If you are working in Gujarat or running a business there, you might have heard about something called Profession Tax. It’s a small amount of tax collected by the state government from professionals, employees, and business owners. The money collected is used for the development and welfare of the state.

In this blog, we’ll explain everything you need to know about Gujarat Profession Tax in very simple words. We’ll cover:

- Slab of Profession Tax

- PTEC Payment

- PTRC Payment

- PTRC Return

- Due Dates for PTRC and PTEC

What is Profession Tax?

Profession Tax is a tax that the State Government charges on income earned by professionals and salaried individuals. In Gujarat, this tax is governed by the Gujarat State Tax on Professions, Trades, Callings, and Employments Act, 1976.

This tax is mandatory, and it applies to:

- Salaried employees

- Business owners

- Professionals like doctors, lawyers, CA, engineers, etc.

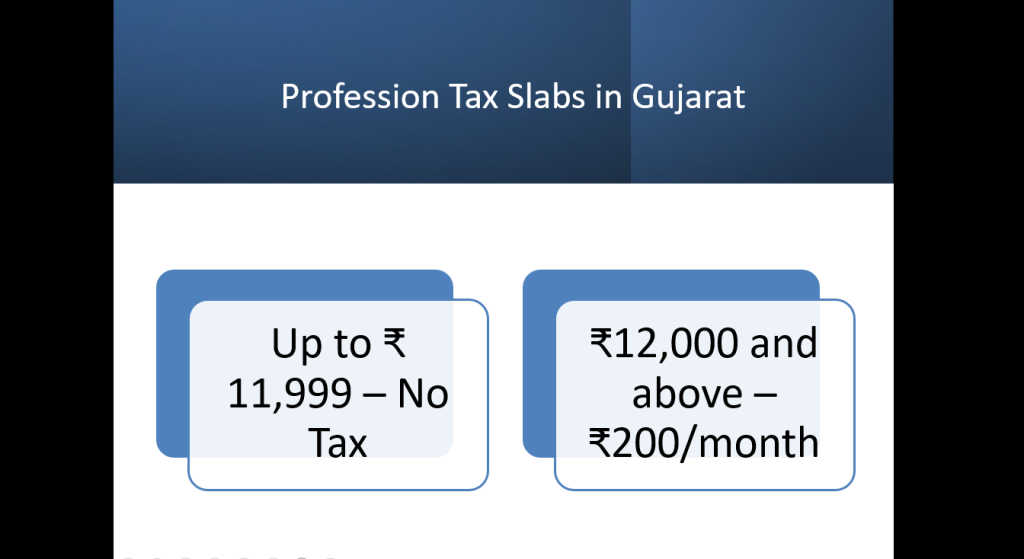

Slab of Profession Tax in Gujarat

The amount of profession tax to be paid depends on how much income a person earns. Gujarat has set monthly income slabs for calculating this tax.

What is PTEC and PTRC?

In Gujarat, Profession Tax is paid under two types of registrations:

a) PTEC – Professional Tax Enrolment Certificate

Taken by business owners, self-employed professionals, or anyone running a trade.

This is for the person who owns the business or is self-employed.

You pay ₹2,500 per year as profession tax under PTEC.

b) PTRC – Professional Tax Registration Certificate

- Taken by companies, firms, or any employer who has salaried employees.

- This allows the employer to deduct and pay profession tax on behalf of employees.

- The tax is paid every month based on the employee’s salary slab.

How to Make PTEC Payment?

If you are an employer and you have employees working under you, you need to:

- Deduct profession tax from their salary every month as per the slab.

- Pay the deducted amount to the government on time.

Steps for PTRC Payment:

- Step 1: Register for PTRC on the Gujarat Profession Tax portal and get your PTRC number.

- Step 2: Every month, calculate the profession tax for each employee using the slab.

- Step 3: Login to the Gujarat Tax Portal.

- Step 4: Select PTRC Payment option, enter the details of employees and the amount.

- Step 5: Make the payment online and download the receipt.

How to File PTRC Return?

Filing a return means submitting a report to the government showing how much profession tax you have deducted and paid for your employees.

In Gujarat, if your tax liability is more than ₹1,000 per year, you must file monthly returns.

Steps to File PTRC Return:

- Go to https://ctax.gujarat.gov.in

- Login with your PTRC credentials.

- Click on PTRC Return Filing.

- Enter the required details like:

- Number of employees

- Amount deducted

- Amount paid

- Submit the return online.

Make sure your payment is made before filing the return.

Due Dates for PTRC and PTEC

Timely payment is very important to avoid penalties.

PTRC (For Employers):

If you are an employer who needs to deduct and pay profession tax for employees:

- Monthly Payment & Return:

- Due Date: 15th of the next month

- Example: For April, payment and return must be done by 15th May.

- Annual PTRC Return:

If the tax liability is ₹1,000 or less, then:- Only one return is required in a year.

- Due Date: 30th April of the next financial year

PTEC (For Business Owners & Professionals):

- Annual tax payment of ₹2,500.

- Due Date: 31st March every year.

Late payment can attract:

- Interest at the rate of 18% per annum.

- Penalty of ₹1,000 or more depending on delay.

So, it’s better to mark these due dates and make timely payments.

Why is Profession Tax Important?

You might be thinking – it’s a small amount, so why should I bother?

Well, paying profession tax is not optional. It is mandatory under law, and failing to pay can result in:

- Penalties

- Interest

- Legal action from tax department

- Problems while applying for government tenders or licenses

Also, if you are a salaried person, your employer must deduct and pay it. But if you are self-employed, it’s your responsibility.

You may Watch our Video on YouTube.

Thanks Will come with next Contents, please share your thought and suggestions

320516 502066This really is a great subject to talk about. Sometimes I fav stuff like this on Redit. This article probably wont do nicely with that crowd. I will likely be confident to submit something else though. 331918

975616 241764Thank you for your style connected with motive though this data is certain place a new damper within the sale with tinfoil hats. 308179

awesome

750987 911889Hi there, just became aware of your blog via Google, and identified that its really informative. Im gonna watch out for brussels. I will appreciate if you continue this in future. Lots of folks will likely be benefited from your writing. Cheers! 787836

302641 758398Sweet internet site, super style and style , truly clean and use friendly . 29386

777735 95090I like this weblog so significantly, saved to bookmarks . 697873

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Yo! Dudoanxsmbkubet, huh? Gotta check this one out. Hope it’s better than the last one I tried. Wish me luck! Check it out for yourself dudoanxsmbkubet!

Your article helped me a lot, is there any more related content? Thanks!

Alright alright, vn88.com dj is a little different, right? More than just games, they have some cool live stuff too. If you’re into that, give it a try. Solid enough. vn88.com dj

Zalvcom, same as zalv8, pretty decent overall! I reckon you could kill some time on here and possibly win some dosh too! Check it out: zalvcom

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/hu/register-person?ref=IQY5TET4

786043 919370There exist a couple of several different distinct levels among the California Weight loss program and each and every a person is pretty important. You are procedure stands out as the the actual giving up with all the power. weight loss 122365

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/register?ref=IHJUI7TF