In the Union Budget 2025, Some important revisions were introduced to India’s income tax structure, mainly in the new tax regime for the financial year 2025-2026 .

The government has revised the tax slabs under the New Tax Regime. However, no changes have been made to the slabs and taxation rates under the old regime. These amended tax slab rates will apply to income earned beginning in the FY 2025-26

These changes have come into effect from 1st April.

The effective tax exemption limit has been raised to Rs 12 lakh from Rs 7 lakh.

Here will discussed about the Old and New Tax Regime

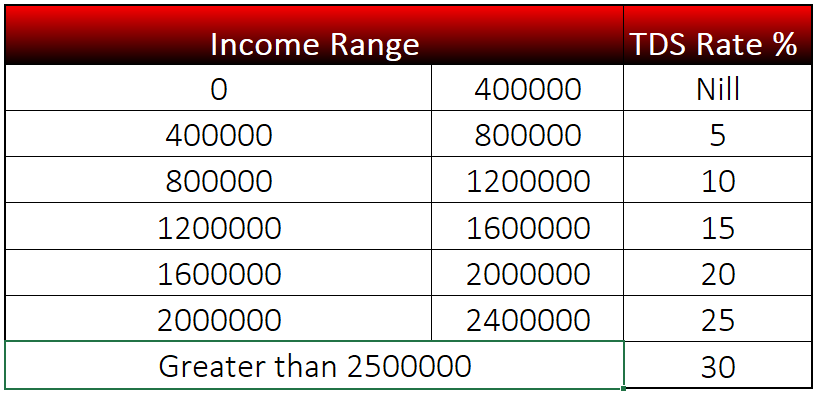

New Tax Regime Slab for FY 2025-2026

Key Features of the New Tax Regime:

Tax Rebate (Section 87A): The rebate has been increased to ₹60,000. For salaried individuals standard deduction of ₹75,000 now the threshold extends to Rs 12.75 lakh.

Increased Basic Exemption Limit: The basic exemption limit has been increased from Rs 3 lakh to Rs 4 lakh.

Standard Deduction: A standard deduction of Rs 75,000 is available for salaried individuals

Employer’s NPS Contribution: Employer contributions to the National Pension System (NPS) are allowed up to 14% of the basic salary.

Default Regime Status: The new tax regime continues to be the default option, though taxpayers can opt for the old regime.

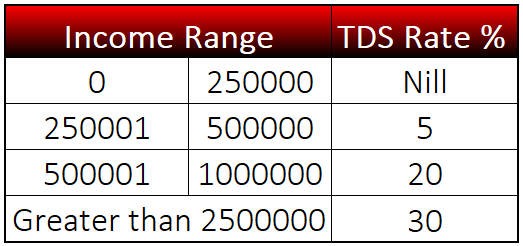

Old Tax Regime Slab for FY 2025-2026

The old tax regime retains the following slab structure for individuals below 60 years of age:

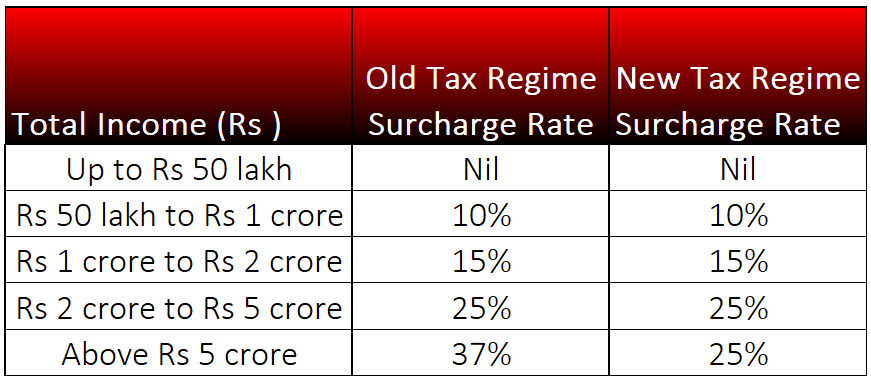

Surcharge Rates for FY 2025-2026

In the Indian income tax system, a surcharge is an additional charge levied on the income tax payable by individuals whose total income exceeds specified thresholds. For the Financial Year Financial Year 2025-2026, the surcharge rates under both the old and new tax regimes are as follows:

Can we switch from new to old tax Regime

Yes, you can switch between the new and old tax regimes, but the rules vary depending on your income type. If you’re a salaried individual, you can choose between the old and new tax regime every financial year. This means you have the flexibility to evaluate both regimes annually and pick the one that gives you the most tax savings.

However, if you’re self-employed or have business income, the rules are stricter. You can switch from the old regime to the new regime only once, and if you later want to go back to the old regime, you cannot choose the new regime again in future years (unless your business income ceases).

So, it’s important to make your decision carefully by comparing both regimes. The old tax regime allows you to claim various deductions and exemptions like HRA, 80C, 80D, etc., while the new regime offers lower tax rates but no exemptions.

If you’re not sure which regime is better for you, using an online tax calculator or consulting a tax expert can help you make the right choice.

For individuals salaried person will get the option while doing their personal Income tax Return means employee can switch the tax regime on during personal income tax return on income tax portal.

Свежие xxx-платформы предлагают инновационный контент для развлечений для взрослых.

Откройте для себя безопасные новые

платформы для современного опыта.

My web blog; oboi ru

It’s remarkable to pay a visit this web site and reading the views of all friends about this article,

while I am also zealous of getting knowledge.

Seksuele inhoud is breed beschikbaar op speciale platforms voor volwassenen.

Kies voor veilige sites voor veiligheid.

Review my webpage: gia derza feet comment now (https://Ipanemaflipflops.Co.uk/)

284601 351958I gotta bookmark this website it seems extremely valuable extremely valuable 435915

390328 78660Music began playing anytime I opened this site, so irritating! 474081

310418 663917Some genuinely wonderful information , Gladiola I detected this. 509676

776226 932187This internet website could be a walk-through for all of the details you wanted in regards to this and didnt know who to question. Glimpse here, and youll definitely discover it. 883406

559217 418683Dude. You mind if I link to this post from my own website? This really is just too awesome. 292368

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

292812 799591Usually I dont read this kind of stuff, but this was genuinely intriguing! 617698

85574 457837Someone essentially assist to make severely posts I may possibly state. That will be the quite first time I frequented your internet site page and so far? I surprised with the analysis you produced to create this specific submit incredible. Magnificent task! 951377

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Finding a good 747 agent can be tough. I used 747agents and had no bad surprises. They seem pretty legit with decent service.

262760 974604I got what you intend, saved to favorites , quite decent internet internet site . 480750

368975 674625hello!,I like your writing so significantly! share we communicate extra approximately your post on AOL? I need an expert in this space to solve my dilemma. Perhaps that is you! Looking ahead to see you. 410679

Yo! Win999phcash is my go-to spot for quick wins. The site’s slick and easy to navigate. Definitely worth checking out if you’re looking for some fun. Check it out here: win999phcash.

Thông qua hệ thống tường lửa WAF 5 lớp và công nghệ mã xác thực 2AF, mã nhận thưởng 888slot ẩn danh tuyệt đối mọi tài khoản người chơi đồng thời, mã hóa toàn bộ hoạt động khi hội viên truy cập, sử dụng dịch vụ, sản phẩm. Vì thế, bạn hoàn toàn có thể yên tâm khi cá cược tại đây. TONY12-30

About to Dive into pk36game! Wish me luck. Maybe this will become my new favorite? Take a look here: pk36game

500762 543111surely like your web web site but you want to check the spelling on several of your posts. Several of them are rife with spelling troubles and I locate it very troublesome to tell the truth nevertheless I will certainly come back again. 520164

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

376256 891106Wohh exactly what I was looking for, appreciate it for posting . 875023

689623 355715I genuinely enjoy reading on this website, it holds great articles . 211579

Oooh, ph23loginbonus sounds tempting. Who doesn’t love a bonus? Time to investigate.

If you’re into betting on League of Legends, check out pnxbetlol. They seem to have pretty competitive odds. Always worth a look. Get your bets in at pnxbetlol.

Anyone using pesobets3? Thinking about signing up. Wondering if the payouts are reliable. Let me know your thoughts pesobets3.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

所有文章都令人印象深刻。敬意 真情。 [url=https://iqvel.com/zh-Hans/a/%E4%BF%84%E7%BD%97%E6%96%AF/%E7%B4%A2%E5%A5%91%E9%87%8C%E7%BB%B4%E5%9F%83%E6%8B%89%E5%85%AC%E5%9B%AD]里維埃拉公園[/url] 棒极了 旅行者门户网站, 请继续 保持这种风格。万分感谢!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/si-LK/register?ref=LBF8F65G

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

386875 624385I truly enjoy examining on this website , it has excellent content material . 657576

Nhóm 4: Tập trung vào Trải nghiệm người dùng & Giao diện (20 đoạn) TONY02-27