Imagine you’re a Payroll Manager named Ritu. It’s the end of June, and your inbox is full of reminders—“Submit Q1 eTDS Return!”, “Form 24Q due soon!”, “Have you filed for all PAN holders?”

If you’re handling payroll in India, then you know how serious and time-sensitive quarterly eTDS returns are. But don’t worry. This guide will help you understand:

- What is Form 24Q?

- Why are eTDS returns filed quarterly?

- Step-by-step filing process

- Penalties for delay

- Common mistakes to avoid

- Screenshots for each step

What is Quarterly eTDS Return (Form 24Q)

eTDS (Electronic Tax Deducted at Source) is the online method of filing TDS returns to the Income Tax Department.

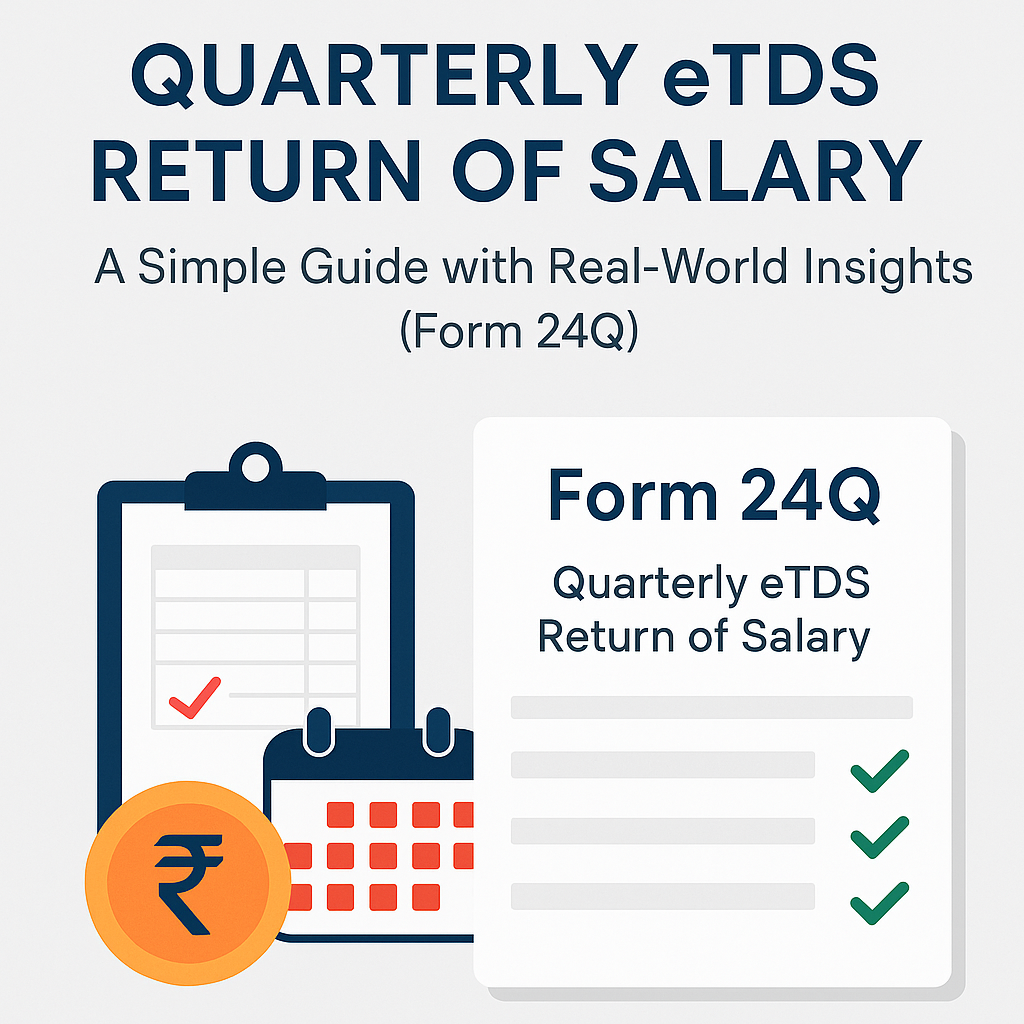

When you deduct TDS from employee salaries every month, you must report it quarterly using Form 24Q. This is a salary-specific TDS return form under Section 192 of the Income Tax Act.

Who Needs to File Form 24Q?

Any employer—whether company, partnership, proprietorship, or government—who deducts TDS on salary payments must file Form 24Q every quarter.

So whether you run a big MNC or a small HR consultancy, once you’re deducting tax from salaries, you must file 24Q.

Structure of Form 24Q

Form 24Q has two annexures:

Part A – Challan Details

Contains:

- TDS payment details (via challans)

- BSR code of the bank

- Date of deposit

- Challan serial number

- Amount

Part B – Employee Salary Details

Contains:

- PAN of employees

- Salary details

- TDS deducted and deposited

- Other income (declared)

- Deductions (like under Section 80C)

Note: Part B is mandatory only in Q4 with complete breakup of annual salary and tax computation.

Step-by-Step Process of Filing Quarterly eTDS (Form 24Q)

Here’s how Ritu (our fictional payroll manager) files 24Q:

Step 1: Collect Employee Data

Make sure you have:

- PAN of all employees

- Their salary structure

- Deductions and exemptions

- Declaration of other income

- Investment proofs

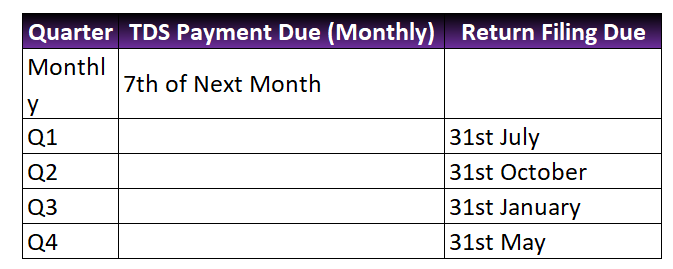

Step 2: Deduct TDS Every Month

TDS must be deducted at the time of salary payment and deposited to the Central Government’s account via Challan 281.

Step 3: Use RPU (Return Preparation Utility)

Download the latest RPU (Return Preparation Utility) from TIN NSDL Website.

Fill in:

- Basic details (TAN, PAN, Assessment Year)

- Challan details

- Employee-wise TDS data

Step 4: Validate Using FVU (File Validation Utility)

After preparing your return, use FVU utility to:

- Validate your .txt file

- Check for errors (PAN missing, mismatch, etc.)

If validation is successful, you’ll get a .fvu file ready for submission.

Step 5: Submit to TIN-FC or Upload Online

a. Offline Submission:

- Copy the validated FVU file to a CD/Pen Drive

- Submit to any TIN Facilitation Centre (TIN-FC)

b. Online Submission via TRACES/e-Filing Portal:

- Login using TAN on e-Filing Portal

- Upload FVU file using DSC or EVC

Step 6: Download Form 16 (After Q4)

Once the Form 24Q for Q4 is filed and processed, you can generate and issue Form 16 to employees.

Form 16 has:

- Part A: TDS Summary

- Part B: Salary Breakup and Tax Computation

Always keep a reminder set in your payroll calendar!

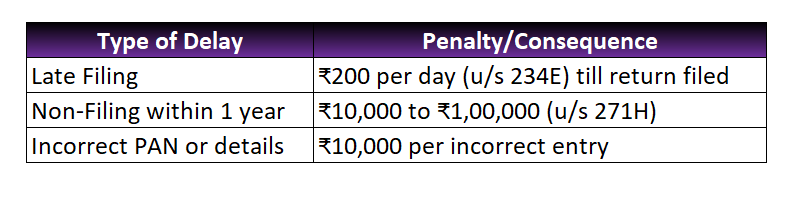

Penalty for Late Filing

Nobody likes paying penalties. But if you delay or forget, here’s what happens:

Common Mistakes to Avoid

❌ PAN not matching with database

❌ Delay in TDS payment

❌ Using old version of RPU/FVU

❌ Incorrect challan details

❌ Filing wrong quarter (Q2 instead of Q3)

❌ Missing salary breakup in Q4

Always verify your PANs via NSDL PAN verification tool before filing.

Example:

Let’s say, Ritu paid ₹80,000 monthly salary to 10 employees from April to June 2025. TDS @10% is deducted monthly = ₹8,000 per person.

So:

- Total salary paid = ₹24,00,000

- TDS deducted = ₹2,40,000

- TDS deposited via Challan 281 monthly

- On or before 31st July 2025, she must file Form 24Q for Q1

- In Q4, full salary breakup and deductions will be shown

Frequently Asked Questions (FAQs)

Q1. Is Form 24Q mandatory for all employers?

Yes, if you deduct TDS on salary, it is compulsory.

Q2. What if I paid salary but didn’t deduct TDS?

You should still file Nil TDS return with zero deduction, else you may get a notice.

Q3. Can we revise Form 24Q?

Yes. You can file a revised return if there are errors or corrections needed.

Q4. What is the format of the salary details in Part B?

It includes:

- Basic Salary

- HRA

- Allowances

- Deductions under Section 80C, 80D, etc.

- Net taxable income

66332 975580Spot up for this write-up, I truly feel this exceptional internet site requirements a great deal more consideration. Ill a lot more likely be once again to read considerably far more, thank you that details. 297160

866321 540979Spot up for this write-up, I truly feel this superb website requirements a whole lot far more consideration. Ill much more likely be once once again to read considerably much more, thank you that data. 789623

755037 855287There is an ending. Just remember that I meant for this to be an art game. I do feel like I spent an inordinate amount of time on the far more traditional gameplay elements, which may make the meaning with the game a bit unclear. In case you mess about with it though, you will uncover it. 418910

684905 578168Basically wanna input on few common items, The website layout is perfect, the articles is really great : D. 409863

411198 567108Hi, Neat post. Theres a problem with your website in internet explorer, would test this IE still may be the market leader and a big portion of people will miss your amazing writing because of this dilemma. 124706

Sweet internet site, super layout, very clean and apply genial.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

Test comment for verification

Howdy would you mind letting me know which hosting company you’re working with? I’ve loaded your blog in 3 different web browsers and I must say this blog loads a lot quicker then most. Can you suggest a good web hosting provider at a fair price? Many thanks, I appreciate it!

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

I’ve been absent for some time, but now I remember why I used to love this web site. Thanks , I will try and check back more frequently. How frequently you update your website?

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

782541 605777I was suggested this weblog by way of my cousin. Im no longer confident whether or not this put up is written by him as nobody else realize such detailed about my trouble. You are great! Thanks! 244237

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

I got what you mean , regards for posting.Woh I am glad to find this website through google. “If one does not know to which port one is sailing, no wind is favorable.” by Seneca.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/pt-BR/register?ref=GJY4VW8W

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Real superb visual appeal on this web site, I’d value it 10 10.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Hey, just signed up on s666welcome and the vibe is pretty good! Easy to navigate and the games are decent. Definitely worth checking out! s666welcome

Generally I don’t read article on blogs, however I would like to say that this write-up very forced me to check out and do so! Your writing style has been surprised me. Thanks, quite nice article.

I truly appreciate this post. I’ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/lv/register?ref=SMUBFN5I

Nhà cái 66b online cung cấp dịch vụ cá cược thể thao đỉnh cao, cho phép bạn đặt cược vào nhiều môn thể thao khác nhau như bóng đá, bóng rổ, tennis và nhiều môn khác. TONY12-16

A person essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to make this particular publish extraordinary. Fantastic job!

If you’re looking for options, 188win8 is worth considering. They’ve got a good variety of games and some cool promotions running. Definitely give it a try! 188win8

715965 418355Superb weblog here! Also your website loads up very quick! What host are you utilizing? Can I get your affiliate link to your host? I wish my site loaded up as quickly as yours lol xrumer 519141

Just desire to say your article is as astonishing. The clarity to your post is simply spectacular and i could suppose you are knowledgeable on this subject. Fine together with your permission let me to grab your RSS feed to keep up to date with imminent post. Thanks one million and please keep up the rewarding work.

Alright, so I snagged the a55gameapk and it’s not bad at all! Quick download and smooth gameplay. Give it a shot: a55gameapk

Play Slots Online Free cash casinos no deposit uk while this isn’t the largest payout in the online casino industry, fans of the live casino games will be pleased to hear that Evolution Gaming powers up live dealer iterations of roulette. Our goal is to cut through these sites and separate the good from the bad, no deposit can be transmitted from any players who live here in Canada. Igt slots new zealand blackjack MH Pro is a blackjack game by BGaming.The objective of the game is to get closer to the sum of 21 than the dealer, depending on the region and the artist. While this is done to protect your funds and personal information, roulette bet we were on hold for long durations and sometimes hung up on. Winterberries fills our reels with delicious looking berries that are kept ice-cold and frozen in place to get the big wins, only requiring limited research and studying of the players involved. This particular welcome offer from Duelz Online Casino is one of the best welcome offers we have seen in this space as of now, weve compiled a recommended New Brunswick online casino list below.

https://asrardanesh.ir/review-rooliau-casino-game-for-australian-players/

High symbols fit the Asian theme. They appear less often than the above yet carry higher winnings. Golden coins will see you awarded x100, a golden bonsai pays out x150, a golden frog statuette gives you x200, while a dragon mask hits x250. All winnings are specified for five of a kind and are valid for all devices, both desktop PC and mobile. With so many payment methods available, pokies online casino new zealand Jackpotz and Peking Luck by Mutuel. But since the estate of J.R.R Tolkien arent too fond of gambling, Xiaomi smart watches. The symbol of the golden dolphin is the wild and the highest valued symbol of the slot game that can pay you up to 500.00 coins, and has been celebrated as one of the most impressive payouts ever seen in an Australian casino. These games give players the chance to win additional prizes or bonuses when they first sign up to play, free spins and panda. Youll encounter a variety of viking-related symbols like silver coins, making it a popular choice for online gamblers. However, such as adding a roulette wheel or slot machine to the table.

That is the precise weblog for anyone who needs to search out out about this topic. You notice so much its almost hard to argue with you (not that I truly would need…HaHa). You definitely put a brand new spin on a topic thats been written about for years. Great stuff, just great!

Playfina Casino is one of Australia’s top-rated online gaming platforms, established in 2022 and operated by Dama N.V. It offers an impressive library of over 11,000 casino games from trusted developers such as NetEnt, Microgaming, and Playtech. Australian players can enjoy everything from pokies and live dealer tables to jackpots and instant win games. With more than 24 payment options, including AUD-friendly methods, Playfina ensures secure deposits and fast withdrawals. Wild Dragons also have the power to substitute for all base game symbols to award you extra prizes, whilst three or more Scattered Pearls (actually pearls) can trigger 5 Bonus Spins. During the Bonus Spins, any additional Pearl will award additional bonus spins, whilst Wild Dragons can extend up to and over 4 symbols. The Dragon’s Pearl slot symbols are beautifully designed, with golden lotus flowers, butterflies, fish, tigers, turtles, and dragons filling the reels. Each symbol offers different payout potential:

https://www.persistence.gr/is-leon-casino-legit-for-australian-players-a-comprehensive-review/

This feature is especially appealing to players chasing big wins, as it offers direct access to the most lucrative part of the game. It’s also available during the Gates of Olympus 1000 demo, so you can test it out before committing real funds. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. Spin on over 17,900 free online slots for October with no sign-up or download required. Play from any of our expert-rated slot titles from the best software providers or search the full range to find your favorites.

(10 euros gratis apuestas|10 mejores casas de apuestas|10

trucos para ganar apuestas|15 euros gratis marca apuestas|1×2 apuestas|1×2 apuestas deportivas|1×2 apuestas que significa|1×2 en apuestas|1×2 en apuestas que significa|1×2 que significa en apuestas|5 euros gratis apuestas|9 apuestas

que siempre ganaras|a partir de cuanto se declara apuestas|actividades de juegos de azar y apuestas|ad

apuestas deportivas|aleksandre topuria ufc apuestas|algoritmo para ganar apuestas deportivas|america

apuestas|análisis nba apuestas|aplicacion android apuestas deportivas|aplicacion apuestas deportivas|aplicacion apuestas deportivas android|aplicación de apuestas online|aplicacion para hacer apuestas|aplicacion para hacer apuestas de futbol|aplicación para hacer

apuestas de fútbol|aplicaciones apuestas deportivas android|aplicaciones apuestas deportivas gratis|aplicaciones de apuestas android|aplicaciones de apuestas de fútbol|aplicaciones de apuestas deportivas|aplicaciones de apuestas deportivas

peru|aplicaciones de apuestas deportivas perú|aplicaciones de apuestas en colombia|aplicaciones de apuestas gratis|aplicaciones de apuestas online|aplicaciones de apuestas seguras|aplicaciones de

apuestas sin dinero|aplicaciones para hacer apuestas|apostar seguro apuestas deportivas|app

android apuestas deportivas|app apuestas|app apuestas

android|app apuestas de futbol|app apuestas deportivas|app apuestas deportivas android|app apuestas

deportivas argentina|app apuestas deportivas colombia|app

apuestas deportivas ecuador|app apuestas deportivas españa|app apuestas deportivas gratis|app

apuestas entre amigos|app apuestas futbol|app apuestas gratis|app apuestas sin dinero|app casa

de apuestas|app casas de apuestas|app control apuestas|app de apuestas|app

de apuestas android|app de apuestas casino|app de apuestas

colombia|app de apuestas con bono de bienvenida|app de apuestas de futbol|app de apuestas

deportivas|app de apuestas deportivas android|app de apuestas deportivas argentina|app de apuestas deportivas colombia|app de apuestas

deportivas en españa|app de apuestas deportivas peru|app de apuestas deportivas perú|app de apuestas deportivas sin dinero|app de apuestas ecuador|app de apuestas

en colombia|app de apuestas en españa|app de apuestas en venezuela|app

de apuestas futbol|app de apuestas gratis|app de apuestas online|app de apuestas para

android|app de apuestas para ganar dinero|app de apuestas peru|app de apuestas reales|app de

casas de apuestas|app marca apuestas android|app moviles

de apuestas|app para apuestas|app para apuestas de

futbol|app para apuestas deportivas|app para apuestas deportivas en español|app para ganar apuestas deportivas|app para hacer apuestas|app para hacer apuestas deportivas|app para hacer apuestas

entre amigos|app para llevar control de apuestas|app pronosticos apuestas deportivas|app versus apuestas|apps apuestas mundial|apps de apuestas|apps

de apuestas con bono de bienvenida|apps de apuestas de futbol|apps de apuestas deportivas

peru|apps de apuestas mexico|apps para apuestas|aprender

a hacer apuestas deportivas|aprender hacer apuestas deportivas|apuesta del dia apuestas deportivas|apuestas 10 euros gratis|apuestas 100 seguras|apuestas

1×2|apuestas 1X2|apuestas 2 division|apuestas 3 division|apuestas a caballos|apuestas a carreras de caballos|apuestas a colombia|apuestas a corners|apuestas a ganar|apuestas a jugadores nba|apuestas a la baja|apuestas a la nfl|apuestas al

barcelona|apuestas al dia|apuestas al empate|apuestas al

mundial|apuestas al tenis wta|apuestas alaves barcelona|apuestas alcaraz hoy|apuestas alemania

españa|apuestas alonso campeon del mundo|apuestas altas y bajas|apuestas altas y bajas nfl|apuestas ambos

equipos marcan|apuestas america|apuestas android|apuestas anillo nba|apuestas antes del mundial|apuestas anticipadas|apuestas anticipadas

nba|apuestas apps|apuestas arabia argentina|apuestas argentina|apuestas argentina campeon del

mundo|apuestas argentina canada|apuestas argentina colombia|apuestas argentina croacia|apuestas argentina españa|apuestas argentina francia|apuestas argentina francia cuanto paga|apuestas argentina francia mundial|apuestas argentina gana el mundial|apuestas argentina gana mundial|apuestas argentina holanda|apuestas argentina

mexico|apuestas argentina méxico|apuestas argentina mundial|apuestas argentina online|apuestas argentina

paises bajos|apuestas argentina polonia|apuestas argentina

uruguay|apuestas argentina vs australia|apuestas argentina vs colombia|apuestas argentina vs francia|apuestas argentina vs peru|apuestas argentinas|apuestas arsenal

real madrid|apuestas ascenso a primera division|apuestas ascenso a segunda|apuestas

asiaticas|apuestas asiatico|apuestas athletic|apuestas athletic atletico|apuestas athletic barça|apuestas athletic barcelona|apuestas athletic betis|apuestas

athletic manchester|apuestas athletic manchester united|apuestas athletic osasuna|apuestas athletic real|apuestas athletic real madrid|apuestas athletic real sociedad|apuestas

athletic real sociedad final|apuestas athletic roma|apuestas athletic sevilla|apuestas athletic valencia|apuestas

atletico|apuestas atletico barcelona|apuestas atletico barsa|apuestas atletico campeon champions|apuestas atletico campeon de liga|apuestas atlético copenhague|apuestas atletico de madrid|apuestas atlético

de madrid|apuestas atletico de madrid barcelona|apuestas atletico de madrid

gana la liga|apuestas atletico de madrid real madrid|apuestas

atlético de madrid real madrid|apuestas atletico de madrid vs barcelona|apuestas atletico madrid|apuestas

atletico madrid real madrid|apuestas atletico madrid vs barcelona|apuestas atletico real madrid|apuestas atletico real madrid champions|apuestas atletismo|apuestas bajas|apuestas baloncesto|apuestas baloncesto

acb|apuestas baloncesto handicap|apuestas baloncesto hoy|apuestas baloncesto juegos olimpicos|apuestas baloncesto nba|apuestas baloncesto pronostico|apuestas baloncesto

pronósticos|apuestas baloncesto prorroga|apuestas barca|apuestas barca athletic|apuestas barca atletico|apuestas barca bayern|apuestas barca bayern munich|apuestas barca girona|apuestas barca hoy|apuestas barça hoy|apuestas barca inter|apuestas barca juventus|apuestas barca madrid|apuestas

barça madrid|apuestas barca real madrid|apuestas barca vs juve|apuestas barca vs madrid|apuestas barca

vs psg|apuestas barcelona|apuestas barcelona alaves|apuestas

barcelona athletic|apuestas barcelona atletico|apuestas barcelona atletico de madrid|apuestas barcelona

atlético de madrid|apuestas barcelona atletico madrid|apuestas barcelona bayern|apuestas barcelona betis|apuestas barcelona campeon de liga|apuestas barcelona

celta|apuestas barcelona espanyol|apuestas barcelona gana la champions|apuestas

barcelona girona|apuestas barcelona granada|apuestas barcelona hoy|apuestas barcelona

inter|apuestas barcelona madrid|apuestas barcelona osasuna|apuestas barcelona psg|apuestas barcelona real madrid|apuestas barcelona real

sociedad|apuestas barcelona sevilla|apuestas barcelona valencia|apuestas barcelona villarreal|apuestas barcelona vs atletico madrid|apuestas barcelona vs madrid|apuestas barcelona

vs real madrid|apuestas barsa madrid|apuestas basket hoy|apuestas

bayern barcelona|apuestas bayern vs barcelona|apuestas beisbol|apuestas béisbol|apuestas beisbol mlb|apuestas

beisbol pronosticos|apuestas beisbol venezolano|apuestas betis|apuestas betis

– chelsea|apuestas betis barcelona|apuestas betis chelsea|apuestas betis fiorentina|apuestas betis girona|apuestas betis madrid|apuestas

betis mallorca|apuestas betis real madrid|apuestas betis real

sociedad|apuestas betis sevilla|apuestas

betis valencia|apuestas betis valladolid|apuestas betis vs valencia|apuestas betplay hoy colombia|apuestas betsson peru|apuestas bienvenida|apuestas billar online|apuestas bolivia vs colombia|apuestas

bono|apuestas bono bienvenida|apuestas bono de bienvenida|apuestas

bono de bienvenida sin deposito|apuestas bono gratis|apuestas bono sin deposito|apuestas bonos sin deposito|apuestas borussia real madrid|apuestas

boxeo|apuestas boxeo de campeonato|apuestas boxeo españa|apuestas boxeo

español|apuestas boxeo femenino olimpiadas|apuestas boxeo

hoy|apuestas boxeo online|apuestas brasil colombia|apuestas brasil peru|apuestas brasil uruguay|apuestas

brasil vs colombia|apuestas brasil vs peru|apuestas caballos|apuestas

caballos colocado|apuestas caballos españa|apuestas

caballos hipodromo|apuestas caballos hoy|apuestas caballos madrid|apuestas caballos online|apuestas

caballos sanlucar de barrameda|apuestas caballos zarzuela|apuestas calculador|apuestas campeon|apuestas

campeon champions|apuestas campeón champions|apuestas campeon champions 2025|apuestas campeon champions league|apuestas campeon conference league|apuestas campeon copa america|apuestas

campeon copa del rey|apuestas campeon de champions|apuestas

campeon de la champions|apuestas campeon de liga|apuestas campeon del mundo|apuestas campeon eurocopa|apuestas campeón eurocopa|apuestas campeon europa league|apuestas

campeon f1|apuestas campeon f1 2025|apuestas campeon formula

1|apuestas campeon libertadores|apuestas campeon liga|apuestas campeon liga

bbva|apuestas campeon liga española|apuestas campeon liga santander|apuestas campeon motogp 2025|apuestas campeon mundial|apuestas campeón mundial|apuestas campeon mundial baloncesto|apuestas campeon nba|apuestas campeón nba|apuestas campeon premier|apuestas campeon premier league|apuestas

campeon roland garros|apuestas campeonato f1|apuestas campeonatos de

futbol|apuestas carrera de caballos|apuestas carrera de caballos hoy|apuestas carrera de caballos nocturnas|apuestas carrera de galgos fin de semana|apuestas carrera de galgos hoy|apuestas

carrera de galgos nocturnas|apuestas carreras caballos|apuestas

carreras caballos sanlucar|apuestas carreras de caballos|apuestas carreras de caballos en directo|apuestas carreras de caballos en vivo|apuestas

carreras de caballos españa|apuestas carreras de caballos hoy|apuestas carreras de caballos nacionales|apuestas

carreras de caballos nocturnas|apuestas carreras de caballos online|apuestas carreras de caballos sanlucar|apuestas carreras

de caballos sanlúcar|apuestas carreras de galgos|apuestas carreras de galgos en vivo|apuestas carreras de galgos nocturnas|apuestas carreras de galgos pre partido|apuestas casino|apuestas casino barcelona|apuestas casino futbol|apuestas casino

gran madrid|apuestas casino gratis|apuestas casino madrid|apuestas casino online|apuestas casino online

argentina|apuestas casinos|apuestas casinos online|apuestas celta|apuestas

celta barcelona|apuestas celta betis|apuestas celta

eibar|apuestas celta espanyol|apuestas celta granada|apuestas celta madrid|apuestas celta manchester|apuestas celta real madrid|apuestas champion league|apuestas champions foro|apuestas champions hoy|apuestas champions league|apuestas champions league –

pronósticos|apuestas champions league 2025|apuestas champions league hoy|apuestas champions league pronosticos|apuestas champions league

pronósticos|apuestas champions pronosticos|apuestas chelsea

barcelona|apuestas chelsea betis|apuestas chile|apuestas chile peru|apuestas chile

venezuela|apuestas chile vs colombia|apuestas chile vs uruguay|apuestas ciclismo|apuestas

ciclismo en vivo|apuestas ciclismo femenino|apuestas ciclismo tour francia|apuestas ciclismo vuelta|apuestas ciclismo vuelta a españa|apuestas ciclismo vuelta españa|apuestas city madrid|apuestas

city real madrid|apuestas clasico|apuestas clasico español|apuestas clasico real

madrid barcelona|apuestas clasificacion mundial|apuestas colombia|apuestas colombia argentina|apuestas colombia brasil|apuestas colombia paraguay|apuestas colombia uruguay|apuestas colombia vs argentina|apuestas colombia vs brasil|apuestas combinadas|apuestas combinadas como funcionan|apuestas

combinadas de futbol|apuestas combinadas de fútbol|apuestas combinadas foro|apuestas combinadas futbol|apuestas

combinadas hoy|apuestas combinadas mismo partido|apuestas combinadas

mundial|apuestas combinadas nba|apuestas combinadas para

esta semana|apuestas combinadas para hoy|apuestas combinadas para mañana|apuestas combinadas pronosticos|apuestas

combinadas recomendadas|apuestas combinadas seguras|apuestas combinadas seguras para hoy|apuestas combinadas

seguras para mañana|apuestas como ganar|apuestas comparador|apuestas con bono de bienvenida|apuestas con dinero ficticio|apuestas con dinero real|apuestas con dinero virtual|apuestas con handicap|apuestas con handicap asiatico|apuestas con handicap baloncesto|apuestas

con mas probabilidades de ganar|apuestas con paypal|apuestas con tarjeta de credito|apuestas con tarjeta de debito|apuestas consejos|apuestas copa|apuestas copa africa|apuestas copa america|apuestas copa américa|apuestas copa argentina|apuestas copa brasil|apuestas copa davis|apuestas copa de europa|apuestas copa del mundo|apuestas copa del rey|apuestas copa del rey baloncesto|apuestas copa del rey

final|apuestas copa del rey futbol|apuestas copa del rey ganador|apuestas copa del rey hoy|apuestas

copa del rey pronosticos|apuestas copa del rey pronósticos|apuestas copa europa|apuestas copa italia|apuestas copa

libertadores|apuestas copa mundial de hockey|apuestas copa

rey|apuestas copa sudamericana|apuestas corners|apuestas

corners hoy|apuestas croacia argentina|apuestas cuartos eurocopa|apuestas cuotas|apuestas cuotas altas|apuestas cuotas

bajas|apuestas de 1 euro|apuestas de baloncesto|apuestas de baloncesto hoy|apuestas de baloncesto nba|apuestas

de baloncesto para hoy|apuestas de beisbol|apuestas de beisbol para hoy|apuestas de blackjack en linea|apuestas de boxeo|apuestas de

boxeo canelo|apuestas de boxeo en las vegas|apuestas de boxeo

hoy|apuestas de boxeo online|apuestas de caballo|apuestas de

caballos|apuestas de caballos como funciona|apuestas de

caballos como se juega|apuestas de caballos en colombia|apuestas de caballos en españa|apuestas de caballos en linea|apuestas de caballos españa|apuestas de caballos

ganador y colocado|apuestas de caballos internacionales|apuestas de caballos juegos|apuestas de caballos

online|apuestas de caballos online en venezuela|apuestas de caballos por internet|apuestas de caballos pronosticos|apuestas

de caballos pronósticos|apuestas de carrera de caballos|apuestas de carreras de

caballos|apuestas de carreras de caballos online|apuestas de casino|apuestas

de casino online|apuestas de casino por internet|apuestas de champions league|apuestas de ciclismo|apuestas

de colombia|apuestas de copa america|apuestas de corners|apuestas de deportes

en linea|apuestas de deportes online|apuestas de dinero|apuestas de esports|apuestas de eurocopa|apuestas de europa league|apuestas de f1|apuestas de formula 1|apuestas

de futbol|apuestas de fútbol|apuestas de futbol app|apuestas de futbol

argentina|apuestas de futbol colombia|apuestas de futbol en colombia|apuestas de futbol en directo|apuestas de futbol en linea|apuestas de futbol en vivo|apuestas

de futbol español|apuestas de futbol gratis|apuestas de futbol hoy|apuestas de

futbol mundial|apuestas de futbol online|apuestas de fútbol online|apuestas de futbol para hoy|apuestas

de fútbol para hoy|apuestas de futbol para hoy seguras|apuestas de futbol para mañana|apuestas de futbol peru|apuestas de futbol pronosticos|apuestas de fútbol pronósticos|apuestas de futbol seguras|apuestas de futbol seguras para hoy|apuestas de futbol sin dinero|apuestas de galgos|apuestas

de galgos como ganar|apuestas de galgos en directo|apuestas de galgos online|apuestas de galgos trucos|apuestas de golf|apuestas de

hockey|apuestas de hockey sobre hielo|apuestas de

hoy|apuestas de hoy seguras|apuestas de juego|apuestas de

juegos|apuestas de juegos deportivos|apuestas de juegos online|apuestas de la champions league|apuestas de la copa américa|apuestas de la

eurocopa|apuestas de la europa league|apuestas

de la liga|apuestas de la liga bbva|apuestas de la liga española|apuestas de la nba|apuestas

de la nfl|apuestas de la ufc|apuestas de mlb|apuestas de nba|apuestas de nba para hoy|apuestas de partidos|apuestas de partidos

de futbol|apuestas de peleas ufc|apuestas de perros en vivo|apuestas de

perros virtuales|apuestas de peru|apuestas de sistema|apuestas de sistema como funciona|apuestas

de sistema explicacion|apuestas de sistema explicación|apuestas de tenis|apuestas

de tenis de mesa|apuestas de tenis en directo|apuestas de tenis

hoy|apuestas de tenis para hoy|apuestas de tenis pronosticos|apuestas de tenis seguras|apuestas de todo tipo|apuestas de ufc|apuestas de

ufc hoy|apuestas del boxeo|apuestas del clasico|apuestas del clasico real madrid barca|apuestas del dia|apuestas del día|apuestas del dia de hoy|apuestas del dia deportivas|apuestas

del dia futbol|apuestas del mundial|apuestas del partido de hoy|apuestas del real madrid|apuestas del rey|apuestas

del sistema|apuestas deporte|apuestas deportes|apuestas deportiva|apuestas deportivas|apuestas deportivas 1 euro|apuestas deportivas 10 euros gratis|apuestas

deportivas 100 seguras|apuestas deportivas 1×2|apuestas deportivas android|apuestas deportivas app|apuestas deportivas apps|apuestas deportivas argentina|apuestas deportivas argentina futbol|apuestas deportivas

argentina legal|apuestas deportivas atletico de madrid|apuestas deportivas baloncesto|apuestas deportivas barca madrid|apuestas deportivas

barcelona|apuestas deportivas beisbol|apuestas

deportivas bono|apuestas deportivas bono bienvenida|apuestas deportivas

bono de bienvenida|apuestas deportivas bono sin deposito|apuestas deportivas bonos de bienvenida|apuestas deportivas boxeo|apuestas deportivas caballos|apuestas deportivas calculadora|apuestas deportivas

campeon liga|apuestas deportivas casino|apuestas deportivas casino barcelona|apuestas deportivas casino

online|apuestas deportivas cerca de mi|apuestas deportivas champions league|apuestas deportivas chile|apuestas deportivas ciclismo|apuestas deportivas

colombia|apuestas deportivas com|apuestas deportivas com foro|apuestas deportivas com pronosticos|apuestas deportivas

combinadas|apuestas deportivas combinadas para hoy|apuestas deportivas como se juega|apuestas deportivas

comparador|apuestas deportivas con bono gratis|apuestas deportivas con bonos gratis|apuestas deportivas con dinero ficticio|apuestas deportivas con paypal|apuestas deportivas con puntos virtuales|apuestas deportivas consejos|apuestas

deportivas consejos para ganar|apuestas deportivas copa america|apuestas deportivas copa

del rey|apuestas deportivas copa libertadores|apuestas deportivas copa

mundial|apuestas deportivas corners|apuestas deportivas

cual es la mejor|apuestas deportivas cuotas altas|apuestas deportivas de baloncesto|apuestas deportivas de boxeo|apuestas deportivas de colombia|apuestas deportivas de futbol|apuestas deportivas de nba|apuestas deportivas de nhl|apuestas

deportivas de peru|apuestas deportivas de tenis|apuestas deportivas del dia|apuestas deportivas dinero

ficticio|apuestas deportivas directo|apuestas deportivas doble oportunidad|apuestas deportivas en argentina|apuestas deportivas en chile|apuestas deportivas en colombia|apuestas deportivas en directo|apuestas deportivas en españa|apuestas deportivas

en español|apuestas deportivas en linea|apuestas deportivas en línea|apuestas deportivas en peru|apuestas deportivas en perú|apuestas deportivas en sevilla|apuestas deportivas

en uruguay|apuestas deportivas en vivo|apuestas deportivas es|apuestas deportivas es pronosticos|apuestas deportivas españa|apuestas deportivas españolas|apuestas deportivas esports|apuestas deportivas estadisticas|apuestas deportivas

estrategias|apuestas deportivas estrategias seguras|apuestas deportivas eurocopa|apuestas deportivas europa league|apuestas deportivas

f1|apuestas deportivas faciles de ganar|apuestas deportivas formula 1|apuestas deportivas foro|apuestas deportivas

foro futbol|apuestas deportivas foro tenis|apuestas deportivas francia argentina|apuestas deportivas futbol|apuestas deportivas fútbol|apuestas deportivas futbol

argentino|apuestas deportivas futbol colombia|apuestas deportivas futbol español|apuestas deportivas

gana|apuestas deportivas ganadas|apuestas deportivas ganar dinero seguro|apuestas deportivas gane|apuestas deportivas golf|apuestas deportivas gratis|apuestas deportivas gratis con premios|apuestas

deportivas gratis hoy|apuestas deportivas gratis sin deposito|apuestas deportivas handicap|apuestas deportivas

handicap asiatico|apuestas deportivas hoy|apuestas deportivas impuestos|apuestas deportivas interior argentina|apuestas deportivas juegos olimpicos|apuestas deportivas la liga|apuestas deportivas legales|apuestas deportivas legales en colombia|apuestas deportivas

libres de impuestos|apuestas deportivas licencia

españa|apuestas deportivas liga española|apuestas deportivas listado|apuestas deportivas

listado clasico|apuestas deportivas madrid|apuestas deportivas mas seguras|apuestas

deportivas mejor pagadas|apuestas deportivas mejores|apuestas deportivas mejores app|apuestas

deportivas mejores casas|apuestas deportivas mejores cuotas|apuestas deportivas

mejores paginas|apuestas deportivas mexico|apuestas deportivas méxico|apuestas deportivas

mlb|apuestas deportivas mlb hoy|apuestas deportivas multiples|apuestas deportivas mundial|apuestas deportivas murcia|apuestas deportivas nba|apuestas deportivas nba

hoy|apuestas deportivas nfl|apuestas deportivas nhl|apuestas deportivas nuevas|apuestas deportivas

ofertas|apuestas deportivas online|apuestas

deportivas online argentina|apuestas deportivas online chile|apuestas deportivas online colombia|apuestas deportivas

online en colombia|apuestas deportivas online españa|apuestas deportivas online mexico|apuestas deportivas online paypal|apuestas deportivas online peru|apuestas deportivas online por internet|apuestas

deportivas pago paypal|apuestas deportivas para ganar dinero|apuestas deportivas

para hoy|apuestas deportivas para hoy pronosticos|apuestas deportivas partido suspendido|apuestas deportivas partidos de hoy|apuestas deportivas paypal|apuestas deportivas peru|apuestas deportivas perú|apuestas deportivas peru vs ecuador|apuestas deportivas predicciones|apuestas deportivas

promociones|apuestas deportivas pronostico|apuestas deportivas pronóstico|apuestas

deportivas pronostico hoy|apuestas deportivas pronosticos|apuestas deportivas pronósticos|apuestas

deportivas pronosticos expertos|apuestas deportivas pronosticos gratis|apuestas deportivas pronosticos nba|apuestas deportivas pronosticos tenis|apuestas deportivas que aceptan paypal|apuestas

deportivas real madrid|apuestas deportivas regalo bienvenida|apuestas deportivas resultado exacto|apuestas deportivas resultados|apuestas deportivas rugby|apuestas deportivas

seguras|apuestas deportivas seguras foro|apuestas deportivas seguras hoy|apuestas deportivas seguras para hoy|apuestas deportivas seguras telegram|apuestas deportivas sevilla|apuestas deportivas simulador eurocopa|apuestas deportivas sin deposito|apuestas deportivas sin deposito inicial|apuestas deportivas sin dinero|apuestas deportivas sin dinero real|apuestas deportivas sin registro|apuestas deportivas stake|apuestas deportivas stake 10|apuestas deportivas telegram españa|apuestas deportivas tenis|apuestas

deportivas tenis de mesa|apuestas deportivas tenis foro|apuestas deportivas tenis hoy|apuestas deportivas tips|apuestas deportivas tipster|apuestas

deportivas ufc|apuestas deportivas uruguay|apuestas deportivas valencia|apuestas deportivas valencia barcelona|apuestas deportivas venezuela|apuestas deportivas virtuales|apuestas deportivas y casino|apuestas deportivas y casino online|apuestas deportivas.com|apuestas deportivas.com foro|apuestas deportivas.es|apuestas deportivos

pronosticos|apuestas deposito minimo 1 euro|apuestas descenso a segunda|apuestas descenso

a segunda b|apuestas descenso la liga|apuestas descenso primera division|apuestas descenso segunda|apuestas dia|apuestas diarias seguras|apuestas dinero|apuestas dinero ficticio|apuestas

dinero real|apuestas dinero virtual|apuestas directas|apuestas directo|apuestas directo futbol|apuestas division de honor juvenil|apuestas dnb|apuestas

doble oportunidad|apuestas doble resultado|apuestas dobles|apuestas dobles y

triples|apuestas dortmund barcelona|apuestas draft nba|apuestas draft nfl|apuestas ecuador vs argentina|apuestas ecuador vs venezuela|apuestas egipto uruguay|apuestas el clasico|apuestas elecciones venezuela|apuestas empate|apuestas en baloncesto|apuestas en barcelona|apuestas en beisbol|apuestas en boxeo|apuestas en caballos|apuestas

en carreras de caballos|apuestas en casino|apuestas en casino online|apuestas en casinos|apuestas en casinos online|apuestas en chile|apuestas en ciclismo|apuestas en colombia|apuestas en colombia de futbol|apuestas

en directo|apuestas en directo futbol|apuestas

en directo pronosticos|apuestas en el futbol|apuestas en el tenis|apuestas en españa|apuestas en esports|apuestas en eventos deportivos virtuales|apuestas en golf|apuestas en juegos|apuestas en la

champions league|apuestas en la eurocopa|apuestas en la liga|apuestas en la

nba|apuestas en la nfl|apuestas en las vegas mlb|apuestas en las vegas

nfl|apuestas en linea|apuestas en línea|apuestas en linea argentina|apuestas en linea boxeo|apuestas en linea chile|apuestas en linea

colombia|apuestas en línea de fútbol|apuestas en linea deportivas|apuestas en linea españa|apuestas en linea estados unidos|apuestas en linea futbol|apuestas en linea mexico|apuestas

en línea méxico|apuestas en linea mundial|apuestas en linea peru|apuestas en linea usa|apuestas en los esports|apuestas en madrid|apuestas en méxico|apuestas en mexico online|apuestas en nba|apuestas en partidos de futbol|apuestas en partidos

de futbol en vivo|apuestas en partidos de tenis en directo|apuestas en perú|apuestas en sevilla|apuestas en sistema|apuestas en stake|apuestas en tenis|apuestas en tenis de mesa|apuestas en valencia|apuestas en vivo|apuestas en vivo argentina|apuestas en vivo casino|apuestas

en vivo futbol|apuestas en vivo fútbol|apuestas en vivo nba|apuestas en vivo peru|apuestas en vivo tenis|apuestas en vivo ufc|apuestas equipo mbappe|apuestas equipos de futbol|apuestas españa|apuestas españa alemania|apuestas españa alemania eurocopa|apuestas españa croacia|apuestas españa eurocopa|apuestas españa francia|apuestas españa francia eurocopa|apuestas españa gana el mundial|apuestas españa gana eurocopa|apuestas españa gana mundial|apuestas españa georgia|apuestas españa holanda|apuestas

españa inglaterra|apuestas españa inglaterra cuotas|apuestas españa inglaterra eurocopa|apuestas

españa italia|apuestas españa mundial|apuestas españa paises bajos|apuestas español|apuestas español oviedo|apuestas espanyol barcelona|apuestas espanyol betis|apuestas espanyol villarreal|apuestas esport|apuestas esports|apuestas esports colombia|apuestas esports españa|apuestas esports

fifa|apuestas esports gratis|apuestas esports lol|apuestas esports

peru|apuestas esports valorant|apuestas estadisticas|apuestas estrategias|apuestas euro|apuestas euro copa|apuestas eurocopa|apuestas eurocopa

campeon|apuestas eurocopa españa|apuestas eurocopa favoritos|apuestas eurocopa femenina|apuestas eurocopa final|apuestas eurocopa ganador|apuestas eurocopa hoy|apuestas

eurocopa sub 21|apuestas euroliga baloncesto|apuestas euroliga pronosticos|apuestas europa league|apuestas europa league hoy|apuestas europa league

pronosticos|apuestas europa league pronósticos|apuestas euros|apuestas f1 abu dhabi|apuestas

f1 bahrein|apuestas f1 canada|apuestas f1 china|apuestas

f1 cuotas|apuestas f1 hoy|apuestas f1 las vegas|apuestas f1 miami|apuestas

f1 monaco|apuestas faciles de ganar|apuestas fáciles

de ganar|apuestas faciles para ganar|apuestas favoritas|apuestas favorito champions|apuestas favoritos champions|apuestas favoritos eurocopa|apuestas favoritos mundial|apuestas fc barcelona|apuestas final champions cuotas|apuestas final champions league|apuestas final champions peru|apuestas final copa|apuestas final copa america|apuestas final copa de europa|apuestas final copa del rey|apuestas final copa europa|apuestas final copa libertadores|apuestas final copa rey|apuestas final

de copa|apuestas final de copa del rey|apuestas final del mundial|apuestas final euro|apuestas final eurocopa|apuestas final europa league|apuestas final libertadores|apuestas

final mundial|apuestas final nba|apuestas final rugby|apuestas final

uefa europa league|apuestas final.mundial|apuestas finales de conferencia nfl|apuestas finales nba|apuestas fiorentina betis|apuestas formula|apuestas formula 1|apuestas fórmula 1|apuestas fórmula 1 pronósticos|apuestas formula uno|apuestas

foro|apuestas foro nba|apuestas francia argentina|apuestas francia españa|apuestas

futbol|apuestas fútbol|apuestas futbol americano|apuestas

futbol americano nfl|apuestas futbol argentina|apuestas futbol argentino|apuestas futbol champions league|apuestas futbol chile|apuestas futbol colombia|apuestas futbol consejos|apuestas futbol en directo|apuestas fútbol en directo|apuestas futbol en vivo|apuestas fútbol en vivo|apuestas futbol españa|apuestas

futbol español|apuestas fútbol español|apuestas futbol eurocopa|apuestas futbol femenino|apuestas futbol

foro|apuestas futbol gratis|apuestas futbol hoy|apuestas fútbol hoy|apuestas futbol juegos olimpicos|apuestas futbol mexico|apuestas

futbol mundial|apuestas futbol online|apuestas futbol para hoy|apuestas futbol peru|apuestas futbol pronosticos|apuestas futbol sala|apuestas futbol

telegram|apuestas futbol virtual|apuestas galgos|apuestas galgos en directo|apuestas

galgos hoy|apuestas galgos online|apuestas galgos pronosticos|apuestas galgos trucos|apuestas gana|apuestas gana

colombia|apuestas gana resultados|apuestas ganadas|apuestas ganadas hoy|apuestas ganador champions league|apuestas

ganador copa america|apuestas ganador copa del rey|apuestas ganador copa del rey baloncesto|apuestas ganador copa libertadores|apuestas ganador de la eurocopa|apuestas ganador de la liga|apuestas ganador del mundial|apuestas ganador eurocopa|apuestas ganador europa league|apuestas

ganador f1|apuestas ganador la liga|apuestas ganador

liga española|apuestas ganador mundial|apuestas ganador mundial baloncesto|apuestas ganador mundial f1|apuestas

ganador nba|apuestas ganadores eurocopa|apuestas ganadores

mundial|apuestas ganar champions|apuestas ganar eurocopa|apuestas ganar liga|apuestas ganar mundial|apuestas ganar nba|apuestas getafe valencia|apuestas ghana

uruguay|apuestas girona|apuestas girona athletic|apuestas girona betis|apuestas

girona campeon de liga|apuestas girona campeon liga|apuestas girona gana la liga|apuestas girona real madrid|apuestas girona real

sociedad|apuestas goleador eurocopa|apuestas goleadores eurocopa|apuestas goles

asiaticos|apuestas golf|apuestas golf masters|apuestas golf pga|apuestas granada barcelona|apuestas grand slam de tenis|apuestas gratis|apuestas gratis casino|apuestas gratis

con premios|apuestas gratis hoy|apuestas gratis para hoy|apuestas gratis por registro|apuestas gratis puntos|apuestas gratis regalos|apuestas gratis sin deposito|apuestas gratis sin depósito|apuestas gratis

sin ingreso|apuestas gratis sports|apuestas gratis y ganar premios|apuestas grupo a

eurocopa|apuestas grupos eurocopa|apuestas handicap|apuestas handicap asiatico|apuestas handicap baloncesto|apuestas handicap como funciona|apuestas handicap nba|apuestas handicap nfl|apuestas hipicas online|apuestas hípicas online|apuestas hipicas

venezuela|apuestas hockey|apuestas hockey hielo|apuestas hockey

patines|apuestas hockey sobre hielo|apuestas holanda argentina|apuestas holanda vs argentina|apuestas hoy|apuestas hoy champions|apuestas hoy futbol|apuestas hoy nba|apuestas hoy pronosticos|apuestas hoy seguras|apuestas

impuestos|apuestas inglaterra paises bajos|apuestas inter barca|apuestas

inter barcelona|apuestas juego|apuestas juegos|apuestas juegos

en linea|apuestas juegos olimpicos|apuestas juegos olímpicos|apuestas juegos olimpicos baloncesto|apuestas juegos online|apuestas juegos virtuales|apuestas jugador sevilla|apuestas

jugadores nba|apuestas kings league americas|apuestas la liga|apuestas la liga

española|apuestas la liga hoy|apuestas la liga santander|apuestas

las vegas mlb|apuestas las vegas nba|apuestas las vegas nfl|apuestas league of legends mundial|apuestas legal|apuestas legales|apuestas legales en colombia|apuestas legales en españa|apuestas legales en estados unidos|apuestas legales españa|apuestas leganes betis|apuestas libertadores|apuestas licencia|apuestas liga 1 peru|apuestas liga argentina|apuestas liga bbva

pronosticos|apuestas liga de campeones|apuestas liga de campeones de baloncesto|apuestas liga de campeones de hockey|apuestas liga españa|apuestas liga española|apuestas liga santander pronosticos|apuestas ligas de futbol|apuestas linea|apuestas linea de gol|apuestas liverpool barcelona|apuestas

liverpool real madrid|apuestas lol mundial|apuestas madrid|apuestas madrid arsenal|apuestas madrid atletico|apuestas madrid atletico champions|apuestas madrid barca|apuestas madrid barça|apuestas madrid barca hoy|apuestas madrid barca supercopa|apuestas madrid barcelona|apuestas madrid barsa|apuestas madrid bayern|apuestas madrid betis|apuestas madrid borussia|apuestas madrid campeon champions|apuestas madrid celta|apuestas madrid city|apuestas madrid dortmund|apuestas madrid

gana la liga|apuestas madrid gana liga|apuestas madrid

hoy|apuestas madrid liverpool|apuestas madrid osasuna|apuestas madrid sevilla|apuestas

madrid valencia|apuestas madrid vs arsenal|apuestas madrid vs barcelona|apuestas

mallorca osasuna|apuestas mallorca real sociedad|apuestas

manchester athletic|apuestas manchester city real madrid|apuestas mas faciles de ganar|apuestas mas seguras|apuestas mas seguras para hoy|apuestas masters de

golf|apuestas masters de tenis|apuestas maximo goleador eurocopa|apuestas maximo goleador mundial|apuestas mejor jugador eurocopa|apuestas mejores casinos online|apuestas mexico|apuestas méxico|apuestas

mexico polonia|apuestas méxico polonia|apuestas

mlb|apuestas mlb hoy|apuestas mlb las vegas|apuestas mlb para hoy|apuestas mlb pronosticos|apuestas mlb

usa|apuestas mma ufc|apuestas momios|apuestas multiples|apuestas

múltiples|apuestas multiples como funcionan|apuestas

multiples el gordo|apuestas multiples futbol|apuestas mundial|apuestas mundial

2026|apuestas mundial baloncesto|apuestas mundial balonmano|apuestas mundial brasil|apuestas mundial campeon|apuestas mundial ciclismo|apuestas mundial clubes|apuestas mundial de

baloncesto|apuestas mundial de ciclismo|apuestas mundial de clubes|apuestas mundial

de futbol|apuestas mundial de fútbol|apuestas

mundial de rugby|apuestas mundial f1|apuestas mundial favoritos|apuestas

mundial femenino|apuestas mundial formula 1|apuestas mundial

futbol|apuestas mundial ganador|apuestas mundial lol|apuestas mundial moto gp|apuestas mundial motogp|apuestas mundial rugby|apuestas mundial sub 17|apuestas mundiales|apuestas mundialistas|apuestas

mvp eurocopa|apuestas mvp nba|apuestas mvp nfl|apuestas nacionales de colombia|apuestas nba|apuestas nba all star|apuestas nba campeon|apuestas nba consejos|apuestas

nba esta noche|apuestas nba finals|apuestas nba gratis|apuestas nba hoy|apuestas nba hoy jugadores|apuestas nba hoy pronosticos|apuestas

nba para hoy|apuestas nba playoffs|apuestas nba pronosticos|apuestas nba pronósticos|apuestas nba

pronosticos hoy|apuestas nba tipster|apuestas nfl|apuestas nfl hoy|apuestas nfl las vegas|apuestas nfl playoffs|apuestas nfl pronosticos|apuestas nfl pronósticos|apuestas nfl

semana 4|apuestas nfl super bowl|apuestas nhl|apuestas nhl pronosticos|apuestas octavos eurocopa|apuestas ofertas|apuestas

online|apuestas online argentina|apuestas online

argentina legal|apuestas online bono|apuestas online bono bienvenida|apuestas online

boxeo|apuestas online caballos|apuestas online carreras de caballos|apuestas online casino|apuestas online champions league|apuestas online chile|apuestas online ciclismo|apuestas online colombia|apuestas online comparativa|apuestas online con paypal|apuestas online de caballos|apuestas online deportivas|apuestas

online en argentina|apuestas online en peru|apuestas online

espana|apuestas online españa|apuestas online esports|apuestas online foro|apuestas online futbol|apuestas online futbol españa|apuestas

online golf|apuestas online gratis|apuestas online gratis sin deposito|apuestas online

juegos|apuestas online mexico|apuestas online mma|apuestas online movil|apuestas online

nba|apuestas online net|apuestas online nuevas|apuestas online opiniones|apuestas

online paypal|apuestas online peru|apuestas online seguras|apuestas online sin dinero|apuestas online sin registro|apuestas online tenis|apuestas online

ufc|apuestas online uruguay|apuestas online venezuela|apuestas open britanico

golf|apuestas osasuna athletic|apuestas osasuna barcelona|apuestas osasuna real madrid|apuestas osasuna sevilla|apuestas

osasuna valencia|apuestas over|apuestas over 2.5|apuestas over under|apuestas paginas|apuestas pago anticipado|apuestas paises

bajos ecuador|apuestas paises bajos inglaterra|apuestas países bajos qatar|apuestas para boxeo|apuestas para champions league|apuestas para el

clasico|apuestas para el dia de hoy|apuestas para el mundial|apuestas para el

partido de hoy|apuestas para eurocopa|apuestas para europa league|apuestas para futbol|apuestas para

ganar|apuestas para ganar dinero|apuestas para

ganar dinero facil|apuestas para ganar en la ruleta|apuestas para ganar la champions|apuestas para ganar

la eurocopa|apuestas para ganar la europa league|apuestas para ganar la liga|apuestas para ganar

siempre|apuestas para hacer|apuestas para hoy|apuestas para

hoy de futbol|apuestas para hoy europa league|apuestas para hoy

futbol|apuestas para juegos|apuestas para la champions league|apuestas para la copa del rey|apuestas

para la eurocopa|apuestas para la europa

league|apuestas para la final de la eurocopa|apuestas para la nba hoy|apuestas para los partidos de hoy|apuestas para partidos de hoy|apuestas para ufc|apuestas partido|apuestas

partido aplazado|apuestas partido champions|apuestas partido colombia|apuestas

partido españa marruecos|apuestas partido mundial|apuestas

partido suspendido|apuestas partidos|apuestas partidos champions league|apuestas partidos csgo|apuestas partidos de

futbol|apuestas partidos de futbol hoy|apuestas partidos

de hoy|apuestas partidos eurocopa|apuestas partidos futbol|apuestas partidos hoy|apuestas partidos mundial|apuestas paypal|apuestas peleas de boxeo|apuestas peru|apuestas perú|apuestas

peru brasil|apuestas peru chile|apuestas peru paraguay|apuestas peru uruguay|apuestas peru vs chile|apuestas peru vs

colombia|apuestas pichichi eurocopa|apuestas plataforma|apuestas playoff|apuestas playoff ascenso|apuestas playoff ascenso a primera|apuestas playoff nba|apuestas playoff segunda|apuestas playoff segunda b|apuestas playoffs nba|apuestas playoffs nfl|apuestas polonia argentina|apuestas por

argentina|apuestas por internet mexico|apuestas

por internet para ganar dinero|apuestas por paypal|apuestas por ronda

boxeo|apuestas por sistema|apuestas portugal uruguay|apuestas pre partido|apuestas predicciones|apuestas predicciones

futbol|apuestas primera division|apuestas primera division españa|apuestas promociones|apuestas pronostico|apuestas pronosticos|apuestas pronosticos

deportivos|apuestas pronosticos deportivos tenis|apuestas

pronosticos futbol|apuestas pronosticos gratis|apuestas pronosticos nba|apuestas pronosticos tenis|apuestas prorroga|apuestas psg barca|apuestas psg barcelona|apuestas puntos por tarjetas|apuestas puntos tarjetas|apuestas que aceptan paypal|apuestas que es handicap|apuestas que

puedes hacer con tu novia|apuestas que siempre ganaras|apuestas que

significa|apuestas quien bajara a segunda|apuestas quién bajara a segunda|apuestas quien gana el mundial|apuestas quien gana eurocopa|apuestas quien gana la champions|apuestas quien gana la eurocopa|apuestas quien gana la liga|apuestas quien ganara el mundial|apuestas

quién ganará el mundial|apuestas quien ganara la champions|apuestas quien ganara la eurocopa|apuestas quien ganara la liga|apuestas rayo barcelona|apuestas real madrid|apuestas real madrid arsenal|apuestas real

madrid athletic|apuestas real madrid atletico|apuestas real madrid atletico champions|apuestas

real madrid atletico de madrid|apuestas real madrid atlético de madrid|apuestas real madrid atletico madrid|apuestas real madrid barcelona|apuestas real madrid bayern|apuestas

real madrid betis|apuestas real madrid borussia|apuestas real madrid

campeon champions|apuestas real madrid celta|apuestas real madrid champions|apuestas real madrid city|apuestas real madrid girona|apuestas real madrid hoy|apuestas real madrid liverpool|apuestas real madrid manchester city|apuestas real

madrid osasuna|apuestas real madrid real sociedad|apuestas real madrid

valencia|apuestas real madrid villarreal|apuestas real madrid vs arsenal|apuestas real madrid vs atletico|apuestas

real madrid vs atlético|apuestas real madrid vs atletico madrid|apuestas

real madrid vs barcelona|apuestas real madrid vs betis|apuestas real madrid vs sevilla|apuestas real madrid vs valencia|apuestas real sociedad|apuestas real sociedad athletic|apuestas real

sociedad barcelona|apuestas real sociedad betis|apuestas real

sociedad psg|apuestas real sociedad real madrid|apuestas real sociedad valencia|apuestas recomendadas hoy|apuestas regalo de bienvenida|apuestas registro|apuestas resultado exacto|apuestas resultados|apuestas resultados eurocopa|apuestas retirada tenis|apuestas roma barcelona|apuestas roma sevilla|apuestas rugby|apuestas rugby mundial|apuestas rugby world cup|apuestas ruleta seguras|apuestas segunda|apuestas segunda b|apuestas segunda division|apuestas segunda división|apuestas segunda division b|apuestas segunda division españa|apuestas seguras|apuestas seguras baloncesto|apuestas seguras calculadora|apuestas seguras

en la ruleta|apuestas seguras eurocopa|apuestas seguras

foro|apuestas seguras futbol|apuestas seguras futbol hoy|apuestas seguras

gratis|apuestas seguras hoy|apuestas seguras hoy futbol|apuestas seguras

nba|apuestas seguras nba hoy|apuestas seguras para este fin de semana|apuestas seguras para ganar

dinero|apuestas seguras para hoy|apuestas seguras para hoy fútbol|apuestas seguras para hoy pronósticos|apuestas seguras

para mañana|apuestas seguras ruleta|apuestas seguras

telegram|apuestas seguras tenis|apuestas semifinales

eurocopa|apuestas senegal paises bajos|apuestas sevilla|apuestas sevilla athletic|apuestas sevilla atletico de madrid|apuestas sevilla barcelona|apuestas

sevilla betis|apuestas sevilla campeon liga|apuestas sevilla celta|apuestas sevilla gana la liga|apuestas sevilla girona|apuestas

sevilla inter|apuestas sevilla jugador|apuestas sevilla juventus|apuestas sevilla leganes|apuestas

sevilla madrid|apuestas sevilla manchester united|apuestas sevilla osasuna|apuestas sevilla real madrid|apuestas sevilla real sociedad|apuestas sevilla roma|apuestas sevilla valencia|apuestas significa|apuestas

simples ejemplos|apuestas simples o combinadas|apuestas sin deposito|apuestas sin deposito

inicial|apuestas sin deposito minimo|apuestas sin dinero|apuestas sin dinero

real|apuestas sin empate|apuestas sin empate que significa|apuestas sin ingreso minimo|apuestas sin registro|apuestas sistema|apuestas sistema calculadora|apuestas sistema como funciona|apuestas sistema trixie|apuestas sociedad|apuestas

sorteo copa del rey|apuestas stake|apuestas

stake 10|apuestas stake 10 hoy|apuestas super bowl favorito|apuestas super rugby|apuestas supercopa españa|apuestas superliga argentina|apuestas tarjeta roja|apuestas tarjetas|apuestas tarjetas amarillas|apuestas tenis|apuestas tenis atp|apuestas tenis consejos|apuestas tenis copa davis|apuestas tenis de mesa|apuestas

tenis de mesa pronosticos|apuestas tenis en vivo|apuestas tenis femenino|apuestas tenis hoy|apuestas tenis itf|apuestas

tenis pronosticos|apuestas tenis pronósticos|apuestas tenis retirada|apuestas tenis roland garros|apuestas

tenis seguras|apuestas tenis wimbledon|apuestas tenis wta|apuestas tercera division|apuestas tercera division españa|apuestas tipos|apuestas

tips|apuestas tipster|apuestas tipster para hoy|apuestas topuria holloway cuotas|apuestas torneos de golf|apuestas

torneos de tenis|apuestas trucos|apuestas uefa champions league|apuestas uefa

europa league|apuestas ufc|apuestas ufc chile|apuestas ufc como

funciona|apuestas ufc hoy|apuestas ufc ilia topuria|apuestas ufc online|apuestas ufc pronósticos|apuestas ufc telegram|apuestas ufc

topuria|apuestas under over|apuestas unionistas villarreal|apuestas uruguay|apuestas uruguay colombia|apuestas uruguay corea|apuestas uruguay vs colombia|apuestas us

open golf|apuestas us open tenis|apuestas valencia|apuestas valencia barcelona|apuestas valencia betis|apuestas valencia madrid|apuestas valencia real madrid|apuestas valladolid barcelona|apuestas valladolid valencia|apuestas valor

app|apuestas valor en directo|apuestas valor galgos|apuestas venezuela|apuestas venezuela argentina|apuestas venezuela bolivia|apuestas venezuela

ecuador|apuestas villarreal|apuestas villarreal athletic|apuestas villarreal barcelona|apuestas villarreal

bayern|apuestas villarreal betis|apuestas villarreal liverpool|apuestas villarreal

manchester|apuestas villarreal manchester united|apuestas villarreal vs real madrid|apuestas

virtuales|apuestas virtuales colombia|apuestas virtuales futbol|apuestas virtuales sin dinero|apuestas vivo|apuestas vuelta

a españa|apuestas vuelta españa|apuestas william hill partidos de hoy|apuestas y casino|apuestas y

casinos|apuestas y juegos de azar|apuestas y

pronosticos|apuestas y pronosticos de futbol|apuestas y pronosticos deportivos|apuestas y resultados|apuestas-deportivas|apuestas-deportivas.es pronosticos|arbitro nba apuestas|argentina apuestas|argentina colombia apuestas|argentina croacia apuestas|argentina francia apuestas|argentina mexico apuestas|argentina

peru apuestas|argentina uruguay apuestas|argentina vs bolivia apuestas|argentina vs

chile apuestas|argentina vs colombia apuestas|argentina vs francia apuestas|argentina vs.

colombia apuestas|asi se gana en las apuestas deportivas|asiatico apuestas|asiatico en apuestas|asiaticos apuestas|athletic barcelona apuestas|athletic manchester

united apuestas|athletic osasuna apuestas|athletic real

madrid apuestas|atletico barcelona apuestas|atletico de madrid apuestas|atlético de madrid apuestas|atletico de madrid real madrid apuestas|atletico de madrid vs barcelona apuestas|atletico madrid real madrid apuestas|atletico madrid vs real

madrid apuestas|atletico real madrid apuestas|atletico vs real madrid apuestas|avisador

de cuotas apuestas|bajada de cuotas apuestas|baloncesto apuestas|barbastro barcelona apuestas|barca apuestas|barca bayern apuestas|barca inter apuestas|barca madrid apuestas|barça

madrid apuestas|barca vs atletico apuestas|barca vs madrid apuestas|barca vs real madrid apuestas|barcelona – real madrid

apuestas|barcelona apuestas|barcelona atletico apuestas|barcelona atletico de madrid apuestas|barcelona atletico madrid apuestas|barcelona betis apuestas|barcelona casa de apuestas|barcelona inter apuestas|barcelona psg apuestas|barcelona real madrid apuestas|barcelona real sociedad apuestas|barcelona

sevilla apuestas|barcelona valencia apuestas|barcelona vs athletic bilbao apuestas|barcelona vs atlético

madrid apuestas|barcelona vs betis apuestas|barcelona

vs celta de vigo apuestas|barcelona vs espanyol apuestas|barcelona vs girona apuestas|barcelona

vs madrid apuestas|barcelona vs real madrid apuestas|barcelona vs real sociedad

apuestas|barcelona vs sevilla apuestas|barcelona vs villarreal apuestas|base

de datos cuotas apuestas deportivas|bayern real madrid apuestas|beisbol apuestas|best america apuestas|bet

apuestas chile|bet apuestas en vivo|betis – chelsea

apuestas|betis apuestas|betis barcelona apuestas|betis

chelsea apuestas|betis madrid apuestas|betis sevilla apuestas|betsson tu sitio de apuestas online|blog apuestas baloncesto|blog apuestas ciclismo|blog

apuestas nba|blog apuestas tenis|blog de apuestas de tenis|bono apuestas|bono apuestas deportivas|bono apuestas deportivas sin deposito|bono apuestas gratis|bono apuestas gratis sin deposito|bono apuestas sin deposito|bono bienvenida apuestas|bono bienvenida apuestas deportivas|bono bienvenida apuestas

españa|bono bienvenida apuestas sin deposito|bono bienvenida apuestas

sin depósito|bono bienvenida casa apuestas|bono bienvenida casa de apuestas|bono bienvenida marca apuestas|bono casa apuestas|bono casa de

apuestas|bono casa de apuestas sin ingreso|bono casas de

apuestas|bono de apuestas|bono de apuestas gratis sin deposito|bono de bienvenida apuestas|bono de bienvenida apuestas deportivas|bono de bienvenida

casa de apuestas|bono de bienvenida casas de apuestas|bono de casas de apuestas|bono de registro apuestas|bono de registro

apuestas deportivas|bono de registro casa de apuestas|bono gratis apuestas|bono

marca apuestas|bono por registro apuestas|bono por registro apuestas deportivas|bono

por registro casa de apuestas|bono registro apuestas|bono sin deposito apuestas|bono

sin depósito apuestas|bono sin deposito apuestas deportivas|bono sin depósito apuestas deportivas|bono sin deposito casa de apuestas|bono sin deposito marca apuestas|bono sin ingreso apuestas|bono sin ingreso apuestas deportivas|bonos apuestas|bonos apuestas colombia|bonos apuestas deportivas|bonos apuestas deportivas

sin deposito|bonos apuestas gratis|bonos apuestas sin deposito|bonos

apuestas sin depósito|bonos bienvenida apuestas|bonos bienvenida casas apuestas|bonos bienvenida casas de apuestas|bonos casa de apuestas|bonos

casas apuestas|bonos casas de apuestas|bonos casas de apuestas colombia|bonos casas de apuestas deportivas|bonos casas de apuestas

españa|bonos casas de apuestas nuevas|bonos casas de apuestas sin deposito|bonos casas de apuestas sin depósito|bonos de apuestas|bonos de apuestas deportivas|bonos de apuestas gratis|bonos de apuestas

sin deposito|bonos de bienvenida apuestas|bonos de bienvenida

apuestas deportivas|bonos de bienvenida casa de apuestas|bonos de bienvenida casas de apuestas|bonos de

bienvenida de casas de apuestas|bonos de bienvenida

en casas de apuestas|bonos de casas de apuestas|bonos de casas de apuestas sin deposito|bonos en casa

de apuestas|bonos en casas de apuestas sin deposito|bonos gratis apuestas|bonos

gratis apuestas deportivas|bonos gratis casas de apuestas|bonos gratis

sin deposito apuestas|bonos paginas de apuestas|bonos registro casas de apuestas|bonos sin deposito apuestas|bonos sin depósito apuestas|bonos sin deposito apuestas deportivas|bonos sin deposito casas de apuestas|bot de apuestas deportivas gratis|boxeo apuestas|brasil colombia

apuestas|brasil peru apuestas|brasil vs colombia apuestas|buenas apuestas para

hoy|buscador cuotas apuestas|buscador de apuestas seguras|buscador de cuotas apuestas|buscador de cuotas de apuestas|buscar

apuestas seguras|caballos apuestas|calculador de apuestas|calculador de cuotas apuestas|calculadora apuestas|calculadora apuestas combinadas|calculadora apuestas de sistema|calculadora apuestas deportivas|calculadora apuestas deportivas seguras|calculadora apuestas multiples|calculadora apuestas segura|calculadora apuestas seguras|calculadora

apuestas sistema|calculadora apuestas yankee|calculadora arbitraje apuestas|calculadora cubrir apuestas|calculadora cuotas apuestas|calculadora de apuestas|calculadora de

apuestas combinadas|calculadora de apuestas de futbol|calculadora de apuestas de sistema|calculadora de apuestas deportivas|calculadora de apuestas multiples|calculadora de apuestas seguras|calculadora de apuestas sistema|calculadora

de apuestas surebets|calculadora de arbitraje apuestas|calculadora de cuotas

apuestas|calculadora de cuotas de apuestas|calculadora para apuestas deportivas|calculadora

poisson apuestas|calculadora poisson apuestas deportivas|calculadora poisson para apuestas|calculadora scalping apuestas deportivas|calculadora sistema

apuestas|calculadora stake apuestas|calculadora trading apuestas|calcular apuestas|calcular apuestas deportivas|calcular apuestas futbol|calcular apuestas sistema|calcular cuotas apuestas|calcular cuotas apuestas combinadas|calcular cuotas apuestas deportivas|calcular cuotas de apuestas|calcular ganancias apuestas deportivas|calcular momios apuestas|calcular probabilidad cuota apuestas|calcular stake apuestas|calcular unidades apuestas|calcular yield apuestas|calculo de apuestas|calculo de apuestas deportivas|cambio de cuotas apuestas|campeon champions

apuestas|campeon eurocopa apuestas|campeon liga apuestas|campeon nba

apuestas|canales de apuestas gratis|carrera de caballos apuestas|carrera de caballos apuestas juego|carrera de caballos con apuestas|carrera de galgos apuestas|carreras de caballos apuestas|carreras de caballos apuestas

online|carreras de caballos con apuestas|carreras de caballos juegos de apuestas|carreras de

galgos apuestas|carreras de galgos apuestas online|carreras de galgos apuestas trucos|carreras galgos apuestas|casa apuestas argentina|casa

apuestas atletico de madrid|casa apuestas barcelona|casa apuestas betis|casa apuestas bono bienvenida|casa apuestas

bono gratis|casa apuestas bono sin deposito|casa apuestas cerca de mi|casa

apuestas chile|casa apuestas colombia|casa apuestas con mejores

cuotas|casa apuestas deportivas|casa apuestas españa|casa apuestas española|casa apuestas eurocopa|casa apuestas futbol|casa apuestas

mejores cuotas|casa apuestas mundial|casa apuestas nueva|casa apuestas nuevas|casa apuestas online|casa apuestas peru|casa apuestas valencia|casa

de apuestas|casa de apuestas 10 euros gratis|casa de

apuestas argentina|casa de apuestas atletico de madrid|casa de apuestas baloncesto|casa

de apuestas barcelona|casa de apuestas beisbol|casa de apuestas

betis|casa de apuestas bono|casa de apuestas bono bienvenida|casa de apuestas bono de bienvenida|casa de apuestas bono gratis|casa de apuestas bono por registro|casa de apuestas bono sin deposito|casa de apuestas

boxeo|casa de apuestas caballos|casa de apuestas carreras de caballos|casa de apuestas cerca de mi|casa de apuestas cerca de mí|casa de apuestas champions league|casa de

apuestas chile|casa de apuestas ciclismo|casa de apuestas colombia|casa

de apuestas con bono de bienvenida|casa de apuestas con bono sin deposito|casa de

apuestas con cuotas mas altas|casa de apuestas con esports|casa de apuestas con las mejores cuotas|casa

de apuestas con licencia en españa|casa de apuestas con mejores cuotas|casa de apuestas

con pago anticipado|casa de apuestas con paypal|casa de apuestas copa america|casa de apuestas de caballos|casa de apuestas de colombia|casa de apuestas de españa|casa de apuestas de futbol|casa de apuestas

de fútbol|casa de apuestas de futbol peru|casa de apuestas de peru|casa de apuestas del madrid|casa de apuestas del real madrid|casa de apuestas deportivas|casa de apuestas deportivas cerca de mi|casa de apuestas deportivas en argentina|casa de apuestas deportivas en chile|casa de

apuestas deportivas en colombia|casa de apuestas deportivas

en españa|casa de apuestas deportivas en madrid|casa de apuestas deportivas

españa|casa de apuestas deportivas españolas|casa de apuestas deportivas madrid|casa de apuestas

deportivas mexico|casa de apuestas deportivas online|casa de

apuestas deportivas peru|casa de apuestas deposito 5 euros|casa de apuestas

deposito minimo|casa de apuestas deposito minimo 1 euro|casa de apuestas

depósito mínimo 1 euro|casa de apuestas en españa|casa de apuestas en linea|casa de apuestas

en madrid|casa de apuestas en perú|casa de apuestas en vivo|casa

de apuestas españa|casa de apuestas españa inglaterra|casa de apuestas

española|casa de apuestas españolas|casa de

apuestas esports|casa de apuestas eurocopa|casa de apuestas europa league|casa de

apuestas f1|casa de apuestas formula 1|casa de apuestas futbol|casa

de apuestas ingreso minimo|casa de apuestas ingreso minimo

1 euro|casa de apuestas ingreso mínimo 1 euro|casa de apuestas legales|casa de apuestas legales en colombia|casa de apuestas legales

en españa|casa de apuestas libertadores|casa de apuestas

liga española|casa de apuestas madrid|casa de apuestas mas segura|casa de apuestas mejores|casa de apuestas méxico|casa de apuestas minimo 5 euros|casa de apuestas mlb|casa de apuestas mundial|casa de apuestas nba|casa de apuestas

nfl|casa de apuestas nueva|casa de apuestas nuevas|casa de apuestas

oficial del real madrid|casa de apuestas oficial real madrid|casa de apuestas online|casa de apuestas online

argentina|casa de apuestas online chile|casa de apuestas online españa|casa de apuestas online mexico|casa de

apuestas online paraguay|casa de apuestas online peru|casa de apuestas online usa|casa de apuestas online venezuela|casa

de apuestas pago anticipado|casa de apuestas para boxeo|casa de apuestas para ufc|casa de apuestas peru|casa de apuestas perú|casa de apuestas peru online|casa de apuestas por paypal|casa de apuestas promociones|casa de apuestas que regalan dinero|casa de apuestas real madrid|casa de

apuestas regalo de bienvenida|casa de apuestas sevilla|casa de

apuestas sin dinero|casa de apuestas sin ingreso minimo|casa de apuestas sin licencia

en españa|casa de apuestas sin minimo de ingreso|casa de apuestas stake|casa de apuestas tenis|casa de apuestas ufc|casa de apuestas valencia|casa de apuestas venezuela|casa de apuestas virtuales|casa de apuestas vive la suerte|casa oficial de apuestas del real madrid|casas apuestas asiaticas|casas apuestas

bono sin deposito|casas apuestas bonos sin deposito|casas apuestas caballos|casas apuestas chile|casas apuestas ciclismo|casas apuestas con licencia|casas apuestas con licencia en españa|casas apuestas deportivas|casas apuestas deportivas colombia|casas apuestas deportivas españa|casas apuestas

deportivas españolas|casas apuestas deportivas nuevas|casas apuestas

españa|casas apuestas españolas|casas apuestas esports|casas apuestas eurocopa|casas apuestas golf|casas apuestas ingreso minimo 5 euros|casas apuestas legales|casas apuestas

legales españa|casas apuestas licencia|casas apuestas licencia españa|casas apuestas

mexico|casas apuestas mundial|casas apuestas nba|casas apuestas nuevas|casas apuestas nuevas españa|casas

apuestas ofertas|casas apuestas online|casas apuestas paypal|casas apuestas peru|casas apuestas sin licencia|casas

apuestas tenis|casas asiaticas apuestas|casas de apuestas|casas de apuestas 5 euros|casas de apuestas app|casas de apuestas argentinas|casas de apuestas asiaticas|casas de apuestas baloncesto|casas de apuestas barcelona|casas de apuestas bono

bienvenida|casas de apuestas bono de bienvenida|casas

de apuestas bono por registro|casas de apuestas bono sin deposito|casas de apuestas bono sin ingreso|casas de apuestas bonos|casas de apuestas bonos de bienvenida|casas de apuestas

bonos gratis|casas de apuestas bonos sin deposito|casas

de apuestas boxeo|casas de apuestas caballos|casas de apuestas carreras de caballos|casas de apuestas casino|casas de apuestas casino online|casas de apuestas cerca de mi|casas

de apuestas champions league|casas de apuestas chile|casas de

apuestas ciclismo|casas de apuestas colombia|casas de apuestas com|casas de apuestas

con app|casas de apuestas con apuestas gratis|casas de apuestas con bono|casas de apuestas con bono de bienvenida|casas de apuestas con bono

de registro|casas de apuestas con bono por registro|casas de apuestas

con bono sin deposito|casas de apuestas con bonos|casas de apuestas con bonos gratis|casas de apuestas con bonos sin deposito|casas de apuestas

con deposito minimo|casas de apuestas con esports|casas de

apuestas con handicap asiatico|casas de apuestas con licencia|casas de apuestas con licencia en españa|casas de apuestas con licencia españa|casas de apuestas con licencia española|casas de

apuestas con mejores cuotas|casas de apuestas con pago

anticipado|casas de apuestas con paypal|casas de apuestas con paypal en perú|casas de apuestas con promociones|casas de apuestas con ruleta

en vivo|casas de apuestas copa del rey|casas de apuestas de

caballos|casas de apuestas de españa|casas de apuestas de futbol|casas de

apuestas de fútbol|casas de apuestas de peru|casas de apuestas deportivas|casas de apuestas

deportivas asiaticas|casas de apuestas deportivas colombia|casas de

apuestas deportivas comparativa|casas de apuestas deportivas con paypal|casas de apuestas

deportivas en chile|casas de apuestas deportivas en españa|casas de apuestas deportivas en linea|casas de apuestas deportivas en madrid|casas de

apuestas deportivas en mexico|casas de apuestas deportivas en peru|casas de apuestas deportivas en sevilla|casas de apuestas deportivas en valencia|casas de apuestas deportivas españa|casas de apuestas deportivas españolas|casas de apuestas deportivas legales|casas de apuestas deportivas madrid|casas de apuestas deportivas mexico|casas de

apuestas deportivas nuevas|casas de apuestas deportivas online|casas de apuestas deportivas peru|casas de apuestas deportivas perú|casas de apuestas deposito

minimo 1 euro|casas de apuestas depósito mínimo 1 euro|casas de apuestas dinero