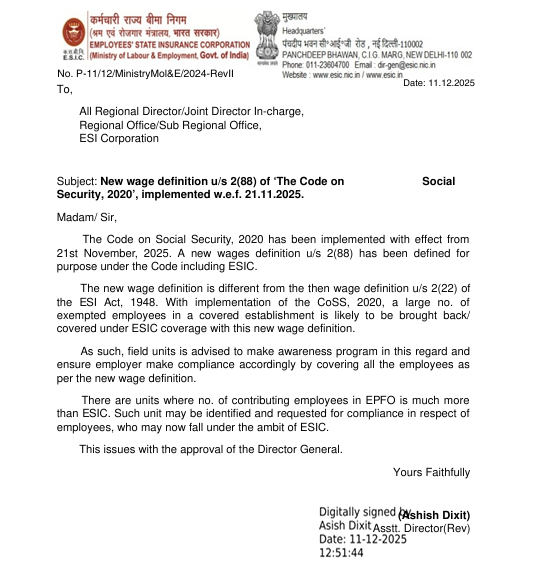

As you aware about the new code of wages which came nationwide on 21sr November 2025.

The Employee State Insurance Corporation ESIC is being operated under the Ministry of Labour & Employment Government of India, is committed to make implementation on social security coverage to every eligible worker across the nation.

As per the new rule the definition of wages has been changes some of the component has been considered and some has been removed for ESIC Gross on which ESIC of employee and employer used to be calculated.

Let see ..

What is included in Wages

Basic Salary, Dearness Allowance and Retaining allowance has been considered for ESIC Gross.

What is excluded from Wages

Employer’s contribution to any pension or provident fund, Gratuity payable on employment termination, Value of house accommodation, light, water, medical attendance, or other amenities/services & Any sum paid to the employee for special expenses incurred due to the nature of employment it all has been excluded apart from that below are some component which has been excluded.

- House Rent Allowance (HRA)

- Conveyance allowance

- value of any traveling concession

- Overtime allowance

- Any commission Any bonus

Conditional inclusions (the 50% rule)

If certain excluded payments exceed 50% of the total Gross, then excess amount is to be consider as remuneration and is added back for ESIC Gross.

We calculated ESIC at rate of 0.75% of wages for employee contribution and for Employer contribution it is 3.25% of wages where this is applicable to only those employee where ESIC gross is up to Rs 21000.

How to Calculate ESIC Wages

So as per code on Social security 2020 and New ESIC wages definition people are little confuse about how to figure out the ESIC wages on which ESIC has to be deducted both employee and employer. Let us understand it with example.

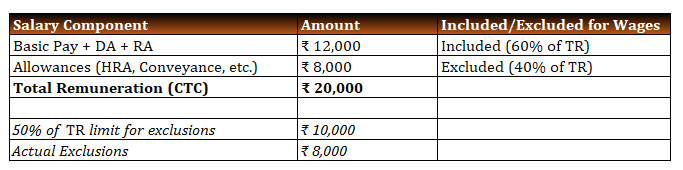

Scenario 1

An employee, Mr. Akash, has a total monthly remuneration of ₹20,000, which is below the ₹21,000 threshold of ESIC.

In this case, the actual exclusions (₹8,000) are less than the 50% limit ₹10,000). The ESI “wages” for calculation are the actual included components:

- Total ESI Wages: ₹12,000 (Basic + DA + Retaining Allowance)

- Employee ESI Contribution: 0.75% of ₹12,000 = ₹90

- Employer ESI Contribution: 3.25% of ₹12,000 = ₹390

- Total ESI Contribution: ₹480

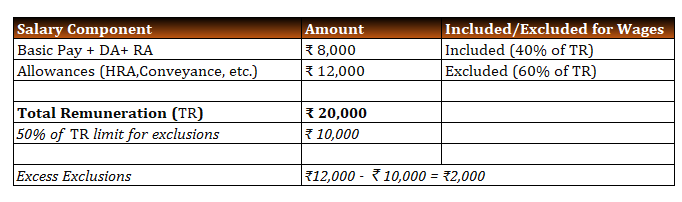

Scenario 2

An employee, Mr Bikas, has a total monthly remuneration (TR) of ₹20,000. Her salary is structured differently.

Here, the actual exclusions (₹12,000) exceed the 50% limit (₹10,000) by ₹2,000. This excess amount must be added back to the “wages”:

- Total ESI Wages: ₹8,000 (Basic+DA+RA) + ₹2,000 (Excess Add-back) = ₹10,000

- Employee ESI Contribution: 0.75% of ₹10,000 = ₹75

- Employer ESI Contribution: 3.25% of ₹10,000 = ₹325

- Total ESI Contribution: ₹400

The Social Security Code, 2020 aims to standardize the wage base to ensure fair and consistent calculation of social security benefits, including ESI.

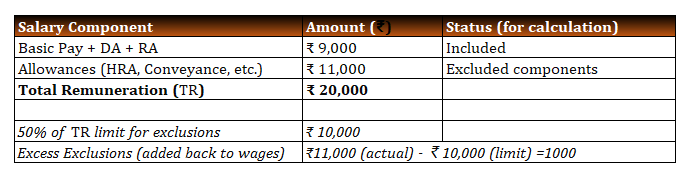

Scenario 3

Mr. Candy earns a total monthly remuneration (TR) of ₹20,000. Her structure has high allowances.

- Total ESI Wages: ₹9,000 (Basic + DA+RA) + ₹1,000 (Add-back) = ₹10,000

- Employee ESI Contribution: 0.75% of ₹10,000 = ₹75

- Employer ESI Contribution: 3.25% of ₹10,000 = ₹325 Key Takeaway

Even though her actual Basic Pay is low, the 50% rule ensures her statutory ESIC wage base is higher, leading to increased contributions compared to the pre-Code era

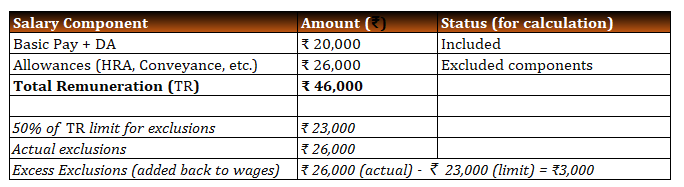

Scenario 4

Ms. Edirsh earns a total monthly remuneration (TR) of ₹46,000, which is above the ₹21,000 threshold. Her structure has also high allowances.

Total ESI Wages: ₹ 20,000 (Basic + DA) + ₹3,000 (Add-back) = ₹23,000 Which is above ₹21,000 ESIC wage limit, hence, Exempted from ESIC.

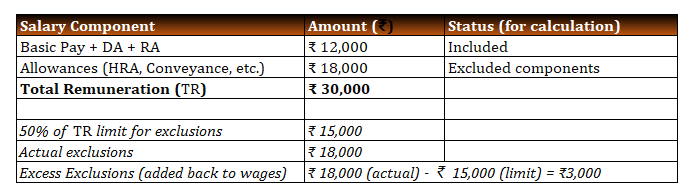

Scenario 5

Ms. Farida earns a total monthly remuneration (TR) of ₹30,000, which is above the ₹21,000 threshold. Her structure has also high allowances.

- Total ESI Wages: ₹ 12,000 (Basic + DA+RA) + ₹3,000 (Add-back) = ₹15,000 Which is below ESIC wages limit i.e ₹21,000.

Calculate ESI Contributions:

- Employee Share: 0.75% of ₹15,000 = ₹112.5

- Employer Share: 3.25% of ₹15,000 = ₹487.5

- Total ESI Deposit: ₹112.5 + ₹487.5 = ₹600

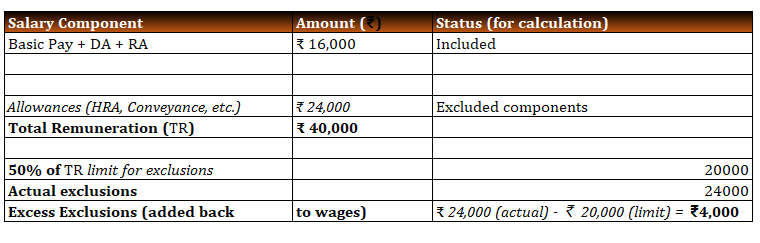

Scenario 6

Ms. Farzana earns a total monthly remuneration (TR) of ₹40,000, which is above the ₹21,000 threshold. Her structure has also high allowances.

- Total ESI Wages: ₹ 16,000 (Basic + DA) + ₹4,000 (Add-back) = ₹20,000 Which is below ESIC wages limit i.e ₹21,000.

Calculate ESI Contributions:

- Employee Share: 0.75% of ₹20,000 = ₹150

- Employer Share: 3.25% of ₹20,000 = ₹650 Total ESI Deposit: ₹112.5 + ₹487.5 = ₹800

Notices…

Download the notice

Anyone used aaajililogin? Thinking of giving it a try, but curious about the community feedback. Let me know your thoughts! aaajililogin

If you are looking for Nesine alternatives with guarantees, Garantidennesine might be what your needs, I recommend you to take a look for more information: garantidennesine

Chưa dừng lại ở đó, hệ thống bảo mật của chúng tôi cũng đã nhận về rất nhiều lời khen từ chuyên gia cá cược. 888slot Nhà cái hiện đang sử dụng công nghệ mã hoá SSL chuẩn 128 bit hiện đại. Vì vậy toàn bộ thông tin cá nhân người dùng sẽ tránh được hoàn toàn tình trạng hacker xâm nhập và đánh cắp. Tuy nhiên để tăng tính an toàn tối đa, thương hiệu vẫn thường xuyên khuyến cáo bet thủ nên thay đổi password định kỳ. TONY01-06S

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how can we communicate?

I want to to thank you for this wonderful read!! I certainly enjoyed every little bit of it. I have you bookmarked to look at new things you

Hi, I do believe this is an excellent website. I stumbledupon it 😉 I may revisit once again since i have book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

The thing is — in case a person remains with programming and makes the training purposeful — they’ll arrive at any stage they wish to.

I am sure this post has touched all the internet visitors, its really really nice post on building up new weblog.

**aqua sculpt**

aquasculpt is a premium metabolism-support supplement thoughtfully developed to help promote efficient fat utilization and steadier daily energy.

**prodentim official website**

ProDentim is a distinctive oral-care formula that pairs targeted probiotics with plant-based ingredients to encourage strong teeth, comfortable gums, and reliably fresh breath

**men balance pro**

MEN Balance Pro is a high-quality dietary supplement developed with research-informed support to help men maintain healthy prostate function.

Greetings! Very helpful advice in this particular article! It’s the little changes that make the biggest changes. Many thanks for sharing!