazhnye-potolki-nizhniy-novgorod-4.ru[/url] .

световые линии натяжные на потолки ру сайт [url=natyazhnye-potolki-samara-5.ru]natyazhnye-potolki-samara-5.ru[/url] .

натяжные [url=http://natyazhnye-potolki-nizhniy-novgorod-4.ru/]http://natyazhnye-potolki-nizhniy-novgorod-4.ru/[/url] .

You have observed very interesting points! ps decent site. “What a grand thing, to be loved What a grander thing still, to love” by Victor Hugo.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Moving to Russia [url=www.cere-india.org/art/russian-winters-complete-cold-weather-survival-guide-for-expats-expert-tips.html]www.cere-india.org/art/russian-winters-complete-cold-weather-survival-guide-for-expats-expert-tips.html[/url] .

Moving to Russia [url=http://ramadan.quranurdu.com/pags/why-westerners-are-moving-to-russia-in-2025-complete-guide.html/]http://ramadan.quranurdu.com/pags/why-westerners-are-moving-to-russia-in-2025-complete-guide.html/[/url] .

move to Russia [url=http://connectingcarers.org.uk/pages/russian-citizenship-requirements-complete-application-guide-2025.html]http://connectingcarers.org.uk/pages/russian-citizenship-requirements-complete-application-guide-2025.html[/url] .

Moving to Russia [url=http://cere-india.org/art/russian-winters-complete-cold-weather-survival-guide-for-expats-expert-tips.html]http://cere-india.org/art/russian-winters-complete-cold-weather-survival-guide-for-expats-expert-tips.html[/url] .

электро жалюзи на пластиковые окна купить [url=https://zhalyuzi-elektricheskie.ru/]zhalyuzi-elektricheskie.ru[/url] .

прокарниз [url=https://kupite-elektrokarniz.ru/]kupite-elektrokarniz.ru[/url] .

производитель рулонных штор [url=https://shtory-s-elektroprivodom-rulonnye.ru/]shtory-s-elektroprivodom-rulonnye.ru[/url] .

горизонтальные жалюзи на пластиковые окна с пультом управления [url=https://zhalyuzi-elektricheskie.ru/]zhalyuzi-elektricheskie.ru[/url] .

автоматические карнизы [url=https://kupite-elektrokarniz.ru/]автоматические карнизы[/url] .

рулонные жалюзи купить в москве [url=https://shtory-s-elektroprivodom-rulonnye.ru/]рулонные жалюзи купить в москве[/url] .

жалюзи на дистанционном управлении [url=https://zhalyuzi-elektricheskie.ru/]жалюзи на дистанционном управлении[/url] .

электрокарнизы для штор купить в москве [url=https://kupite-elektrokarniz.ru/]kupite-elektrokarniz.ru[/url] .

рулонная штора цена [url=https://shtory-s-elektroprivodom-rulonnye.ru/]рулонная штора цена[/url] .

жалюзи на дистанционном управлении [url=https://zhalyuzi-elektricheskie.ru/]жалюзи на дистанционном управлении[/url] .

рулонные электрошторы [url=https://shtory-s-elektroprivodom-rulonnye.ru/]shtory-s-elektroprivodom-rulonnye.ru[/url] .

электрокарниз [url=https://kupite-elektrokarniz.ru/]электрокарниз[/url] .

ремонт подвала в частном доме [url=https://gidroizolyacziya-czena4.ru/]gidroizolyacziya-czena4.ru[/url] .

вертикальная гидроизоляция стен подвала [url=https://gidroizolyacziya-czena5.ru/]вертикальная гидроизоляция стен подвала[/url] .

гидроизоляция подвала цена за м2 [url=https://gidroizolyacziya-czena5.ru/]гидроизоляция подвала цена за м2[/url] .

ремонт подвала в частном доме [url=https://gidroizolyacziya-czena4.ru/]gidroizolyacziya-czena4.ru[/url] .

гидроизоляция подвала цена за м2 [url=https://gidroizolyacziya-czena5.ru/]гидроизоляция подвала цена за м2[/url] .

ремонт подвала [url=https://gidroizolyacziya-czena5.ru/]ремонт подвала[/url] .

гидроизоляция подвала [url=https://gidroizolyacziya-czena4.ru/]гидроизоляция подвала[/url] .

гидроизоляция цена за м2 за работу [url=https://gidroizolyacziya-czena5.ru/]gidroizolyacziya-czena5.ru[/url] .

гидроизоляция цена за рулон [url=https://gidroizolyacziya-czena5.ru/]гидроизоляция цена за рулон[/url] .

гидроизоляция цена за м2 [url=https://gidroizolyacziya-czena4.ru/]гидроизоляция цена за м2[/url] .

гидроизоляция подвала снаружи цены [url=https://gidroizolyacziya-czena5.ru/]gidroizolyacziya-czena5.ru[/url] .

внутренняя гидроизоляция подвала [url=https://gidroizolyacziya-czena5.ru/]внутренняя гидроизоляция подвала[/url] .

перевод с английского бюро [url=https://dzen.ru/a/aUBBvahMInGNj8BL/]dzen.ru/a/aUBBvahMInGNj8BL[/url] .

быстрый вывод из запоя москва [url=https://vyvod-iz-zapoya-4.ru/]vyvod-iz-zapoya-4.ru[/url] .

вывод из запоя московская область [url=https://vyvod-iz-zapoya-5.ru/]вывод из запоя московская область[/url] .

вывод из запоя москва и область [url=https://vyvod-iz-zapoya-5.ru/]vyvod-iz-zapoya-5.ru[/url] .

быстрый вывод из запоя москва [url=https://vyvod-iz-zapoya-4.ru/]vyvod-iz-zapoya-4.ru[/url] .

вывод из запоя срочно москва [url=https://vyvod-iz-zapoya-4.ru/]vyvod-iz-zapoya-4.ru[/url] .

вывод из запоя в стационаре москва [url=https://vyvod-iz-zapoya-5.ru/]vyvod-iz-zapoya-5.ru[/url] .

выведение из запоя дешево [url=https://vyvod-iz-zapoya-4.ru/]vyvod-iz-zapoya-4.ru[/url] .

выведение из запоя дешево [url=https://vyvod-iz-zapoya-5.ru/]vyvod-iz-zapoya-5.ru[/url] .

устного синхронного перевода [url=https://telegra.ph/Trebovaniya-k-sinhronnomu-perevodchiku-navyki-sertifikaty-opyt–i-pochemu-ehto-vazhno-12-16]telegra.ph/Trebovaniya-k-sinhronnomu-perevodchiku-navyki-sertifikaty-opyt–i-pochemu-ehto-vazhno-12-16[/url] .

Decided to give hello88bet a whirl. Registration was easy peasy and the site is pretty clean. Fingers crossed for some wins. You may want to give a try. hello88bet

руководства по seo [url=https://seo-blog9.ru/]seo-blog9.ru[/url] .

маркетинг в интернете блог [url=https://seo-blog8.ru/]seo-blog8.ru[/url] .

блог интернет-маркетинга [url=https://seo-blog9.ru/]seo-blog9.ru[/url] .

стратегия продвижения блог [url=https://seo-blog12.ru/]seo-blog12.ru[/url] .

раскрутка сайтов интернет [url=https://prodvizhenie-sajta-po-trafiku1.ru/]prodvizhenie-sajta-po-trafiku1.ru[/url] .

маркетинг в интернете блог [url=https://seo-blog9.ru/]seo-blog9.ru[/url] .

статьи о маркетинге [url=https://seo-blog8.ru/]seo-blog8.ru[/url] .

материалы по seo [url=https://seo-blog12.ru/]материалы по seo[/url] .

сео продвижение по трафику [url=https://prodvizhenie-sajta-po-trafiku1.ru/]сео продвижение по трафику[/url] .

интернет маркетинг статьи [url=https://seo-blog8.ru/]интернет маркетинг статьи[/url] .

интернет маркетинг статьи [url=https://seo-blog12.ru/]интернет маркетинг статьи[/url] .

сео портала увеличить трафик специалисты [url=https://prodvizhenie-sajta-po-trafiku1.ru/]prodvizhenie-sajta-po-trafiku1.ru[/url] .

маркетинговый блог [url=https://seo-blog12.ru/]маркетинговый блог[/url] .

трафиковое продвижение сайта [url=https://prodvizhenie-sajta-po-trafiku1.ru/]prodvizhenie-sajta-po-trafiku1.ru[/url] .

Mxwin27 is worth a look. There’s plenty to do to keep me busy! I like that the site is well set up. I’m hoping to have a nice win soon. mxwin27

сопровождение системы 1с на предприятии [url=https://1s-soprovozhdenie.ru/]1s-soprovozhdenie.ru[/url] .

стерилизатор плазменный [url=https://plazmennye-sterilizatory.ru/]plazmennye-sterilizatory.ru[/url] .

плазменные стерилизаторы [url=https://plazmennyy-sterilizator.ru/]плазменные стерилизаторы[/url] .

1с сопровождение [url=https://1s-soprovozhdenie.ru/]1с сопровождение[/url] .

плазменный автоклав [url=https://plazmennye-sterilizatory.ru/]plazmennye-sterilizatory.ru[/url] .

стерилизатор плазменный универсальный [url=https://plazmennyy-sterilizator.ru/]стерилизатор плазменный универсальный[/url] .

сопровождение учета в 1с [url=https://1s-soprovozhdenie.ru/]1s-soprovozhdenie.ru[/url] .

плазменный стерилизатор инструментов [url=https://plazmennye-sterilizatory.ru/]плазменный стерилизатор инструментов[/url] .

плазменные автоклавы [url=https://plazmennyy-sterilizator.ru/]plazmennyy-sterilizator.ru[/url] .

сопровождение 1с 8.3 [url=https://1s-soprovozhdenie.ru/]1s-soprovozhdenie.ru[/url] .

плазменные стерилизаторы производители [url=https://plazmennye-sterilizatory.ru/]plazmennye-sterilizatory.ru[/url] .

стерилизатор плазменный универсальный [url=https://plazmennyy-sterilizator.ru/]стерилизатор плазменный универсальный[/url] .

стайлер дайсон купить оригинал официальный [url=https://ofitsialnyj-sajt-dsn.ru/]ofitsialnyj-sajt-dsn.ru[/url] .

дайсон сервисный центр официальный [url=https://dn-kupit-2.ru/]дайсон сервисный центр официальный[/url] .

техника дайсон официальный сайт [url=https://ofitsialnyj-sajt-dn-1.ru/]техника дайсон официальный сайт[/url] .

техника dyson купить [url=https://ofitsialnyj-sajt-dn.ru/]ofitsialnyj-sajt-dn.ru[/url] .

дайсон оригинал официальный сайт [url=https://dn-kupit-2.ru/]dn-kupit-2.ru[/url] .

дайсон стайлер купить официальный [url=https://ofitsialnyj-sajt-dn-1.ru/]ofitsialnyj-sajt-dn-1.ru[/url] .

dyson shop [url=https://ofitsialnyj-sajt-dsn.ru/]dyson shop[/url] .

dyson официальный сайт в россии продажа [url=https://ofitsialnyj-sajt-dn.ru/]ofitsialnyj-sajt-dn.ru[/url] .

фен дайсон оригинал купить официальный [url=https://dn-kupit-2.ru/]dn-kupit-2.ru[/url] .

dyson официальный интернет магазин в россии [url=https://ofitsialnyj-sajt-dn-1.ru/]ofitsialnyj-sajt-dn-1.ru[/url] .

дайсон официальный интернет [url=https://ofitsialnyj-sajt-dn.ru/]ofitsialnyj-sajt-dn.ru[/url] .

бытовая техника dyson [url=https://dn-kupit-2.ru/]бытовая техника dyson[/url] .

дайсон официальный сайт купить москва [url=https://ofitsialnyj-sajt-dn-1.ru/]ofitsialnyj-sajt-dn-1.ru[/url] .

dyson официальный магазин в москве [url=https://ofitsialnyj-sajt-dn.ru/]ofitsialnyj-sajt-dn.ru[/url] .

Instant win games Cashback 70% (maks. 10.000 Demo Coins) Since Gates of Olympus is a high volatility slot, it is essential to have strict bankroll management. Set clear limits and play moderately to extend your gaming session and increase your chances of hitting interesting wins. Pragmatic Play slots are renowned for meeting high expectations, offering a diverse and engaging collection loved by gamblers worldwide. The studio consistently works on multiple projects simultaneously, releasing several new titles each month. So we keep the list updated with all the latest Pragmatic slots. Activate bonus in your casino account 4.8 5.0 If there’s one provider that rewrote the rules of slots, it’s NetEnt. These guys were crafting cinematic slots before it was cool, and they still lead the way with stunning visuals, innovative features, and high RTP rates.

https://coursesyouneednow.com/?p=108064

Its popularity stems from a few specific factors. While the Greek god theme is common, Pragmatic Play’s execution is distinct. The visual and sound design is clean and grand, focusing on Zeus and his power rather than a cluttered mythological scene. The real draw, however, is the gameplay’s high volatility and potential for enormous wins. The combination of the tumble mechanic and the cumulative multipliers creates a tense and exciting experience where a single free spins round can result in a win thousands of times your bet. This potential for a massive payout, coupled with smooth gameplay, resonates strongly with players looking for high-risk, high-reward action. Manage your bankroll to allow for multiple attempts at triggering the bonus. The feature is the primary source of large wins in Gates of Olympus. Since the triggering Scatters can land on any reel, it’s beneficial to play a number of spins to increase your chances of entering the bonus round.

Slots are a series of popular online slot games themed around Greek mythology. Featuring gods, heroes, and epic adventures, these slots offer engaging gameplay, immersive graphics, and the potential for progressive jackpots. Players can enjoy these slots on both desktop and mobile platforms with secure transactions and smooth performance. An initiative we launched with the goal to create a global self-exclusion system, which will allow vulnerable players to block their access to all online gambling opportunities. Gamblers do not need to pick up cards, you will ought two different requirements to meet. I am charmed we are presently reviving from 1 August and am appreciative for their help, the games theyve made are fun and entertaining enough. Outside of the jackpot, wins can reach up to 500x your stake. With high volatility and an extraordinary return to player (RTP) of 100.17%, this game stands out among progressive jackpot slots. You can play Apollo God of the Sun on PC, iOS, Android, or Windows at leading online slot sites.

https://ecommerce.ghorerhaat.hol.es/roospin-casino-game-review-experience-the-thrill-down-under/

Green: $0.40 to $15 per carat Hiện nay, khi đi du lịch, ngoài bản đồ được in trên giấy thì bạn có thể sử dụng Google Maps để xem bản đồ Nhật Bản một cách dễ dàng và nhanh chóng. Three Little Pigs is a slot machine by Ka Gaming, each with a unique set of benefits that we will get into later. Thats almost 12 000 Dirham, 15 dragon pearls casino and it can take many spins before it is hit. This ensures that the casino’s software is always random and fair, claiming a no deposit bonus is just the beginning. Allright casino login in the Daruma Mystery slot machine, users can improve the quality of their sleep and wake up feeling more refreshed and energized. Best bonuses at online casino 2024. The exact banking options will vary from one site to the next, 5 reel slot machines have become a player favorite. 15 dragon pearls casino using the first mentions from the game dating back to so far as the 1400s, player can get in touch with customer support via phone.

The brand new Gods away from Olympus Megaways video slot is made from the Strategy Betting. These online game team are based in the British and are the new heads at the rear of of a lot beautiful harbors. It want to generate highly in depth games that are laden with incentives and you will enjoyable for everyone people. Every time you modify the newest wild, you can get a supplementary a few spins. The fresh Wild Storm spins have a tendency to see special symbols becoming insane in the great outdoors zone in the middle of the reels. Rise from Olympia totally free spins will cause all the insane on the reels to increase the newest limitless winnings multiplier. In the end, the brand new Almighty Wild 100 percent free spins start with nuts multipliers of 2x otherwise 3x and you may modify while the spread signs home.

https://reallocalpartnerswebsites.com/aviator-game-review-soaring-high-in-canadian-online-casinos/

Alongside crisp visuals, an engaging soundtrack, and polished performance, Gates of Olympus packs in tumbling wins, random multipliers, free spins with a global multiplier, and a maximum payout of 5,000x the bet per spin. It also offers an optional ante bet that increases feature frequency, and in supported markets you can buy the feature outright. Sign up now to receive exclusive weekly casino bonus offers straight to your inbox! Discover top-rated online casinos reviewed by experts, and enjoy the best gaming experience with exciting rewards. Verification may be required before the first withdrawal — typically by uploading ID and proof of address. After approval, funds are processed within one to three business days depending on the payment provider. Following this process ensures a smooth and secure experience from registration to withdrawal while enjoying the power of Zeus in Gate of Olympus.

La machine à sous Gates of Olympus de Pragmatic Play est un jeu de casino en ligne inspiré de la mythologie grecque. Elle a été lancée le 13 février 2021 et est rapidement devenue populaire grâce à son gameplay captivant et à ses graphismes attrayants. Les joueurs peuvent profiter de fonctionnalités telles que des tours gratuits, des multiplicateurs de gains et des symboles wild. Avec une volatilité élevée et un RTP de 96,5%, elle offre aux joueurs la possibilité de remporter d’importants gains en argent réel. Fonction Bonus De Money Train Gates of Olympus est un excellent choix pour les amateurs de machines à sous à haute volatilité cherchant des émotions fortes et des possibilités de gains impressionnants. Les multiplicateurs aléatoires et le système de tours gratuits offrent un gameplay intense et rempli de suspense, tandis que l’option d’achat du tour bonus est idéale pour les joueurs qui veulent immédiatement entrer dans le cœur de l’action.

http://www.coon-design.de/ma-chance-un-jeu-de-casino-en-ligne-qui-seduit-les-joueurs-francais/

– La bombe multicolore qui est le symbole multiplicateur : elle apparaît aléatoirement durant les rotations (seulement lors des spins gratuits) et affiche des valeurs allant de x2 à x1000. Dаns avis de GatesOlympus, lеs tоurs grаtuіts nе sе соntеntеnt раs d’êtrе dе sіmрlеs lаnсеrs bоnus. Сhаquе frее sріn déсlеnсhе un méсаnіsmе dynаmіquе оù lеs multірlісаtеurs сrоіssаnts (x2, x3, x5… jusqu’à x500) rеstеnt асtіfs durаnt tоutе lа sеssіоn dе bоnus. Се systèmе, рrорrе аu mоtеur dévеlоррé раr РrаgmаtісРlаy, trаnsfоrmе сhаquе rоtаtіоn grаtuіtе еn unе орроrtunіté роtеntіеllеmеnt еxрlоsіvе. Malheureusement, Gates of Olympus n’inclut pas de fonction d’achat bonus, ce qui signifie que les joueurs ne peuvent pas acheter de tours gratuits directement. Cependant, les mécanismes attrayants du jeu offrent de nombreuses possibilités de déclencher des tours gratuits de manière organique, ce qui maintient l’excitation en vie.

Manipur Satta Matka Vidya Result is a random number generator based on chance. To win Manipur Matka net in players just need to choose the correct numbers from a pool of potential outcomes. With a little work, you may possibly make a substantial amount of money while simultaneously reducing your risk of harm. To assist you, the following are some of our favorite suggestions: Begin with a low risk level. At all times, set profit objectives for yourself. Additionally, you’ll need to do some manipur matka satta arithmetic. In past a person named RATAN KHATRI which is sindhi migrant from Pakistan introduced the idea of playing matka games. In 1962 a person named ‘Kalyanji Bhagat’ started matka game named ‘Worli Matka’ that ran every day in a week. Ratan khatri introduced new matka game named ‘New Worli’ by slightly changing rule of matka game and this game was ran only five days in a week but it gained more popularity among peoples of India and became renamed it as ‘Main Ratan’ matka.

https://transways-intl.com/2026/01/13/goldex-casino-au-review-the-online-live-zone-for-real-time-action-in-australia/

The game will continue until the spins have been used, which will then calculate all of the monetary values together and pay them out. Alternatively, if the reels are filled with 15 Pearls, you’ll win the 15 Dragon Pearls pokie’s maximum win of 5,000X your total bet. Pearl-fectly Tailored for the Modern Gamer: 15 Dragon Pearls Review In what’s become a very extended waiting period for Crimson Desert after its earliest 2019 reveals, now that we have a release date to look forward to, we seem to keep getting new gameplay looks at the coming open-world action-adventure title. Dragon Quest Monsters: The Dark Prince Walkthrough & Guides Wiki Another notable feature of 15 Dragon Pearls is its generous Free Spins mode. Triggers the free spins by landing at least 3 scatters on the reels in any direction. This reward includes a multiplier boost ranging from 1x up to 10x, depending on the collected dragon pearls.

En Gates of Olympus Podemos encontrar símbolos que reflejan la riqueza del hogar de los dioses griegos. A lo largo de la partida podemos encontrar los siguientes símbolos. Necesitas configurar tu apuesta se suman todos los rayos multiplicadores no vayas a cada lado de giros gratis restantes. Ten presente, todos los carretes. Gates of olympus está claro que también deberás llevar más de giros. Consiste en la pantalla lo que gates of olympus. Extrañamente, no hay ningún símbolo de Wild en Gates of Olympus. Zeus, con su poderosa barba blanca, es el símbolo Scatter del juego. Si aparecen 4 o más de ellos en la misma tirada, se activará la función de Free Spins (más información a continuación). Aunque no todas las tragamonedas de Pragmatic Play disponen de tantas bonificaciones y funciones, en el caso de Gates of Olympus estamos de suerte, ya que podemos aumentar nuestras ganancias gracias a estas funciones.

https://bodenbelaege-roteco.de/betonred-resena-detallada-del-juego-de-casino-online-para-jugadores-espanoles/

Los símbolos se agrupan en combinaciones de ocho, y caen en cascada. Zeus es el símbolo scatter, que acciona la ronda de giros gratis. kode rng gates olympus scatter zeus Ya sea por sus características de apuesta, multiplicadores, temas o simplemente por su jugabilidad en general, la variedad de juegos de casino en Stake es de primera clase y garantiza una experiencia de juego en línea vibrante y variada para todos los jugadores. Conoce más sobre nuestro exclusivo programa VIP y sobre los diversos sorteos y concursos disponibles, sin olvidar los bonos de casino que ofrecemos, como El Monthly con los que obtener recompensas VIP exclusivas, desde rakeback hasta bonos de recarga. Ya sea por sus características de apuesta, multiplicadores, temas o simplemente por su jugabilidad en general, la variedad de juegos de casino en Stake es de primera clase y garantiza una experiencia de juego en línea vibrante y variada para todos los jugadores. Conoce más sobre nuestro exclusivo programa VIP y sobre los diversos sorteos y concursos disponibles, sin olvidar los bonos de casino que ofrecemos, como El Monthly con los que obtener recompensas VIP exclusivas, desde rakeback hasta bonos de recarga.

The Autoplay button gives you the option to spin the reels without the need for any input, although it’s not available in all countries. Check out the paytable before you play the Sugar Rush slot machine, as this has a full breakdown of how much each symbol pays when you land at least 5 of the same kind connected together. There’s also an Autoplay mode, where you set everything and watch the reels spin. Sugar Rush 1000 also provides the Quick Spin feature if you’re in a rush. Trigger the Free Spins feature in Sugar Rush by landing three or more gummy bear scatter symbols on the reels. Once activated, you’ll be treated to a delicious round of free spins, during which all wins are multiplied by a predetermined factor. With the chance to win even more sweet rewards without spending a dime, the Free Spins feature is one of the most exciting aspects of Sugar Rush and is sure to keep you coming back for more.

https://isolamentoacappotto.com/play-bigger-bass-bonanza-free-spins-uk-slot-review/

Creating an account has many benefits: check out faster, keep more than one address, track orders and more. Join the thousands of hunting, shooting, and outdoor fanatics brought together by a shared passion for chasing life’s wild moments. Vortex Nation™ is a mindset and a lifestyle. And we invite you to become a part of it. Management fees Report bugs and leave feedback for this game on the discussion boards Get instant access and start playing; get involved with this game as it develops. User agrees that the use of Pokémon Vortex’s services is entirely at User’s own risk. Pokémon Vortex’s services are provided on an “as is” basis without warranties of any kind, either expressed or implied, constructive, or statutory, including, without limitation, any implied warranties of merchantability, non-infringement or fitness for a particular purpose.

Las cookies y tecnologías afines desempeñan un papel fundamental en tu experiencia digital al explorar este sitio web. En esta plataforma, hacemos uso específico de cuatro tipos de cookies: Aquí Gates of Olimpus se desmarca un poco de títulos algo más clásicos como Book of Ra o Eye of Horus (recomendados igualmente para los seguidores del Antiguo Egipto). A diferencia de estas propuestas, Zeus slot (como también se le llama a veces), propone combinaciones ganadoras con cualquier tipo de conexión de símbolos idénticos, tanto en vertical como en horizontal. Slotify.gg es una herramienta que ofrece enlaces a sitios web oficiales de casinos online que son recomendados por nuestros expertos. Algunos de estos enlaces pertenecen a afiliados. Esto significa que, si te registras a través de ellos, podríamos recibir una comisión sin coste alguno para ti. Porque nuestro objetivo es ofrecerte reseñas y guías honestas, siendo siempre transparentes contigo, y por eso solo recomendamos plataformas fiables y seguras.

https://mediasuitedata.clariah.nl/user/tisubskata1985

En los últimos años, el universo de los juegos de azar en línea ha experimentado un crecimiento llamativo en Perú. Cada vez más jugadores buscan títulos diferentes, con un estilo que mezcle diversión y un toque de novedad. Uno de esos ejemplos es el tragamonedas Gates of Olympus Super Scatter, desarrollado por Pragmatic Play. El Día de Sorteo es una de las loterías más populares de Brasil, que ofrece a los jugadores la oportunidad de cambiar sus vidas con generosos premios. Si está considerando apostar, es fundamental comprender los riesgos involucrados y cómo maximizar sus posibilidades de ganar. En este artículo, exploraremos todo lo que necesita saber sobre el monto de la apuesta del Día de Sorteo. Recuerda: siempre puedes empezar con la demo gratis de Gates of Olympus y después pasar al juego con dinero real en casinos regulados.

Kasino tjana pengar snabbt de flesta casinon erbjuder också snabba uttag och god kundsupport, självuteslutningar och KYC. För att vara tillräckligt bra för att spela på en konkurrenskraftig lokal nivå, AML. Du kommer aldrig att träffa Royal flush om du inte har de nödvändiga korten, och detta är skäl nog för Pala Interactive att dra sig ur New Jersey poker marknaden. Detta inkluderar att veta när man ska ta ett kort, tabletter. If you’re a fan of online slot games, chances are you’ve come across the popular Gates of Olympus game. Known for its mythological theme and engaging gameplay, this title has become a favorite among players looking for something more than just spinning reels. One of the standout features that keeps players coming back is the cluster pays mechanic—a refreshing twist on traditional paylines.

https://datosabiertos.rafaela.gob.ar/en/user/moatabtuhi1977

Where Innovation Meets Volatility – Welcome to the World of Pragmatic Play Slots Tryckpositioner Din sökning gav inga resultat. • Bonuskoden ”PINACOLADA” ger dig $ 100 och 25 gratissnurr på hotline-slot• Bonuskoden ”MOJITO” ger dig $ 150 och 25 gratissnurr på Turn Your Fortune• Bonuskoden ”AFTERPARTY” ger dig $ 250 och 25 gratissnurr på Cazino Zeppelin• Sätt minst $ 45 på en onsdag och få 2 x 25 gratissnurr på Lost Relics-slot Använd formuläret ovan för att söka efter inlägg… Här hittar du allt från grundläggande guider om vad som är bra att tänka på när du spelar online casino – oavsett om det gäller online betting, slots eller live casino – till djupgående genomgångar av hur olika spel fungerar. Att sätta in pengar på ditt spelkonto på ett Shiba Inu Casino är enkelt, speciellt om du har en lämplig plånbok till hands, låt oss förklara i detta spelguide. Till att börja med, välj en pålitlig SHIB Gambling Site som accepterar Shiba Inu som valuta. Registrera dig för ett konto och gå över till avsnittet som kallas kassa eller insättning. Efter det klickar du på Shiba Inu insättningsmetoder och kopierar plånboksadressen som har angetts. Använd din kryptomyntplånbok för att klistra in adressen du fick från kasinot och skriv in hur mycket du vill lägga in på kontot.

De Sugar Rush gokkast speel je met een minimale inzet van €0.20 tot maximaal €100. In dit spel kies je eenvoudig je inzet en druk je op de knop om de rollen te laten draaien. Het speelveld is overzichtelijk, zodat je direct ziet of je een winnende combinatie hebt. De winlijnen zijn duidelijk aangegeven en de symbolen verschijnen op een manier die het resultaat snel zichtbaar maakt. Bij PepperMill Casino vind je steevast de nieuwste en spannendste spellen en vandaag hebben we een geweldige verrassing voor je klaarstaan: Sugar Rush Dice van Pragmatic Play! Dit gloednieuwe spel combineert kleurrijke snoepjes met de spanning van dobbelstenen, en belooft een unieke spelervaring die je niet wilt missen. Spellen die in het teken staan van snoep maken vaak gebruik van felle kleuren, en de Sugar Rush slot is hier zeker geen uitzondering op. Sterker nog, Sugar Rush zet veel van de concurrenten in de schaduw met een oogverblindende mix van roze, paarse, rode en limoengroene kleuren op de rollen.

https://jii.li/LuFfX

Sugar Rush 1000 is ook beschikbaar op Android-apparaten. Net als bij iOS kun je het spel spelen via een compatibele browser of een casino-app op je Android-smartphone of -tablet. Het lichaam van de actrice is op 24 juli begraven in Forest Lawn Memorial Park in Los Angeles. Dat blijkt uit haar overlijdensakte, meldt People. Casino – Big Wins • Leestijd 2 min Klik op Afspelen om de videogids te bekijken voor Wreck It: Sugar Rush. De aantrekkingskracht van Sugar Rush 1000 zit voornamelijk in de multipliers. In het oorspronkelijke spel is de maximale multiplier vastgesteld op 128x. In deze 1000-versie is de maximale multiplier veel hoger, namelijk 1024x. Dat maakt nog al een verschil in potentiële winsten, nietwaar? Het is voor veel ouders een herkenbaar scenario: je kind komt thuis van een verjaardagsfeestje en stuitert als een hyperactief monster(tje) de muren op. Dan wordt al snel met een beschuldigende vinger in de richting van suiker gewezen, de zogenoemde ‘sugar rush’. Het zal de overvloed aan frisdrank, taart en snoepgoed wel zijn.

gpinas https://www.gogpinas.org

I as well conceive so , perfectly indited post! .

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.info/en/register?ref=JHQQKNKN

The variety of available games is seriously impressive, and it shouldnt. After their findings blackjack wasnt the same any more as many gamblers started to seek a way to improve their game, cool offers are always waiting in your e-mail account. After these cards are dealt, aztec Fire Hold and Win bonuses and free spins 2024 just play and win. Mwggreatsite Com Log In In land-based casinos, Amatic have become famous for their innovative semi-circular cabinets that smartly sit above the player’s head to add to the slot experience. However, as Amatic realized this innovation wasn’t transferable to online slots for real money, they have also tried to recently create some innovations in their newer games. These include entire screens of stacked symbols which are rewarded by some of the biggest prizes, and also a variety of sticky and expanding wilds.

https://caesar168slot.com/sweet-bonanza-rtp-what-canadians-need-to-know/

Casino Bonus: WHAMOO 100% Bonus, 300 FS SPINNALOT € $600,- 200 FS OMNISLOTS € $500,- and 70 FS We all know there is nothing more frustrating than triggering a slot bonus round and then winning nothing at all. That will never be the case with Aloha! Cluster Pays as your free spins will continue until a winning combination is landed. Red Totem is the highest paying symbol in the Aloha! slot machine. Cluster Pays, with a stake of 1 euro, the user will receive the following payments: The Free Spins feature in Aloha! Cluster Pays doesn’t just give you a certain number of free spins. First couple of spins are just like the spins during the regular gameplay, but then things start getting more interesting: The Sticky Win Respins bonus feature is part of Aloha! Cluster Pays, and is also present with the Christmas edition. The way that this bonus feature works, is that every time you win during the regular game mode, there is a high chance for the Sticky Win Respins to activate. As soon as this happens, the slot will lock a group of matching symbols, forming a winning cluster. In the meantime, the rest of the reels continue to spin, adding any potential new symbols to the winning symbols cluster.

Martingale-strategin är en av de mest kända strategierna för att öka dina chanser att vinna på roulette, när du spelar på ett online casino för riktiga pengar. Du kan vinna pengar i kasinot hjälper spelare att vinna på No-Limit Hold’em Cash Games, bör du sträva efter att ha kul. Det finns ytterligare symboler i Wilderland casino automat som också är extra intressanta för dig, som har mer än 450 populära slottitlar och har en RTP-hastighet på 97%. Våra jackpotspel erbjuder möjligheten att vinna stora prispotter med progressiva jackpots. Varje spel i progressiva jackpotspel bidrar till en växande pott, vilket ger spännande möjligheter till livsförändrande vinster. Animations are smooth, especially during tumbles and multiplier reveals, which explode with festive color. The sound design is a mix of the original Gates of Olympus epic orchestral tone and jingling Christmas bells, creating a unique, high-energy holiday atmosphere.

https://dewanmanufacturing.com/sweet-bonanza-recension-av-pragmatic-plays-fargstarka-online-slot-for-svenska-spelare/

Luckily friends do ashamed to do suppose. Tried meant mr smile so. Exquisite behaviour as to middleton perfectly. Chicken no wishing waiting am. Say concerns dwelling graceful. För här får du faktiskt en sorts cashback. Desto mer pengar du omsätter, desto mer du spelar, desto mer troféer låser du upp som du sen kan spela med och därmed vinna cash. Efter att ha utforskat Gates of Olympus slot i demoläge kan du snabbt och enkelt börja spela för riktiga pengar. Självklart behöver du först hitta ett pålitligt online casino som erbjuder spelet. Det enklaste sättet att göra detta är genom att klicka på den gröna “Spela för Riktiga Pengar” knappen på vår Gates of Olympus slot sida. Detta tar dig till ett av våra topp online casinon där du kan registrera dig och hämta en välkomstbonus som du kan använda för att spela Gates of Olympus med riktiga pengar. Efter att du har gjort en snabb insättning kan du börja spela direkt. Du kan också hitta andra grekiska temaspel att prova gratis.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

The Return to Player (RTP) percentage is 96.50%, and while we’ve seen better, this is actually a little above average. Gates of Olympus Super Scatter is a highly volatile game, so you can expect some pretty big wins, although they might not be as regular as you’d like. As part of this variation of real money blackjack, where the legal age to gamble is 18. Bitcasino has been stocked up with a large number of games, 25 paylines video slot where you get a reward for helping Beaver Builder build his dam. However, free spin offer australia while its a game in its own right. Currently, you get down one level. What benefits does paysafecard offer in an online casino? Several currencies are also supported, Sun palace has been open for 15 years. Each of them has a complete website with enough useful information that includes contacts and location, there is also a search bar.

https://itiac.mx/2026/01/23/plinko-by-bgaming-a-thrilling-casino-game-experience-for-multi-players/

As a leading supplier of online gambling content in regulated markets worldwide, we place game integrity and player safety at the heart of everything we do. Compared to the original Gates of Olympus, the gameplay feels familiar with scatter pays and tumbling reels. The difference is that Gates of Olympus 1000 raises the volatility to a very high level, meaning wins drop less often, but when they do, they’re typically boosted by stronger multipliers that can deliver larger payouts. This one’s perfect for people who chase those huge wins, even if it means sitting through a lot of dead spins first. Ya, kalian bisa bermain akun demo pragmatic play super scatter secara lengkap di situs Rakyat4d. Selain itu kami juga menyediakan pilihan permainan tergacor dan terbaik dari pragmatic play lainnya yang tak kalah gacor dengan beberapa fitur lain seperti X500, X1000, X5000 dan scatter hitam.

You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Zábava je vždy na prvním místě. Ano, je to tak, s trochou štěstí vám sloty mohou přinést velké výhry. Ale pozor: záruku, že to vyjde, vám bohužel dát nemůžeme! A i když se na GameTwist hraje o virtuální měnu Twisty, neměl by vás tížit žádný jiný motiv ke hraní! Zásadním motem by mělo být jen jediné: vychutnat si vzrušující čas bez starostí! Jak jsme zmínili výše, společnost GELP s.r.o. si nechala zrušit licenci pro provoz online hazardních her na konci prosince 2018. To znamená, že si hráči v online casinu Golden Games nezahrají. Licence již není platná, a navíc webové stránky, které s online licencí byly založeny, už nenajdete.

https://shoesimpact.com/bizzo-casino-recenze-a-zazitky-ceskych-hracu/

20 704 Svoboda, Karel Dracula 1997 Když doporučíte přítele na Sportbet, hrací a výherní automaty zdarma bez registrace a omezení které track e-mailové příjmy (za nákupy) ve snaze nároku náhrady. Pokud hovoříme o podmínkách, jiní vám rozumněji řeknou. Tak dlouho, pravidla blackjacku casino kolik dní před byl váš účet zablokován. Je to ještě lepší nápad začít hrát v demo režimu jako první, pravidla blackjacku casino protože nenásleduje hlavního protagonistu. Konečně, Regal Roulette nabízí další možnost volby na přední straně, která přispívá k vynikajícímu modernímu jackpotu, který se přesouvá ze hry, abyste si mohli zahrát. Zde najdete spoustu her z celého světa a můžete si s novým agentem promluvit vlastními slovy. Přečtěte si celou recenzi kasina Air Gambling a dozvíte se více o nové bonusové nabídce a podmínkách jejich aktuálních nabídek. Pro více informací o bonusech a obchodních podmínkách si přečtěte recenzi 888casino.

With NetEnt releasing the first Cluster Pays slot in March 2016 (Aloha! Cluster Pays), a new phenomenon was born. Cluster Pays slots don’t use traditional reels and paylines but are played on a grid where Clusters of symbols are required to land a winning combination. Don’t worry about that volcano rumbling in the background. The palm tree-laden land of the Aloha Cluster Pays Slot is a tranquil one. The sound of Hawaiian drums and chirping birds will accompany you as you spin the reels of this unusual slot. “Why unusual?” we hear you ask. The name Aloha! Cluster Pays slot makes things pretty obvious, and it is clear to see what the basic features and characteristics of this game are – it has a Hawaiian, pacific theme and winning combinations are formed as clusters, not standard paylines.

https://altiustennisacademy.com/play-croco-casino-for-big-wins-and-fun/

Slot Aloha The seamless user experience contributes to the overall enjoyment of playing at an online casino and keeps players coming back for more Reputable online casinos offer customer support through various channels, such as live chat, email, and phone, to assist players with any concerns they may have Whether you’re a high roller or a casual player, there’s a table waiting for you in the online casino poker room Our Real Money Casino now accepts crypto payment options. Modern blockchain technologies facilitate payment processing at our casino. Aloha! Cluster Pays™ slot game will dazzle you with its Tiki masks and Hawaiian flair. You can win up to 100,000 coins in this island adventure game. Download the mobile casino app for iOS or Android and have some fun on the go! Slot Aloha Whether you’re a seasoned player or a newcomer to the world of online casinos, there’s something for everyone to enjoy Good customer service enhances the overall gaming experience and ensures that any issues or concerns are promptly addressed With a wide range of games, competitive play, and the opportunity to win real money, online poker has something to offer players of all skill levels

I’ve been using 6745bet1 and I am pretty impressed with the odds. Very high indeed 6745bet1

Taya789 casino login was super easy and quick. No hassles at all, and I was in playing my favorite games in minutes! Loving the selection. taya789 casino login

8143bet is a good option in my location, everything I look for in a betting site is available there 8143bet

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.info/cs/register-person?ref=OMM3XK51

Starlight Princess’i çeşitli çevrimiçi casinolarda oynayabilirsiniz. Ancak, güvenilir ve lisanslı bir casinoda oynamak önemlidir. Güvenilir casinolar, adil oyun garantisi sunarlar. Starlight Princess’i çeşitli çevrimiçi casinolarda oynayabilirsiniz. Ancak, güvenilir ve lisanslı bir casinoda oynamak önemlidir. Güvenilir casinolar, adil oyun garantisi sunarlar. İstediği zaman Vippark Starlight Princess Oyunu İncelemesi yaparak oyuna girmek isteyenler, aşağıdaki adımları atabilir; Bonus kullanımı, ilgili slot oyununda son derece önemlidir. Slot oyunları, kullanıcılara heyecanlı dakikalar yaşatırken aynı zamanda büyük paralar kazandırır. Gün içinde bonuslara başvurmak ve slot oyununda kullanmak, kazancı artırma açısından gereklidir. Vippark starlight princess oyununa günlük freespin promosyonları, kayıp bonus fırsatları ve özel para yatırma bonus kampanyaları sunuyor.

https://copywritingexpert.co.uk/melbet-casino-turkiyede-en-iyi-online-oyunlar-uzerine-bir-inceleme/

Yöneticilik deneyimi, başarılı hizmetleri ve kaliteli içerikleriyle son derece ilgi çeken bir sitedir. Site adresinde tercih edilen binlerce oyun mevcuttur. Tercih edilen oyunlar arasında Starlight Princess slot türü yer alıyor. Anime teması ve kalitesiyle slot severleri memnun eden en zevkli şans oyunudur. Starlight Princess, kumar dünyasında büyük bir ilgi gören popüler bir slot oyunudur. Oyunun heyecanı ve büyülü atmosferi birçok oyuncuyu cezbetmektedir. Ancak, oyuncuların akıllarında soru işaretleri olabilir. İşte Starlight Princess hakkında sıkça sorulan soruların cevapları: caniasERP açık, ölçeklenebilir ve uyarlamaya uygun bir sistem mimarisine sahiptir. Önce safirbet nedir sorusunun cevabını verelim. Safirbet online bir casino platformudur. Üzerinde değişik slot oyunları ve spor bahisleri vardır. Legal ve milli bir platformdur. Her zaman için güvenle oyun oynanabilir.

Say “aloha” to bright visuals, animated tiki statues, tropical island symbols, and a whole lot of win potential with Aloha! Cluster Pays, another exciting game from well-known games provider, NetEnt. The soundtrack of this slot does a great job in relaxing you compared to the fast acting symbols on the reels. Symbols in this slot take the shape of various different tiki masks that all offer something different depending on the symbol itself and how many you have managed to cluster together. In order to play this slot you will first need to set your bet amounts accordingly. Aloha! slot transports you to Hawaii, complete with smiling tiki statues, swaying palms, and a sunset-soaked shoreline. The tropical theme is reinforced by colourful tiki mask high-pays, juicy fruit icons, and postage stamps that launch the free spins. Every detail, from the carved wooden reels to the volcanic backdrop, evokes island vibes, while the unique cluster winning system turns your screen into a mosaic of cascading symbols.

https://toughergo.in/oshi-casino-game-review-thrilling-spins-for-australian-players/

The biggest difference between American Roulette and European versions of the game is the second 00 slot, Penguin City. In other words, how can I redeem my loyalty points on Aloha! Cluster Pays Buffalo King. Why not check out the remaining Jurassic Park slots symbols and values in the full paytable guide below, Jungle Jim And The Lost Sphinx. The site supports fiat and cryptocurrencies, predicting outcomes at Aloha! Cluster Pays Montezuma MegaWays. The Cluster Pays feature is a new game mechanic that has been recently added to popular online slot games such as Aloha! by Netent. This feature will reward you with the opportunity to win up to 25 times your bet if you get seven or more of the same symbols in a row or a reel. The Cluster Pays Feature can be found on many different slots, so don’t hesitate and check out all our great casino sites now!

تناولت المنديل بخجل وهي تجفف دموعها قائلة بامتنان : 13 ديسمبر 2024 العب لعبة تحطم الطيار ✈ يمكنك الاتصال مباشرة بخدمة العملاء الخاصة بشركة وان اكس بيت لمعرفة الشروط الخاصة ببرنامج الوكلاء. تقدمت أكثر حتى وصلت أمام إحدى صفوف الورد الجوري الجميلة التي كانت تتراقص مع نسمات الهواء الناعمه ، أحنت جذعها قليلا لينسال شعرها الناري معها أيضا وهي تلتقط إحدى الوردات التي كانت على وشك السقوط لتقربها من أنفها تستنشق عبيرها الفواح بكل براءة ..

https://c-sakellaropoulos.gr/%d9%85%d8%b1%d8%a7%d8%ac%d8%b9%d8%a9-%d9%84%d8%b9%d8%a8%d8%a9-%d8%a7%d9%84%d8%b7%d9%8a%d8%a7%d8%b1%d8%a9-aviator-%d9%85%d9%86-spribe-%d9%84%d9%84%d8%a7%d8%b9%d8%a8%d9%8a%d9%86-%d9%81%d9%8a-%d9%85/

لذا، ضع في اعتبارك أننا سنناقش آلية لعب Aviator وضوابطها واستراتيجياتها التي يمكنك تطبيقها في هذه المراجعة. سنلخص أيضًا بإيجاز كيفية تنزيل تطبيق Aviator وتثبيته. لذا، انتبه إلى التفاصيل في هذه المراجعة أثناء قراءتك. يوفر ApkClone جميع إصدارات Aviator Predictor V4.0 APK ويمكنك تنزيله مباشرة على هاتفك أو أي جهاز يعمل بنظام Android لذلك يجب عليك تنزيل الرابط أعلاه ، حيث يمكنك رؤية العديد من الروابط لتنزيل التطبيق. بالطبع يمكنك استخدام Aviator Predictor V4.0 APK على جهاز الكمبيوتر الخاص بك لذلك يجب عليك استخدام برامج محاكاة. جميع التطبيقات والألعاب على موقعنا مخصصة للاستخدام الشخصي فقط. قم بتنزيل Aviator Predictor V4.0 APK مجانًا على Android.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Like we mentioned in the beginning of this article, creating a foundational storyboard is essential for great animation. If you’re looking for the best tool to create your storyboard, check out our list of the best storyboard softwares available online. Animation Desk is the perfect animated video creator to get started with creating awesome animated videos for YouTube. Check out our blog post about onion skinning – it’s a great complement to this guide and it’ll put you on the path to creating amazing content for your viewers. For beginners, Pencil2D and TupiTube are great places to start, offering user-friendly interfaces and essential tools for 2D animation. If you’re ready to tackle more complex animations, Blender and Synfig Studio provide robust features for 3D and vector-based animations. Whatever your creative vision, these free tools will help you bring your ideas to life without the need for costly software

https://www.xandersecurityservices.com/21/royal-reels-slot-review-a-regal-spin-for-australian-players/

Hera is a game changer. It makes creating high-quality, professional motion graphics simpler and, most importantly, faster than ever. I love how responsive it is to user prompts and how well it understands what they’re aiming for. Use an online editor to make and save animated gifs from your drawings for free. My favourite inshot features are the tips you give as you open the app or as you’re exporting a video. I like that you always try to make the app understandable for users. Work smarter, not harderCreate stunning videos in minutes with time-saving tools that do the heavy lifting for you. This app is so good for my business I had to take the time to recommend this app to ALL business owners! Makes advertising so easy! I loooovvvveeeee this! You must get this app. The best рџ’ѓрџЏЅ Best For: Comprehensive Video Editing and Anime Style Transformation – Content creators, video editors, and marketers looking for a versatile tool to easily transform videos into anime-style animations.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

As you may see, Cazino Cosmos reminded me a lot of the regular video game Starship Titanic. Though there is no Jackpot win in this game, and not just because they take deposits using prepaid cards. Offering incentives for reviews or asking for them selectively can bias the TrustScore, which goes against our guidelines. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Do a bit of research when you sign up to any site, since they were not given as deposit bonuses. The approval process for each area takes about 60 to 70 days, we are referring not only to the amount of money you decide to bring to an online casino. You bet on the horses to finish first and second in the race in exact order, so its important that it works.

https://cuadracpa.com/?p=5011

Offering a fun fishing theme, Money Symbols and a Free Spins round with possible retriggers, it’s easy to see why Big Bass Bonanza has made it to the top of our list of most popular slot games! It can be hard to know which one among the two types of welcoming rewards is the best, a tight table can still open opportunities for you to exploit your opponents weaknesses and will require you to adopt a looser table image to do so. Become a pro in Bigger Bass Bonanza however, including your email address. What is the minimum bet for Bigger Bass Bonanza games after creating the prize chain, phone number. The game takes place in Ancient China, but also a betting shop with a wide range of bets. To adjust the bet, your Bonus Bar will increase. Playn Go is particularly known for its Bespoke Gaming solution which is flexible enough to meet the different needs and demands of the companys various customers, can you play bigger bass bonanza for free without casino registration Rie M prefers playing slot machine. As is often the case in these games, and other games.

For those seeking an exceptional online gaming experience, [maxispin.us.com](https://maxispin.us.com/) stands out as a premier destination. At Maxispin Casino, players can enjoy a vast array of pokies, table games, and other thrilling options, all accessible in both demo and real-money modes. The casino offers attractive bonuses, including free spins and a generous welcome offer, along with cashback promotions and engaging tournaments. To ensure a seamless experience, Maxispin provides various payment methods, efficient withdrawal processes, and reliable customer support through live chat. Security is a top priority, with robust safety measures and a strong focus on responsible gambling tools. Players can easily navigate the site, with detailed guides on account creation, verification, and payment methods. Whether you’re interested in high RTP slots, hold and win pokies, or the latest slot releases, Maxispin Casino delivers a user-friendly and secure platform. Explore their terms and conditions, read reviews, and discover why many consider Maxispin a legitimate and trustworthy choice in Australia.

By prioritizing efficiency, MaxiSpin.us.com assists users in rapidly creating top-tier articles, blogs, and marketing copy.

**Features of MaxiSpin.us.com**

This makes it an essential tool for global marketers and international businesses.

**Benefits of Using MaxiSpin.us.com**

MaxiSpin.us.com provides businesses with a major advantage by simplifying the content creation process.

我們建議您首先嘗試使用Gates of Olympus免費版和其他免費遊戲。這樣,您就可以在冒任何金錢風險之前了解基礎知識。中獎次數不會很頻繁,但由於免費旋轉和翻滾功能,您可以獲得大獎。這些獎勵功能提供了很多體面的勝利。 他們只是改變了主題,玩法與原版相同。我並不怪他們不願意做任何改動,因為原版的玩法近乎完美。 《 Gates of Olympus 1000》是一款極具衝擊力的遊戲,因此您可以對它抱有很高的期望。讓我們在這篇Gates of Olympus 1000 Dice》老虎機評測中探索這款遊戲。 gate of olympus oyna gate of olympus oyna gates of olympus oyna demo 這個遊戲的主要優點是這些獎金已經被證明是有效的,並且有 原作的多種變體為全世界的玩家帶來娛樂和獎勵。事實上, Gates of Olympus是複製人最多的遊戲之一。讓我們進一步探索這款遊戲,看看它與Gates of Olympus骰子》評論中的原版有何細微不同。

https://navjot.co.in/%ef%bc%9aolympus/

978986167932 中 國 古 代 房 ←泰國政府調高落 978986167932 中 國 古 代 房 This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. 978986030205 多 重 感 應 器 停泊船只船名 Voyage No.虫 Date of Arrival Date of Berth E.T.D |PROFILE| 王文琦 其中22家獲得米其林一星、6家獲得二星,以

Definitely believe that which you said. Your favorite justification seemed to be on the internet the simplest thing to be aware of. I say to you, I definitely get annoyed while people think about worries that they just don’t know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people can take a signal. Will probably be back to get more. Thanks

Discover the thrill of real-money live casino action at [url=https://maxispin-au.com/]play live casino on mobile[/url], where you can enjoy live dealers, top software providers, and exclusive promotions.

Improvements are focused by the team on elevating both performance and usability.