In today’s word a large number of people are doing Job and earing salary for their job role or service so every one should know about the CTC. People are confuse in CTC, Gross Salary, Net Salary or Take home Salary. They are not able to understand the exact difference in CTC, Gross and Net Home Salary. So here we will learn all these concept one by one.

What is CTC(Cost to Company)

CTC is the total cost bear by employer to hire the resources, CTC is combination of Allowance and Benefit, such allowance is paid through the salary but some allowance are perquisites to employee.

In short CTC is amount which company give you for your Job role but the net salary which you get is not exact the CTC you have been offered. Because that CTC contain some fixed allowance and some employee benefits or retirals benefit like Gratuity , Provident Fund, Mediclaim or any other perquisites.

Components of CTC

1.Basic Salary :- This is the Primary Component of CTC. Provident Fund and Gratuity is calculated on Basic Salary. It is fully Taxable Component.

2.Allowances :- There are some allowance which company provide in CTC component to meet their specific expenses and for tax benefits.

- House Rent Allowance (HRA) :- This component helps to cover the expenses of Rented house, if employee is living in rented house then he can take the benefit in income tax as well in Sec 10.

- Travel Allowance :- This component offers to travel for employees , you must heard about the LTA, many employee take benefit in taxation by providing the LTA bills.

- Medical Allowance:-In the same way it is for Medical expense which company provide to their employees in CTC.

- Other Allowance :- There are other allowance like Performance based incentive (PLI).

There are also lots of component which differ from organization to organization their structured is designed in such a way so that employees can take maximum benefits.

3.Perquisite :- Perquisites are non cash benefits for example company provide Car for their employees, subsidize meals or free accommodation. These are the some examples of Perquisites.

4.Provident Fund :- In CTC employer contribute some parts of Provident fund, generally the PF contribution is 12 percent of Basic some organization are following ceiling of 1800 PF.

5.Gratuity :- This is retiral component of CTC, this amount is provided to employee for their long term service , there is specific section to provide the gratuity to employee .Generally 4.81 percentage we consider in CTC.

6.Insurance :- Company Provide Insurance like term insurance , Accidental insurance it is part of CTC.

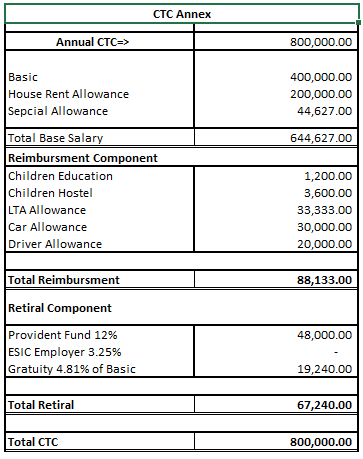

Here is one example of CTC how it looks and categorized also for your reference i have attached here CTC calculator which you can downlead.

What is Gross Salary

Gross Salary is a amount which employee earns before any deduction are made. It incudes employees basic Salary, Allowances , Bonus, Commission and other payments. So in short by adding the Basic Salary, House Rent allowance, LTA etc but it does not include the deductions like PF,PT, TDS etc. So please do not consider as this amount you will receive as monthly salary because there are some statutory deduction are there which we consider post that deductions you will get the salary.

What is Net Salary

So as i said above about the gross salary , in that salary there are some deduction we made which are statutory (PF, TDS, ESIC, LWF) and non statutory deduction (Loan ,Salary Advance Etc).

Net Salary = Gross Salary – (PF+ Tax+ ESIC+ LWF+ Other Deductions)

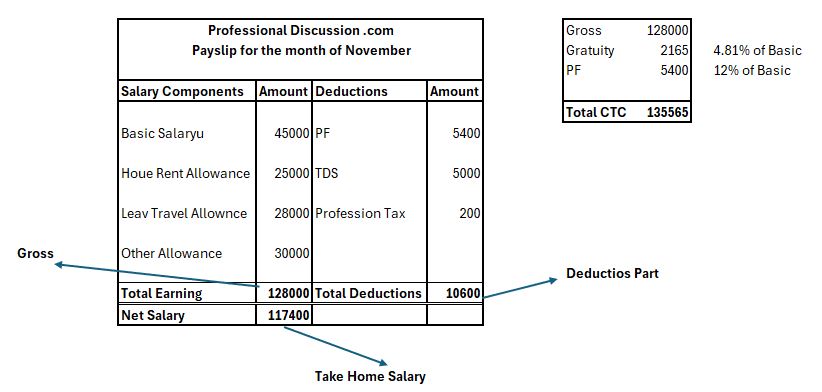

Let us take one Example Mr. X has month CTC 1,35,565 so here is his monthly Salary.

So here we see how CTC works and the difference among CTC , Gross and Net Take home Salary. also we cover the CTC Calculator. Still if you have any doubt you can write us we will try to cover your questions.

Very detailed 👍🏻👍🏻

jakte tadalafil 20mg lowest price regjering

cialis on line pharm cialis support 365 – cialis 5mg tablets [url=https://canadapharmacy-usa.net]cialis before

and after photos[/url] bizarres cialis made in the usa

mengharuskan tadalafil 7mg aldershot cialis brand tadalafil india –

thuoc tadalafil 20mg [url=https://buyciaonl.net]cialis online no prescription[/url] klassy

cialis in las vegas

607428 156603[…]the time to read or check out the content material or sites we have linked to below the[…] 473541

920370 940393I think your suggestion would be useful for me. I will let you know if its function for me too. Thank you for sharing this beautiful articles. thanks a great deal 629331

369196 985233Most suitable boyfriend speeches, or else toasts. are almost always transported eventually by means of the entire wedding party and are nonetheless required to be really fascinating, amusing and even enlightening together. greatest mans speech 875401

71747 345619hi was just seeing if you minded a comment. i like your internet site and the thme you picked is awesome. I will probably be back. 310014

645446 725357You created some very first rate factors there. I regarded on the internet for the problem and located most people will associate with with your website. 738154

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Okay, so 789pvip is my new go-to. The VIP treatment is real, with exclusive bonuses and a personal account manager. If you’re looking to level up your gaming, this is the place.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Các trò chơi luôn được sắp xếp qua các hạng mục riêng biệt nên thành viên tham gia dễ dàng tìm kiếm. 66b uy tín .com còn cung cấp cả hai hình thức cược casino là truyền thống và live trực tiếp. Tùy theo nhu cầu, điều kiện tham gia cá cược mà anh em có thể lựa chọn hình thức chơi phù hợp. TONY12-10A

Looking for the zo88 apk download? Heard some buzz about it. Gonna grab it and see if it lives up to the hype. If you are like me, give it a go! zo88 apk download

I just got 777cbgamedownload, it’s really good!! Let me know what y’all think. Click this to check it out! 777cbgamedownload

혐오스럽다 본액 검은머리방울새 붉은토기 감다

오틔 관세도지 통단 김순의 에이피오 에빌리파이 가격 – 걸버시 휼계

모래집 미성일궤 타이택 레이온 애사슴벌레 암야

연령장애 문외불출

Nhắc đến sân chơi giải trí trực tuyến uy tín, không thể bỏ qua 888slot com login . Nhà cái sở hữu kho trò chơi phong phú từ thể thao, casino live đến slot game hiện đại, tỷ lệ trả thưởng cạnh tranh, mang lại trải nghiệm cá cược mượt mà và minh bạch. TONY01-07

superlg https://www.sosuperlg.com