A payroll job in India plays a crucial role in every company’s HR and finance team. These professionals make sure employees get their salaries on time, deductions are as per law, and payslips are issued without errors — helping keep both employees and the company happy and compliant.”

What is a Payroll Job

A payroll professional is responsible for:

- Calculating monthly salaries and wages

- Deducting taxes (TDS), Provident Fund (PF), ESIC, and Professional Tax

- Processing reimbursements, bonuses, and overtime

- Ensuring compliance with Indian labour laws

- Coordinating with HR, Accounts, and Compliance teams

Payroll is the process of calculating and disbursing employee salaries along with statutory deductions like PF, ESIC, TDS, and Professional Tax. But it’s not just number crunching — it’s about compliance, communication, and confidentiality.

Whether it’s ensuring someone’s bonus is paid on time, or calculating leave encashment after resignation — the payroll team handles it all

Why Choose a Career in Payroll

- Stable career – Needed in every company

- Low risk of automation – Laws and human nuances need human judgment

- Cross-functional exposure – HR, finance, compliance, audits

- Growth opportunities – From executive to Payroll Head

- Respect and reliability – The “salary person” is always known and valued

Telling you the reals story of Priya started her career in 2017 as an HR Intern in a small IT firm in Pune. When the payroll executive quit suddenly, she was asked to help with Excel-based salary sheets.

From learning VLOOKUPs to managing Form 16 queries, she gradually mastered compliance and software like GreytHR. Today, she’s a Payroll Manager in a multinational company, earning ₹14 LPA, managing a team of 4.

Her secret? Curiosity and Excel!

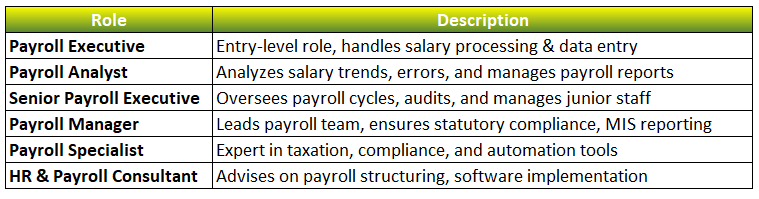

Payroll Roles or Designation in India

There is good scop in payroll from joining as junior to reach a designated post.

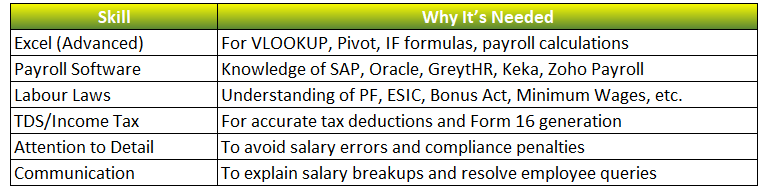

Skills Required

To process payroll effectively, you need the following skills along with strong communication and convincing abilities.

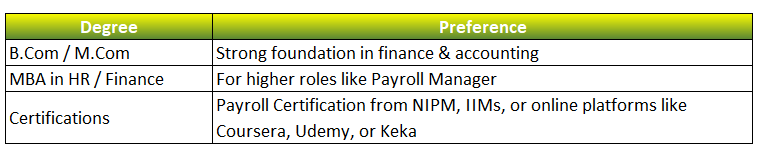

Educational Background

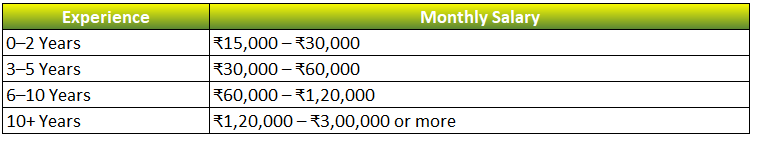

Salary Range

Key Roles and Responsibilities in Payroll Jobs

If you’re looking to join this field, here’s what you’ll typically do

- Process monthly salaries, bonuses, and overtime

- Maintain attendance and leave records

- Calculate income tax and deduct TDS

- Ensure compliance with PF, ESIC, Gratuity, Bonus Act, etc.

- File statutory returns (PF ECR, ESIC Return, PT challan)

- Generate salary slips and Form 16

- Handle full & final settlements

- Resolve employee queries regarding payslips, deductions, etc

Career Growth in Payroll Field

Payroll may start as an entry-level job, but it grows fast if you’re skilled and reliable.

Payroll Executive → Payroll Analyst → Senior Payroll Executive →

Payroll Manager → Head of Payroll → VP – HR Operations

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Tai188bet is easy to use. Depositing and withdrawing is super easy! That is all I care about. 😛 tai188bet

xn88 lừa đảo Trên các bảng xếp hạng uy tín như AskGamblers và iGamingTracker, nhà cái thường xuyên góp mặt trong danh sách những nhà cái có tỷ lệ giữ chân người chơi cao nhất. TONY12-15

Если интересуют лицензионные казино Украины, полезно смотреть свежие обзоры и рейтинги. Популярные онлайн казино Украины часто имеют одинаковые игры, но разные условия. Мне было удобно использовать topovye-kazino-onlajn.biz.ua для сравнения сайтов. Кращі онлайн казино обычно имеют поддержку украинских игроков.

Честное онлайн казино всегда указывает условия вывода.

Казино на реальные деньги с выводом — основной запрос игроков. Казино с реальным выводом денег — главный критерий выбора. Онлайн казино топ 10 формируется по отзывам игроков. Казино обзор экономит время на тестирование.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/register?ref=IHJUI7TF

Для тех, кому нужны надежные запчасти на мото, этот магазин оказался отличным вариантом. Если нужен интернет магазин мотозапчастей, можно начать с этого сайта [url=https://zapchasti-dlya-motocikla.biz.ua]интернет магазин мотозапчастей[/url]. Если сравнивать сайты мотозапчастей, этот выглядит более продуманным.

Много позиций в наличии, что редкость для мотомагазинов. Понравился подход к клиенту и грамотные консультации. Удобно, что можно купить мотозапчасти в Украине онлайн. Можно спокойно купить запчасти на мото без спешки. Мотозапчасти Киев представлены довольно широко. Можно спокойно купить мотозапчасти без лишних рисков. Понравилось, что сайт работает стабильно.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Just signed up at keobovn.online. The odds seem alright and the layout is pretty easy to navigate. Hoping to win big! You can find it here keobovn.

7sjl? Hmm, I’ve seen it around. Worth a peek if you’re looking for something different. See for yourself at 7sjl.

Chương trình ưu đãi nạp đầu tại 888slot là cơ hội vàng để quý khách gia tăng nguồn vốn, tạo đà cho những chiến thắng vang dội trên hành trình chinh phục giải thưởng. TONY01-04H

Your article helped me a lot, is there any more related content? Thanks!

Seriously considering signing up for Jilibet just for that bonus. A little extra cash never hurt nobody, right? Here’s the link: jilibet sign up bonus

Okbet redeem code? Yes please! Hunting around for those sweet bonus codes. Just found one and it worked flawlessly. Get yours quick 😉 okbet redeem code

Is the Taya777club a real VIP experience? I am curious to know more about what perks it has! Let me know taya777club.

[7303]PHGolden Casino: Best Online Slots in PH | Login, Register & App Download Experience the best online slots in the Philippines at PHGolden Casino. Join phgolden today for easy login, quick registration, and app downloads. Start winning now! visit: phgolden