Imagine you work in a company. You work hard all month — meetings, targets, reports, and deadlines. Then one day, you get an SMS on your phone:

“Your salary of ₹85,000 has been credited to your account.”

Feels great, right?

But have you ever wondered how this money reached your account? That entire process is called Payroll.

In simple words — Payroll is the process of calculating, processing, deducting, and distributing salary to employees, all as per government rules and company policies.

Payroll in India isn’t just about giving out salaries. It’s a complex legal and financial process, involving multiple departments like HR, Accounts, Compliance, Legal, and various Government authorities which includes..

- Basic salary calculation

- Allowances (like HRA, LTA, Bonus)

- Deductions (PF, ESI, PT, TDS)

- Payslip generation

- Statutory Compliance

- Reimbursements and incentives

And this process is repeated every single month – with new challenges each time.

Step by Step Payroll Process

Lets assume Rahul is an HR Executive at XYZ Pvt Ltd. He’s responsible for managing payroll for 50 employees. He uses payroll software, Excel sheets, and has multiple deadlines.

Step 1: Collect Employee Data

- Employee ID

- PAN, Aadhaar, UAN

- Date of Joining, Salary details

- Attendance & Leave data

- Overtime, Bonuses, Incentives

Step 2: Attendance & Leave Management– Track attendance: who came, who took leave, who arrived late. This helps calculate “LOP – Loss of Pay” for extra leaves.

Step 3: Salary Calculation :- Gross Salary = Basic + HRA + Allowances Net Salary = Gross – Deductions (PF, ESI, PT, TDS)

Step 4: Deductions:-

In India, some statutory deductions are mandatory:

- Provident Fund (PF) – 12% from both employee and employer

- ESI – Applicable if salary is below ₹21,000/month

- Professional Tax (PT) – In some states

- TDS – Based on income tax slabs

Step 5: Payslip Generation :- Each employee gets a payslip showing:

- Salary breakup

- Deductions

- Net salary

- Bank details

- Month & Year

Step 6: Salary Disbursement :- Salary is transferred via bank (usually by the 1st or 7th of each month) using NEFT/RTGS/IMPS.

Step 7: Compliance Filing:- This is a critical step

- PF Return – Uploaded monthly on ECR portal

- ESI Return – On ESIC portal

- TDS Return – On TRACES or NSDL

- Form 16 – Given at year-end for tax filing

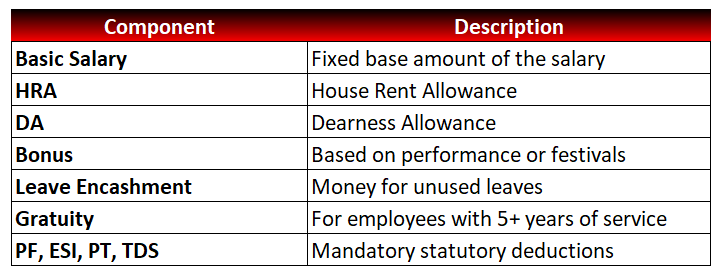

Payroll Components in India

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/el/register?ref=DB40ITMB

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/register?ref=IHJUI7TF

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Yo, signing up for W88 can be a pain sometimes, but dangkyw88 makes it super easy. Smooth process, highly recommend giving it a shot if you’re looking to join them. Go sign up at dangkyw88!

Bong88comcom, now that’s a name I recognize. Heard mixed things, so do your research before diving in. Always good to know what you’re getting into. You can see it for yourself here: bong88comcom

nhà cái 888slot là nhà cái hiếm hoi có mục “Hướng dẫn chơi slot cho người mới” – học nhanh, chơi giỏi, thắng lớn! TONY01-13

888slot thường xuyên tung mã giảm giá, voucher nạp tiền – theo dõi fanpage để không bỏ lỡ cơ hội vàng! TONY01-13

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/sv/register-person?ref=GQ1JXNRE