On 21 November 2025 the Government of India has took a big step for Code on Wages, 2019 (often called the “Wages Code”). This is part of a bigger restructuring that merges 29 older labour laws and consider into four modern Labour Codes to make it simplify. The new Wages Code will affect millions of pay slips across India. This change has brings a drastic changes in CTC structure as well.

Why New Wages Code matters

If you see the definition of wages so its slightly changes and create confusion when it comes to calculate PF,Gratuity, Leave Encashment, Minimum wages, Overtime etc but now the new code on wages unifies the definition and aims to bring clarity and uniformity. It includes protect Minimum wages, Ensure timely payment prevention of gender base discrimination in pay.

This matters because any change to the definition of “wages” ripples through payroll calculations which contain PF, gratuity, gratuity base, overtime, retrenchment compensation, leave encashment, employer cost, and finally employee take-home pay.

The most notable and Practical Changes

This Code requires a uniform definition of wages and the limit to understand how much of CTC can be categorized as non-wages which is allowances. Practically government and advisors have interpreted the code and said at least 50 % of and employee’s CTC should be structured as wages that is the component Basic and DA which is further used to calculate the PF, Gratuity , Leave Encashment and others.

Why this law introduced? Because many organizations used to keep “wages” preciously low and load CTC into allowances and benefits that were excluded from the statutory wage like Basic and DA. This Code aims to reduce such practices and ensure statutory pay-outs are calculated on a meaningful norm of Wages.

What the Code defines as wages

If we search for definition of wages it takes a longer look , here we are taking wages as BASIC and DA as per new Wage code which are regular, recurring and which is mapped to our employment contract which is also the part of recurring Salary.

Some component is frequently considered as non-wages like certain reimbursement, some special allowances.

How the Salary component will Change

Below are common salary components and the likely effect under the Wages Code (Nov 2025): the CTC structure may change

- Basic Pay: As per new wages Rule the Basic pay (BASIC+DA) will be 50% threshold of CTC where previously they used lower basics 20–30%.

- Dearness Allowance (DA): If it applicable as per the CPI index and minimum wages then this will count as “wages”. For sectors that still use DA, it will be part of the wages base.

- House Rent Allowance (HRA): HRA may remain as an allowance which will be the part of the remaining 50% of CTC.

- Special / Flexible Allowance: These are easy to manipulate and may be reduced because they often formed the allowance remains portion of previous CTCs.

- Performance Bonus / Variable Pay: Generally paid irregularly; still it be treated as non-wage

- Reimbursements (conveyance, telephone): Typically excluded from wages if they are pure reimbursements with actual bills; documentation will be critical.

- Employer contributions (PF/ESI): These are employer cost items, not part of employee wages but because the wage base expands (due to higher basic/wages), PF employer liability (12% of basic) will increase.

- Gratuity and Leave encashment base: Since the Code wage definition, gratuity and leave encashment (which is being calculated on wages) will likely be higher where wages increase.

These changes mean employer statutory costs will rise (PF, gratuity liabilities), and employees may see changes in take-home pay depending on how allowances are rebalanced.

So its general things if your Basic and DA increase so your Gratuity, PF etc will increase and the consequence your net salary will decrease.

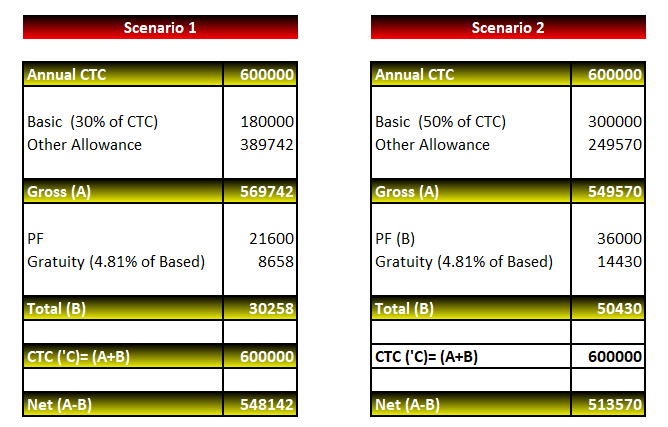

Numeric example — see the real impact

Scenario 1 — Before change (old structure, preliminary example):

- Annual CTC: ₹6,00,000

- Basic (30% of CTC): ₹1,80,000 per year (₹15,000 per month)

- Other allowances & benefits: ₹4,20,000 per year

Scenario 2 — After applying the 50% wages idea (new structure):

Assume the employer sets Basic at 50% of CTC to ensure a healthy wage base.

- Basic (50% of CTC): ₹3,00,000 per year (₹25,000 per month)

- Remaining allowances: ₹3,00,000 per year

Effect on employer PF (illustration):

(Employer PF = 12% of basic, illustrative only — actual rules and limits apply)

- PF employer contribution before: 12% × ₹1,80,000 = ₹21,600 per year

- PF employer contribution after: 12% × ₹3,00,000 = ₹36,000 per year

- Increase in employer PF cost = ₹14,400 per year

Effect on gratuity (illustrative):

If we approximate a gratuity cost factor (for illustration) as ~4.81% of basic wages (note: actual gratuity calculation uses a formula based on last drawn wages and years of service, but for employer provisioning you might use such percentages)

- Gratuity provision before: ≈ ₹8,658 per year

- Gratuity provision after: ≈ ₹14,430 per year

- Increase ≈ ₹5772 per year

Net picture (illustrative):

- employer statutory costs (PF, gratuity) rise when you increase the basic/wage base — in above example, employer statutory burden increased by some amount of rupees per employee annually. If a company has many employees, this scales up. (Numbers used above are for illustration and to show direction and magnitude, not exact legal liabilities for any particular company.)

This example shows the key point: raising the wages base increases statutory pay-outs, and companies will need to revise CTC structures to be compliant while attempting to preserve net take-home where possible.

Ideally Organization will think to preserve the Net take home Salary if Net Salary decrease then it will impact the organization in many way so the company has to work on the CTC restructure in a way where they can fulfil the law as well as the Net pay of employees.

What employers will likely do some common restructuring approaches

Employers faced with the new wage base will have several levers to manage costs and preserve take-home:

- Increase Basic (and other wage components): Shift to a higher basic (and DA, if applicable) so “wages” cross the 50% threshold. This increases statutory costs but ensures compliance.

- Convert some allowances into reimbursements: Reimbursements backed by bills (travel, telephone,Fuel, etc.) can remain non-wage if properly documented — employers will tighten documentation.

- Cap some flexible allowances or convert them to variable pay: Variable performance pay paid irregularly may remain outside monthly wages (subject to rules), so employers may move some amounts into variable pay.

- Rebalance benefits (e.g., employer contribution split): Employers might increase employer-side benefits (one-time bonuses, contributions not counted as wages) to offset a nominal drop in take-home.

- State-specific minimum wages and rules: As the Code rolls out, states will issue minimum wage notifications and rules. Employers must track state-level notifications especially for minimum wage

Employers must consult payroll advisors and HR to redesign templates, update payroll software, and communicate the changes clearly to employees so that employee can get their CTC understanding.

What employees (jobseekers & staff) should Do

- Pay slips Component will change: Expect higher basic and clearer breakdowns of wages vs allowances. If your take-home reduces on paper, ask for an explanation: companies may shift benefits to variable pay or increase employer contributions instead.

- PF and gratuity increasing: This is good for long-term retirement/benefit outcomes but might slightly reduce immediate take-home if gross remains same and statutory deductions increase.

- Minimum wage protections: More workers will be covered under a standardized minimum wage regime; employers will have to ensure minimum wage compliance per state notifications.

- Clarity in equal pay: The Code emphasizes equal pay for equal work and reduces ambiguity a positive for gender pay parity and other non-discrimination issues.

Employees should carefully scan updated employment contracts and salary breakups, and seek clarification where components are renamed or restructured.

what’s good about the new Wages Code

Uniformity and simplicity: One unified definition of wages reduces confusion and litigation across multiple statutes. Employers and payroll teams eventually have a single reference point.

Better worker protection: Minimum wage enforcement and timely payment rules strengthen worker protections and aim to ensure everyone receives a fair basic wage.

Gender pay parity emphasis: The Code includes provisions that aim to prevent discrimination in pay. That strengthens rights for women and marginalized groups.

Modernized compliance (digital-first): The Codes aim for digital registers and single-window compliance mechanisms, reducing paperwork and simplifying filings for employers.

Transparency in pay structures: Standardized rules reduce the possibility of disguised wages and make it easier for workers to understand their entitlements.

what’s downsides about the new Wages Code

Short-term employer cost increase: Raising the wage base increases employer liabilities (PF, gratuity), it is raising costs for businesses especially small firms that relied on allowance-heavy structures to manage cash flows. Multiple advisory sources flagged potential increases in payroll burden.

Possible drop in take-home pay (for some): Employers balancing the books may shift more into employer-side contributions or variable components, which can reduce immediate take-home for new hires if the net CTC is adjusted.

Transition pain: Payroll system updates, employee communication, HR policy rewrites, tax implications and renegotiation of employment contracts take time and cost money. This is an operational headache in the short run.

State variability and uncertainty: Although the Code is central, states will issue rules (minimum wages, procedures); organizations operating across states will face a patchwork during the transition.

Interpretation disputes: Some components’ classification (wage vs non-wage) may remain litigated or subject to rulings; companies must be conservative and seek legal clarity.

Frequently asked questions

Q: Will my HRA be counted as a “wage”?

A: Not automatically. HRA’s tax treatment is a separate matter; whether it’s counted as “wages” under the Code depends on the form and recurrence of payment and the rules issued. Employers often restructure HRA and other allowances carefully.

Q: Does the 50% wage rule mean my gross/CTC will rise?

A: Not necessarily. Employers can rebalance components to make wages cross the threshold without increasing total CTC — but that usually increases statutory deductions (PF, gratuity) and employer contributions. Some companies may increase CTC to offset increased statutory burden.

Q: Will this affect PF/EPF calculations?

A: Yes — because PF is calculated on wages/basic (subject to EPF rules and salary thresholds), a higher wages base may increase PF contributions (both employer and employee shares) in absolute terms.

Q: When states issue minimum wages, will those be higher or lower?

A: States decide their own minimum wage notifications consistent with the Code. Minimum wages could increase in many states to align with the new structure; employers must track each state’s notification.

You may check our new CTC Calculator and write us for any query.

Wow, this article is good, my younger sister is analyzing such

things, thus I am going to convey her.

Excellent post. I was checking constantly this blog and I’m impressed!

Extremely helpful info specially the last part 🙂 I care for such information much.

I was looking for this certain info for a very long time.

Thank you and good luck.

I’ve been seeing mentions of Paybis for a while now, and I’m still not

completely certain about whether it truly deserves all the attention it gets, but it’s clearly an interesting name within the cryptocurrency space, especially when it

comes to combining crypto markets with fiat currencies.

From what I understand so far, Paybis presents itself as

one of the biggest cryptocurrency platforms that also supports traditional fiat money,

which is something many exchanges either limit or complicate.

What initially caught my interest was the way Paybis seems to link the

gap between traditional finance and the crypto world.

Many platforms focus strictly on crypto-to-crypto trades, but Paybis appears to allow users to buy digital currencies using credit cards.

I’m not claiming this process is flawless, but it does seem aimed at newcomers rather than only

advanced traders.

Another aspect worth mentioning is the range of cryptocurrencies supported.

Paybis doesn’t appear to limit itself to the most popular assets.

Instead, it offers access to various digital assets,

which might appeal to users who are diversifying. That said, I still wonder about things like

liquidity, so it’s probably something potential users should

investigate further.

Security and compliance are also frequently mentioned in relation to Paybis.

The platform emphasizes identity verification,

which could be seen as professional for some users, though others might find it time-consuming.

I’m honestly unsure where I stand on that, but it does suggest that

Paybis is trying to operate as a regulated crypto and

fiat marketplace.

When it comes to fees and exchange rates, opinions seem divided.

Some sources claim that Paybis is transparent with pricing,

while others mention that costs may change based on currency.

This isn’t uncommon in the crypto industry, but it does mean users should probably

do proper research before making decisions.

Overall, I wouldn’t say Paybis is the best exchange available,

but it does appear to be a platform that’s worth learning more about.

For anyone who is curious about buying crypto with fiat, spending some time reading

more about Paybis could be useful. I’m still undecided myself,

but it’s promising enough to justify further exploration.

After looking over a number of the blog articles on your

website, I seriously appreciate your technique of blogging.

I book-marked it to my bookmark website list and will be checking back soon. Please

visit my website as well and let me know how you

feel.

Yo, heard about go99vina from a friend. Gave it a shot and not gonna lie, kinda dig it. Site’s pretty smooth and the games are decent. Check it out yourself at go99vina.

Keo188bet’s odds are pretty competitive, which is what I look for. I’ve used them a few times and haven’t had any problems so far. Always do your research. keo188bet

888slot hỗ trợ chơi offline một số tính năng như xem lịch sử, đọc tin tức – tuy nhiên, để đặt cược thật, bạn vẫn cần kết nối internet để đảm bảo tính bảo mật. TONY01-04H

9999jili https://www.be9999jili.net

Gold08game… hmm. It’s got a certain charm, I’ll give it that. Not the best, not the worst, squarely in the middle. See if it suits your fancy! gold08game

Heard a lot about Lucky103! Gonna give it a spin tonight. Fingers crossed for some good luck. Check it out lucky103.

Anyone else heard of x3337x? Is it any good? I will try it now! Find out with me:x3337x

jljl7 – jljl7 Casino Philippines: Login, Register & App Download for Top Online Slots.Experience the best online gaming at jljl7 Casino Philippines! Secure your jljl7 login, complete your jljl7 register, and get the jljl7 app download to enjoy top-rated jljl7 slot games. Join the leading jljl7 casino today for exclusive rewards and big wins! visit: jljl7

어제 친구들과 회식 자리로강남가라오케추천다녀왔는데, 분위기도 좋고 시설도 깨끗해서 추천할 만했어요.

요즘 회식 장소 찾는 분들 많던데, 저는 지난주에강남가라오케추천코스로 엘리트 가라오케 다녀와봤습니다.

분위기 있는 술자리 찾을 땐 역시강남하퍼추천확인하고 예약하면 실패가 없더라고요.

회사 동료들이랑강남엘리트가라오케방문했는데, VIP룸 덕분에 프라이빗하게 즐길 수 있었어요.

신논현역 근처에서 찾다가강남룸살롱를 예약했는데, 접근성이 좋아서 만족했습니다.

술자리도 좋지만 요즘은강남셔츠룸가라오케이라고 불릴 만큼 서비스가 좋은 곳이 많더군요.