As you know Salary Structure is details of your Salary, it is made with different types of salary component. Every country has some different types of compliance hence the salary component varies from one country to another country.

Generally, in Salary structure we take care below parts.

- Fixed Components

- Variable Components

- Statutory Component

- Benefits/Perquisites

- Other Components

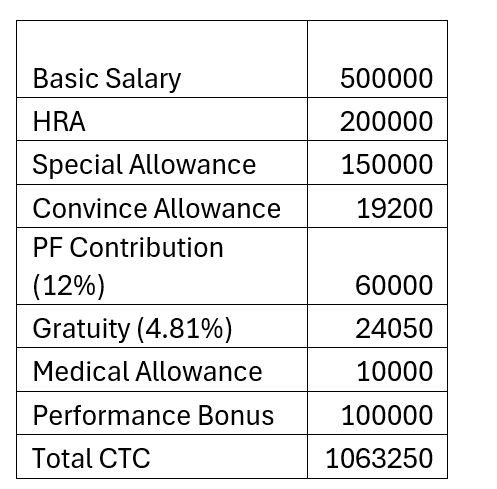

Here is how a CTC/Salary Bifurcation looks like

CTC Calculator

Basic Salary

Basic Salary is very important part of CTC bifurcation usually the amount we consider 40% to 50% of Total CTC, for example if your CTC is 50000 then your basic may be 20000.

Basic salary is fully taxable element of our CTC and there is certain compliance which we calculate on the Basic Salary for example PF is calculated on 12% of Basic, Gratuity we calculate on Basic, Bonus we calculate on Basic

In this way Basic is very important and primary component of Our CTC.

Dearness Allowance

As the word suggest compensating the effect of inflation, we consider Dearness Allowance.

It is mainly applicable on Government sector, or which follow the government pay structure special falling in the minimum wages Act which differ from state to state.

It is again fully taxable and play role like the Basic Salary.

House Rent Allowance

This is very beneficial in prospective of saving tax, those employees who are living in the rented house they avail the benefit of House Rent Allowance.

Under Section 10 (13A) an employee can save the tax by submitting the rent receipt/Rent Agreement.

Generally, we consider 40% of 50% of House Rent Allowance of Basic Salary.

There is Exemption calculation rule for getting the HRA exemption as per the income tax Act.

LTA (Leave Travel Allowance)

LTA is part of Salary which cover the cost of travel made by the employee when employee is on leave, if any employee is traveling Domestic (Only India) then employee has to submit the travel receipt to get exemption in Tax.

The are certain rules and regulations like employee should be the part of the travel, he or she should be granted leaves taken, it should be domestic travel etc.

Other Allowance

Children’s Education allowance: – It is paid for the children education expense for max 2 child and per child Rs 100

Meal Allowance- It is given to employee for meal allowance Rs 2200 PM is tax free in meal allowance reimbursement,

Uniform Allowance-: This allowance covers the unform cost, in income tax it is tax fee if it is required for work

Special allowance

If in your CTC if you have bifurcated Basic, HRA, LTA or any other component and if any balance amount is there then it will be in Component Special Allowance, hence it is fully taxable.

Performance Bonus and Incentives

Performance Bonus or Incentives are payable to employees for his good work it is linked with the employee performance.

Some companies provide Monthly, Quarterly or Annually Performance Bonus to their employee for their best performance. Again, it is fully Taxable income.

Provident Fund (PF)

It is benefit plane for the employees, so as per the PF act employee and employer both contribute 12% of his Basic Salary o PF account which is followed with UAN number.

Employees can check his PF construction on the EPFO portal with his UAN login, employee can withdrawal their PF amount on certain conditions.

You can see in deduction side 12% of your Basic Salary in your pays lip, some organization has 1800 PF contributions where it is based on EDLI Basic of Rs 15000 so if you calculate 12% of your Basic Salary then it will come 1800.

Profession Tax

Profession tax varies from state to state in some state Profession tax in not applicable like you can check for Delhi and Goa.

Every state has different PT slab as per their PT Gross the PT slab go change

The Maximum Contribution is 2500 Annual.

Gratuity

It is an amount which employee gets on his retirement or resignation after at lease five years of service.

While calculating Gratuity if you have completed 5 years 6 month then you will received gratuity of 6 years, if you have completed 5-year 5 Month 29 days then you will get gratuity for 5 years.

Formula :- Gratuity= Basic*15/26 *Number of Completed years.

Employee state Insurance (ESI)

It is social security benefit to employees which is basically for medical treatment of employees and their dependents.

So, employee whose gross is less than 21000 then he or she will be eligible for ESI, we deduct .75% of employee Gross Salary. Company reimbursement the payment to ESIC department deducted from salary including the company contribution of 3.25% of Gross.

TDS (Tax Deducted at Source)

So, each employee grad has different salary benchmark, according to the salary income employee fall under the income tax slab, current we have to slab Old Tax Regime and New Tax Regime.

It is employee’s choice which regime he opted for the tax calculations.

Above are the some basic component of salary which 95% company follows, in some organizations there are certain need where they created different types of Salary components.

15684 762715Outstanding post, I conceive people need to larn a good deal from this weblog its quite user friendly . 901442

20191 800939Thank you for the auspicious writeup. It in reality was a amusement account it. Look complicated to far delivered agreeable from you! However, how can we keep in touch? 320670

820646 424139Outstanding post, I feel blog owners ought to larn a good deal from this internet site its rattling user friendly . 86616

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

496089 259799Woh I like your content material , saved to bookmarks ! . 328970

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Just logged into Axiebet88Login, and everything was easy peasy. The interface is pretty straightforward, even for a rookie like me. Let’s see if I can win some moolah! Give axiebet88login a whirl if you’re looking for a new place to play.

594322 416620Magnificent beat ! I would like to apprentice whilst you amend your website, how could i subscribe for a weblog site? The account helped me a appropriate deal. I had been slightly bit acquainted of this your broadcast provided brilliant transparent idea 96752

VG99 hả? Thấy quảng cáo rầm rộ lắm đó. Để vào xem có đúng là ‘ngon’ như lời đồn không đã. Biết đâu lại tìm được bến đỗ mới. Let’s explore vg99.

Baji666, eh? The name sounds interesting. Gonna do some exploring and see what this site has to offer. That baji666 link is lookin’ good!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/vi/register?ref=MFN0EVO1

995676 426107Magnificent site. Lots of useful info here. 387282

898648 855777They call it the self-censor, just because you are too self-conscious of your writing, too judgmental. 212452

810606 172587Thank you for your extremely good info and feedback from you. san jose used car 472595

Играешь в казино? ап икс сайт Слоты, рулетка, покер и live-дилеры, простой интерфейс, стабильная работа сайта и возможность играть онлайн без сложных настроек.

kinggamebio – Kinggamebio: Top Philippines Slot Online & Casino Games. Experience easy Kinggamebio login, register today, and enjoy our official app download for the best gaming experience.Experience the premier Philippines slot online and casino games at Kinggamebio. Enjoy easy Kinggamebio login, fast register, and our official app download for the ultimate gaming experience. Join today! visit: kinggamebio

226075 854638I besides believe therefore , perfectly composed post! . 608010

698407 132011I agree completely with what you said. Excellent Stuff. Keep it going.. 411956

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

3450kplataforma seems to be a good option for playing online games. While I haven’t played there much, its fast navigation makes it quite good overall for those who just wanna get straight to it! You’ll definitely enjoy it. 3450kplataforma

Just starting out on 87lucky but so far it is quite a smooth experience! I find that its platform overall has some cool promotions that are worth investigating! See what’s in store yourself. 87lucky

Needed to download something and stumbled upon yes555download. Quick and easy to use! If you’re after a hassle-free download experience, this is it. yes555download