Professional Tax is a direct tax levied by State Governments in India under the Constitution It applies to individuals earning income from employment, profession, trade, calling, or occupation. While the central government collects Income Tax, Professional Tax (PT) is collected by state governments as per their respective Acts.

In Karnataka, the tax is governed by the Karnataka Tax on Professions, Trades, Callings, and Employments Act, 1976, and is amended regularly through state budgets/notifications. PT must be deducted and paid to the government based on the applicable slab and statutory requirements.

Why Professional Tax Matters

PT is one of India’s most common statutory compliances required for almost every entity and individual engaged in economic activities in a state. If ignored:

- You face penalties, interest and compliance notices

- You risk enforcement action by State Commercial Tax officers

- You may lose credibility with regulators and bankers

In Karnataka, every working professional and business entity must evaluate whether they are liable to pay PT and register appropriately.

Professional Tax is collected by the State Government, not the Central Government.The oney is used for public services such as building roads and infrastructure, running government schools and colleges, improving hospitals and healthcare, supporting welfare schemes, and paying salaries and pensions of state government employees.

Who Is Liable to Pay Professional Tax in Karnataka?

1. Salaried Employees

If you are currently employed and earning a salary that exceeds the prescribed Professional Tax slab, your employer is legally required to deduct Professional Tax (PT) from your monthly salary and remit the deducted amount to the government within the specified timelines.

2. Employers / Businesses

All employers and registered business entities operating within the state of Karnataka are required to enroll under the Professional Tax Act and pay Professional Tax for their respective establishments. This mandatory requirement applies to the following categories:

- Companies (private/public limited)

- LLPs

- Partnership firms

- Sole proprietorships

- Associations, clubs, societies

- Co-operative societies

- Any business with fixed place of operation

These entities may also have to pay fixed yearly PT based on employee count or registration status.

3. Self-Employed Professionals

Individuals engaged in a profession or carrying on a business—such as doctors, consultants, lawyers, chartered accountants, freelancers, and similar professionals—may be required to pay Professional Tax on a yearly basis for their profession, provided they are actively engaged for a period exceeding the statutory limit prescribed during the financial year

4. Exemptions

Some categories are exempt, including:

- Senior citizens above a certain age

- Persons with specified physical disabilities

- Those with minimal time in practice (less than statutory days)

- Others as per government notification

Note: exact exemptions should be checked in the latest Karnataka PT schedule.

Karnataka Professional Tax Slabs (2025–26)

The Karnataka government has recently revised the Professional Tax (PT) slabs under the Karnataka Professional Tax Amendment Act, 2025, and the updated provisions have come into effect from 1st April 2025, making them applicable for the relevant assessment periods.

🧾 Salaried Individuals

| Monthly Income | PT to be Deducted |

| Up to ₹24,999 | Nil |

| ₹25,000 and above | ₹200 per month (standard) |

| In February (each year) | ₹300 |

The February PT deduction is ₹300 for salary above ₹25,000, while other months are ₹200 each.

This sets an annual maximum of ₹2,500 per employee.

Self-Employed / Professionals

If you are running a profession—such as a consultant, coach, chartered accountant, lawyer, doctor, training institute, or any similar professional activity—and you have been actively engaged in that profession for a period exceeding two years:

- PT is typically ₹2,500 per annum.

- Registration and payment are done online through the Karnataka PT portal (e-Prerana).

How to Register for Karnataka Professional Tax

All employers, self-employed professionals, and businesses are required to obtain a Professional Tax Enrollment Certificate (PT-EC) from the Karnataka Commercial Taxes Department.

Registration Procedure

The Karnataka Government has simplified the process using the e-Prerana online portal. Key steps:

- Visit the official PT portal:

Karnataka PT e-Prerana portal — ptax.karnataka.gov.in - Choose Registration Type:

- For professionals — use PAN

- For businesses — use GSTIN or PAN

- Enter details:

- Name, PAN/GSTIN, occupation, address

- OTP Verification:

OTP is sent to your mobile — verify and set password - Complete Profile:

Enter details of employees, business activities - Enrollment Certificate:

After registration you receive a certificate with a unique PT-EC number.

With the new e-Prerana system, PT enrollment is mostly instant, and payments & returns can be filed online anywhere.

Professional Tax Returns — Monthly & Annual

1. Monthly PT Returns

Employers are responsible for deducting Professional Tax (PT) from employee salaries on a monthly basis and are required to deposit the deducted amount with the government and file the applicable return on or before the 20th day of the following month

Example:

PT for April must be deposited & return filed by 20th May.

2. Annual Return (Form 5)

At the end of the financial year:

Employers are required to prepare a consolidated return that includes details of all Professional Tax (PT) deductions made for their employees during the year and must file this annual return on or before 30th April each year, as prescribed under the applicable regulations.

3. Business / Professional Returns

Entities holding a Professional Tax Enrolment Certificate (PT-EC) and not making any Professional Tax deductions from employees are required to file Form 4A on an annual basis to report the payment of fixed Professional Tax and formally close the compliance for the financial year.

4. Other Returns

There are specific monthly or quarterly Professional Tax statements, such as Form 5A, that employers are required to file, depending on factors like the number of employees on their rolls and the applicable Professional Tax payment schedule.

Payment Options & Due Dates

Payment Methods

✔ Professional Tax payments can be made through net banking facilities.

✔ Debit and credit cards are also accepted for making PT payments.

✔ Unified Payments Interface (UPI) can be used for quick and secure transactions.

✔ Payments may also be made through direct debit using the official online e-filing portal.

Due Dates

| Return Type | Due Date |

| Monthly PT Payment & Returns | 20th of the following month |

| Annual Return (Form 5) | 30th April every year |

| Form 4A Filing | Within 60 days from the close of the financial year |

Failure to comply with these prescribed timelines may result in the levy of penalties and applicable interest as per the provisions of the Professional Tax regulations.

Payment link- https://ptax.karnataka.gov.in/

PT Return- https://ptax.karnataka.gov.in/ptemployer

Due Dates

| Return Type | Due Date |

| Monthly PT Payment & Returns | 20th of next month |

| Annual Return (Form 5) | 30th April every year |

| Form 4A filing | Within 60 days of fiscal year close |

Adherence to these statutory due dates is mandatory. Any delay or failure in filing the returns or making payments within the specified timelines may attract penalties, interest, and other consequences as prescribed under the Professional Tax laws.

Penalties for Karantaka PT

Delays in payment or non-compliance with Professional Tax provisions can result in the following consequences:

1. Interest on Delayed Payment

✔ An interest charge of 1.5% per month is levied on the overdue Professional Tax amount.

✔ This interest is calculated from the original due date until the actual date of payment is made.

2. Penalty

✔ A penalty of up to 10% of the tax due may be imposed in cases of voluntary non-payment before the issuance of any official notice.

✔ In addition, separate late fees may be applicable for delayed filing of returns, such as ₹250 per month, subject to the limits prescribed under the rules.

3. Other Consequences

✔ Issuance of enforcement or demand notices by the Professional Tax Department.

✔ Initiation of legal proceedings against the business or employer in cases of continued or repeated defaults.

✔ Difficulties in obtaining future registrations, renewals, or facing increased scrutiny during departmental audits and inspections.

Common Scenarios & Practical Examples

Suppose Rohan works in Bangalore earning ₹35,000 per month.

✔ PT deducted: ₹200/month from April–January

✔ February deduction: ₹300

✔ March: ₹200

Total PT for year: ₹2,500.

Example 2: Small Business Employer

A company in Mysore with 8 employees needs to:

✔ Register for PT-EC

✔ Pay ₹1,500 per year as employer PT

✔ Deduct PT from employees satisfying the slab

✔ File monthly returns and annual return

Example 3: Freelancer / Consultant

Seema is a graphic designer with PAN and no employees:

✔ She must enrol using her PAN

✔ Because she’s self-employed more than two years, she pays ₹2,500 per annum

✔ File her annual report on the portal

Example 4: Company With GST but No Revenue

Even if a company has no active operations or revenue but holds GSTIN, PT may be applicable. Courts and practitioners often advise filing returns and payments or surrendering GST if dormant. (Reddit community experiences show confusion when companies miss PT despite inactivity.)

As per Slab I have created the Karantak PT deduction formula

=IF(B2<25000,0,IF(OR(C2=”Feb”,C2=”February”),300,200))

- Put salary in B2

- Put month name in C2

- Put formula in D2

- Drag down for all employees

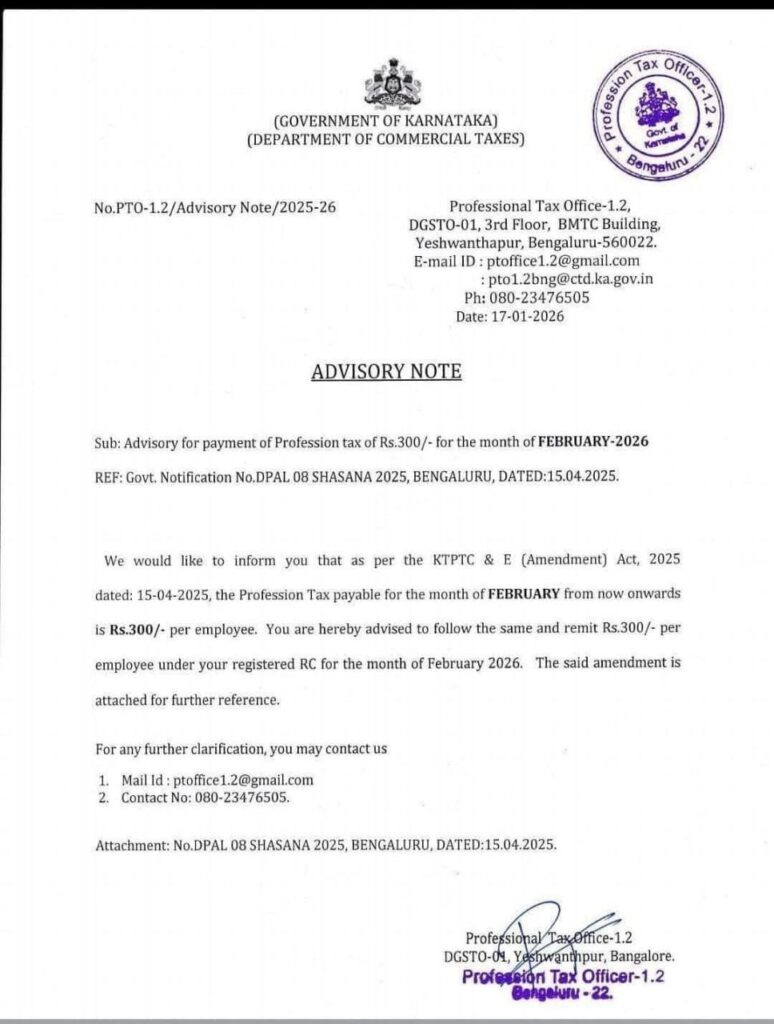

Notification on Jan 2026

**mitolyn**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

ah88 https://www.adah88.net

I’ll immediately grab your rss as I can not in finding your e-mail subscription link or newsletter service. Do you’ve any? Kindly let me understand so that I may subscribe. Thanks.

Great beat ! I would like to apprentice even as you amend your web site, how could i subscribe for a weblog web site? The account aided me a acceptable deal. I had been tiny bit familiar of this your broadcast offered shiny transparent idea