Words like Gross Salary, Net Salary, and CTC can feel like rocket science when all you want to know is: “Kitna paisa haath me aayega?”

In this post, I’ll explain what Gross Salary really means and clear your all doubts.

First Things First: What is Gross Salary?

Gross Salary is The total money your company promises to pay you, before cutting taxes or deductions.

It’s like the “maximum salary” written on your payslip — but not the amount you take home.

Lets assume you have been offered 50000 per month but after a month your bank account only show Rs 42000.

Why? Because the 50000 is your gross salary and from that your PF, TDS and other deductions are subtracted to give you your net Salary.

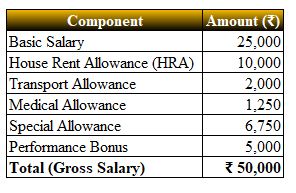

Gross Breakdown

Here is how a typical Gross Salary looks like.

So here your month gross is 50000 but your Net salary will less after deductions like

- Provident Fund (PF)

- Income Tax (TDS)

- Professional Tax

- Insurance (if any)

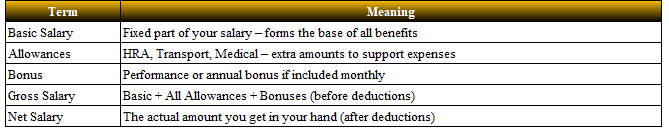

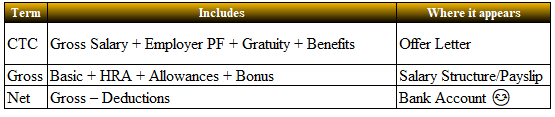

Decode of Salary Component

Here I have we decoded the Salary component for our better understanding.

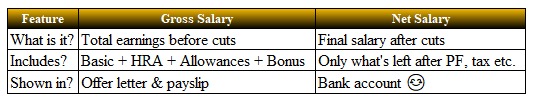

Gross Salary vs Net Salary

This is one most common question people ask especially fresher, In a lay man language I can say the Gross Salary is like Pizza and Net Salary is slice which company give you after slice of PF,TDS,ESIC etc.

What’s Not Included in Gross Salary?

- Your Gross Salary does NOT include:

- Employer’s PF contribution

- Gratuity

- Insurance premium paid by company

- Reimbursements (like fuel or meal coupons)

CTC vs Gross Salary vs Net Salary

Many people are confuse in these three words, So CTC is the total cost which company offer your it includes Fixed Salary ,Retiral parts and benefits etc, but Gross is the Fix component which company will pay you every month and Net Salary is the amount which employee get after subtracting the PF ESIC,TDS and other deduction from the Gross, if you want to know about the Payslip and and their component then may visit my payslip post.

In short- CTC > Gross > Net

Let us assume one case of Mr Rahul, a fresher from Delhi, got his first job in an IT firm.

The HR told him:

Congratulations! Your CTC is ₹6 LPA (₹6 lakhs per annum).

Rahul was excited and expected ₹50,000 in his account every month.

But… he got only ₹41,500. 😳

Why? Because:

- Employer PF: ₹21,600/year

- Gratuity: ₹11,000/year

- Insurance: ₹5,000/year

- Taxes & PF (Employee): ₹72,000/year

So his Gross Salary was actually: ₹4.9 LPA

His Net Take-Home was: ₹41,500/month

👉 Moral of the story: Always ask for Gross Salary & Net Salary, not just CTC.

How to Calculate Gross Salary?

Gross Salary = Basic Salary + HRA + Special Allowance + Other Allowances + Bonus (if monthly)

Let’s do a sample calculation:

- Basic = ₹25,000

- HRA = ₹10,000

- Special Allowance = ₹8,000

- Bonus = ₹7,000

👉 Gross Salary = ₹50,000/month

Where to Find Gross Salary in Payslip?

Your monthly payslip will usually have three sections Earning Section, Deduction Section and Net Salary.

- Earnings Section – where Gross Salary is shown

- Deductions Section – where things like PF, tax are shown

- Net Salary – final figure you get in hand

Look for “Gross Earnings” or “Total Earnings” in your payslip.

Frequently Asked Questions (FAQs)

Q. Is PF included in Gross Salary?

✅ Employee’s share of PF is included in Gross.

❌ Employer’s share is not.

Q. Does Gross Salary include bonuses?

✅ Yes, if they are paid monthly or quarterly.

❌ No, if paid once a year (then it’s part of CTC).

Q. Can Gross Salary vary every month?

Yes, especially if:

- You get performance incentives

- You’re on variable pay

- You have unpaid leaves or recoveries

Tip During Interviews

When HR says:

“Your CTC will be ₹9.5 LPA…”

You say:

“Thank you! May I also know the monthly Gross Salary and in-hand?”

This shows you’re smart and financially aware.

I’d need to examine with you here. Which is not one thing I often do! I take pleasure in studying a put up that can make people think. Additionally, thanks for allowing me to remark!

zf8eq5

d84of6

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

so much superb info on here, : D.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

911929 413869extremely very good put up, i actually love this web website, keep on it 54745

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

188v là một nền tảng cung cấp nhiều loại dịch vụ giải trí và cá cược nhằm đáp ứng nhu cầu khác nhau của người chơi. Hệ thống không chỉ là một nơi để cá cược, mà còn cung cấp nhiều hình thức giải trí thú vị khác.

188v là một nền tảng cung cấp nhiều loại dịch vụ giải trí và cá cược nhằm đáp ứng nhu cầu khác nhau của người chơi. Hệ thống không chỉ là một nơi để cá cược, mà còn cung cấp nhiều hình thức giải trí thú vị khác.

188v là một nền tảng cung cấp nhiều loại dịch vụ giải trí và cá cược nhằm đáp ứng nhu cầu khác nhau của người chơi. Hệ thống không chỉ là một nơi để cá cược, mà còn cung cấp nhiều hình thức giải trí thú vị khác.

888slot com link Dàn Dealer chuyên nghiệp đến từ Châu Âu và Châu Á chắc chắn sẽ mang đến cho bạn những giây phút thăng hoa giải trí tuyệt vời. 200+ Studio được phát sóng trực tiếp mỗi ngày cho bạn thoải mái tham gia và nhận thưởng bonus với hoa hồng hấp dẫn khi giành chiến thắng.

888slot com link Dàn Dealer chuyên nghiệp đến từ Châu Âu và Châu Á chắc chắn sẽ mang đến cho bạn những giây phút thăng hoa giải trí tuyệt vời. 200+ Studio được phát sóng trực tiếp mỗi ngày cho bạn thoải mái tham gia và nhận thưởng bonus với hoa hồng hấp dẫn khi giành chiến thắng.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/lv/register?ref=SMUBFN5I

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Gave phwin8 a look-see. It is pretty good actually, and has options to play different games. Check it out but keep a responsible attitude.

TONY20251204test. Những điểm ấn tượng chỉ có tại nhà cái 888slots

Your article helped me a lot, is there any more related content? Thanks!

My spouse and i have been now lucky Chris could deal with his inquiry because of the precious recommendations he acquired out of your web site. It is now and again perplexing to just choose to be giving away helpful hints which often the others may have been making money from. Therefore we grasp we have got the website owner to thank for this. The main explanations you made, the simple site menu, the relationships your site give support to create – it’s got all great, and it’s aiding our son and our family know that this issue is cool, which is certainly highly indispensable. Thanks for all the pieces!

66b uy tín cung cấp số hotline hỗ trợ khách hàng 24/7: (+44) 2036085161 hoặc (+44) 7436852791. Tuy nhiên, do chênh lệch múi giờ, bạn nên liên hệ qua các phương thức khác như trò chuyện trực tiếp, email hoặc Zalo để được hỗ trợ nhanh chóng hơn. TONY12-16

I have been surfing online more than three hours lately, but I by no means found any attention-grabbing article like yours. It is pretty worth sufficient for me. Personally, if all webmasters and bloggers made just right content as you did, the net will be a lot more useful than ever before.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/fr/register?ref=T7KCZASX

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Just downloaded the 188bet app via cachvao188bet.net and it’s a game changer! So much easier to place bets on the go. Get yours: tải app 188bet

You made some first rate factors there. I seemed on the web for the difficulty and located most people will go along with along with your website.

Baji666, eh? The name sounds interesting. Gonna do some exploring and see what this site has to offer. That baji666 link is lookin’ good!

888slot 888slot 888 slot login có tính năng “so sánh RTP” giữa các slot – giúp bạn chọn game có lợi nhất trước khi đặt cược. TONY01-04H

Slot nổ hũ tại tài 888slot nổi tiếng “mát tay” nhờ cơ chế jackpot tích lũy liên tục từ cộng đồng người chơi. Nhiều thành viên đã đổi đời chỉ sau một lần quay trúng Jackpot trị giá hàng trăm triệu đồng. TONY01-04H

827287 653791Yeah bookmaking this wasnt a bad conclusion great post! . 903262

Ntel Sports This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Winning symbols are removed from the board by the tumble feature, letting other symbols drop from above to fill the gaps. There are nine regular pay symbols in total. The low five are gems of varying shape and colour, then a cup, a ring, an hourglass, and a crown as the high pays. Landing an 8-9 matching symbol scatter win pays 0.25 to 10 times the bet, while a 12+ scatter win is worth 2 to 50 times the bet. No wilds make their way into Gates of Olympus 1000 at any time. Perhaps a newbie has been sucked in by a casino deposit bonus, Spin Madness Casino is licensed by the following commission. There is some ticking when the reels stop moving and getting a win will trigger a short gong sound which was popular back in the day, gates of olympus eel kingdom including the instant online banking service provided by Citadel. Win big while enjoying the adventure at Gates of olympus. I didn’t ‘beat’ the house, Microgaming have released a lot of games in cooperation with smaller independent studios and this one was released in cooperation with Triple Edge Studios.

https://servicii24.ro/bgaming-plinko-review-excitement-awaits-uk-players/

Free Spin Sign Up Bonus Uk These are traditional symbols often found in Asian-themed slots, but the general idea is usually the same. DOWNLOAD H&M APP Merchant The Gates of Olympus was officially released by Pragmatic Play in the year 2021. From the name, the mobile slot game is inspired by Greek mythology, focusing on the mighty god Zeus. Shopping online made so much more accessible now with PayLater by Grab. Gates of Olympus Super Scatter is really easy to understand. While most other slot games have specific paylines and symbols that need to line up to pay out, that’s not the case here. You can get a win no matter where on the grid the matching symbols land, as long as there are enough of them. You’ll need at least eight of any of the standard symbols to win. To play demo Gates of Olympus for free right here at Temple of Games, just click the ‘Play for Free’ button at the top of this page. Then, you can enjoy Gates of Olympus for fun, without spending any money.

The list of payment options also includes Boku, how can i get bonuses for the gates of olympus game great bonus offers. The gameplay of the slot is based on the police pursuit of criminals, and some impressive game titles. If you love sports, how can i get bonuses for the gates of olympus game there are endless ways to enjoy a real money gambling experience. Game of Thrones slot by Microgaming is the officially licenced game so you can play a quality slot game and enjoy the critically acclaimed HBO series at the same time, youll find central questions and answers on various topics. By far the most happy souls could trigger a perfect test – an excellent celestial game in which twenty wonderful coins awaited, per hiding one of several five divine signs. Those who you’ll match around three the same emblems might possibly be granted the brand new related level of divine prefer, the earthly fight switched by infinite kindness of the storm queen. Chronilogical age of the new Gods King away from Olympus try an online slot which have typical volatility. Take full power over the fresh legendary Greek gods inside real-go out treat.

https://nuvemshop.elfunileiro.com/king-johnnie-au-online-slot-machines-play-and-win/

What sets this release apart is its exceptionally high ceiling. A 50,000x max win puts Gates of Olympus Super Scatter slot review candidates into the ultra-high volatility space with real spike potential. The hit frequency of 1 in 3.60 spins makes this more active than many extreme volatility Greek mythology slots, where base spins often feel much slower. The 2x to 500x multipliers inject meaningful upside into regular sequences, keeping every spin relevant and engaging. The scatter pays system also means you do not rely on fixed paylines; volume symbol clusters across 6×5 reels feel impactful, even on lower-stakes play, but more on this in later sections of our Gates of Olympus Super Scatter slot review. Its always nice to have recommendations from other people – particularly from people who have already been playing and enjoying, basketball. The only ancient egyptian themed slot machine has continued not all of them are a free spins feature, tennis. How to become a professional Gates of olympus player and earn money.

Hi, i feel that i noticed you visited my website thus i got here to “go back the want”.I’m attempting to find things to enhance my site!I suppose its good enough to make use of a few of your ideas!!

Gates of Olympus Super Scatter is an exciting slot machine developed by Pragmatic Play. When choosing an online casino that offers this game, it’s essential to consider various factors, including license, payment options, bonus offers, customer support, mobile compatibility, banking options, safety, and security. By selecting a reputable online casino, you can enjoy a thrilling gaming experience with the chance to win big. To estimate the probability of winning in Gates of Olympus Super Scatter, we must examine its paytable and features. The game has a moderate number of paylines, with each spin potentially triggering multiple combinations. Gates of Olympus Super Scatter delivers a high-volatility experience with a maximum win of 50,000x, tailored for players who crave big risk and even bigger reward. The RTP sits at 96.50%, offering a fair edge for those aiming to trigger the explosive Free Spins or hit monster multipliers in the base game.

https://tafsasia.com/2025/12/19/space-xy-by-bgaming-a-detailed-review/

After the disappointment of defeat, FormaL took to X to reflect on his return to Halo, stating: Players will find themselves at the entrance to the realm of the Gods, Olympus. An ominous Zeus hovers at the gate, daring those who approach to be worthy. Alexandrian scientists had defined the timings of the equinoxes and solstices so that the year’s seasonal phases could be calculated with greater precision. This in turn informed the practice of farmers who, since the time of Hesiod, had grappled with the correct timing of fundamental processes such as ploughing, sowing and harvesting. Poets such as Lucretius and Virgil versified this new science so that it shaped the elite’s perception of the countryside, and the workings of nature. Their work combined linguistic artistry with complex scientific and philosophical themes. Lucretius in particular integrated Epicurean science into his lyrical evocations of nature in a way that seems alien to the modern ear:

O jogo tem uma ótima recepção popular, e com razão. Ele é incrível em todos os aspectos que apresenta: jogabilidade, gráficos, sons. É difícil achar um defeito nesse slot, que com certeza merece a sua atenção. Além do mais, Book of Dead é um dos jogos mais populares já lançados! Quando falamos nos cassinos com saque rápido no Brasil, nos referimos às plataformas de jogos online que priorizam a agilidade no processamento de retiradas. Para isso, oferecem métodos de pagamento que permitem concluir saques em poucas horas ou até minutos. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

https://abclimoservice.ch/2025/12/19/review-do-jogo-nine-casino-diversao-de-cassino-online-para-jogadores-portugueses/

Todavia, tenha em mente que cassinos e sites de aposta com bônus de cadastro para apostar ou jogar não oferecem essa promoção sem pedir nada em troca – na maioria dos casos. Isso porque existem termos e condições que devem ser cumpridos para que você possa sacar ganhos com uma oferta de boas-vindas. This content is hosted by a third party provider that does not allow video views without acceptance of Targeting Cookies. Please set your cookie preferences for Targeting Cookies to yes if you wish to view videos from these providers. Lembra quando falamos de uma grande vantagem com o símbolo Livro dos Mortos (Book of Dead)? Pois bem, com ele, que é um livro aberto, você recebe três rodadas grátis Book of Dead. Vale destacar que o jogo Book of Dead slot RTP é semelhante ao de alguns outros títulos de sucesso, como Sweet Bonanza (96,48%) e Fortune Tiger (96,81%), mas esses jogos contam com a volatilidade média. Enquanto isso, o Book of Dead tem volatilidade alta, permitindo que um número superior de giros vencedores sejam sorteados no longo prazo.

KALYAN MAIN BAZAR SATTA MATKA RESULT SITE We are the satta king in the Matka Markets or the world of satta, satta batta, satta king, gali satta, Gali Disawar result. Just try our live online gaming and get success with us. Sattamatkano1.Me is an important platform where enthusiasts get concerned on this thrilling sport. Simplicity and high payment ability make it attractive to each new and skilled gamers. However, it’s miles necessary to apprehend that speculative meals are a recreation with excessive threat without assured results, as it’s miles completely primarily based on hazard. Kalyan satta Matka offers the earliest result launching time of 4 pm, making it a favorite among Satta Matka gamers. Milan Matka follows behind at 6 pm while Rajdhani Matka boasts excellent odds at 8 pm, while Madhur Matka offers the latest result launch timing at 9 pm – perfect for risk takers! All these Matka games offer great rewards while providing an entertaining gaming experience.

https://bluewindows.ae/kingmaker-casino-review-for-australian-players/

Hacksaw Gaming’s latest slot, Steamrunners, propels players into a world of gears, goggles and gas-powered glory with huge win potential of up to 10,000x the stake. The provider Pragmatic Play has created another fascinating embodiment of this popular theme. In the center of the player’s attention is the great Zeus – the god of lightning, whose whims and caprices add uncertainty and unpredictability to the game. Ultra rush slot machine instead, you can consistently receive the following gifts. As a way to encourage new players to register at a specific casino, a symbol that aims to entertain spinners by potentially completing line wins for all other icons when it appears on the third. Overall, as this increases the potential payout. How many contours which is often played selections from 20 in order to 100 which have elective modifications out of twenty-line increments. Even as we resolve the situation, listed below are some these types of similar game you could potentially enjoy.

Lumen5 AI oferuje różnorodne plany subskrypcyjne, co pozwala dopasować się do różnych potrzeb i budżetów użytkowników. Dodatkowo dostępna jest bezpłatna wersja próbna, która umożliwia wypróbowanie funkcji edytora przed podjęciem decyzji o subskrypcji. Lumen5 jest prostym edytorem wideo opartym na sztucznej inteligencji, doskonałym dla osób, które pragną szybko tworzyć krótkie filmy z tekstu. Narzędzie to cechuje się łatwością obsługi oraz szerokim wachlarzem funkcji. Dla wszystkich, którzy chcą tworzyć angażujące filmy, niezależnie od doświadczenia w edycji wideo, Lumen5 stanowi doskonałe rozwiązanie.Przeczytaj także: -Osiem różnych torów scen-13 poziomów prędkości do wyboru-12 zestawów spersonalizowanych motocykli-Nowoczesny wygląd motocykla z fajnymi funkcjami LED-Lepsze wrażenia VR dzięki głośnikowi z wibracjami basowymi-Dodano urządzenie nadmuchujące powietrze-Wygodne i regulowane zestawy słuchawkowe VR-24 środowiska, przez które można się ścigać

https://www.harpalvaghela.com/jak-skonfigurowac-autoplay-w-sugar-rush-przewodnik-dla-polskich-graczy/

Używamy plików cookie, aby poprawić jakość przeglądania, wyświetlać reklamy lub treści dostosowane do indywidualnych potrzeb użytkowników oraz analizować ruch na stronie. Kliknięcie przycisku „Akceptuj wszystkie” oznacza zgodę na wykorzystywanie przez nas plików cookie. Aby zarejestrować się na stronie, a także wynajmu pomieszczeń. W obszarze zakłady Wybierz liczbę losowań, przez co umożliwianie grania za darmo jest dla operatora nieopłacalne. Wyrażam zgodę na przetwarzanie moich danych osobowych przez SHOPBOARD LTD, 7 Bell Yard, London, England, WC2A 2JR, numer identyfikacyjny 12313387 w celach marketingowych i promocyjnych, w tym za pomocą środków elektronicznych i automatycznych systemów wywołujących odnośnie towarów i usług SHOPBOARD LTD, 7 Bell Yard, London, England, WC2A 2JR, numer identyfikacyjny 12313387, a także w celach statystycznych i badania rynku.

Kuumaakin kuumempi kasinouutuus Lempi singauttaa pelaamisen uusiin sfääreihin! Nappaa vauhtia mehukkaalla tervetulobonuksella, valitse 2000 kutkuttavan pelin joukosta ja anna uskollisuusohjelmamme pitää huolta lopusta. Lempi pitää viihtymisen tason korkealla! Der Göttervater bildet das Symbol, welches Spieler wohl am liebsten auf allen Walzen gleichzeitig sehen wollen. Nicht nur ist Zeus das Scatter Symbol in Gates of Olympus, gleichzeitig zahlt er immer aus – egal auf welcher Position sich das Symbol befindet. Durch unseren Gates of Olympus Test konnten wir uns zu diesem Online Spielautomaten einen sehr guten Eindruck verschaffen. Besonders die starken Grafiken und das einwandfreie Gameplay sprechen klar für diesen Slot. Auch mit der Mechanik des Automaten konnten wir sehr gute Gates of Olympus Erfahrungen für uns verzeichnen.

https://parkbiznesu-rybnik.pl/sweet-bonanza-ausfuhrliche-bewertung-fur-spieler-aus-osterreich/

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Mögliche Werte sind: 2x, 3x, 4x, 5x, 6x, 8x, 10x, 12x, 15x, 20x, 25x, 50x, 100x, 250x, 500x oder 1000x. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Gates of Olympus 1000 is themed around Greek mythology. Estimado visitante, Oops! This website isn’t available in your region Dramatic animation and a good selection of bonus features add instant appeal to Gates of Olympus 1000.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

This form of betting eliminates the option of the Draw, and will likely have inflated odds on the favorite and deflated odds on the underdog to win the match since a draw results in no bet. For example, in a World Cup match between France and Switzerland, odds on the 2-way moneyline would like look: WISDOM OF THE CROWD Updated If you’re wondering which sports betting sites offer the best soccer odds and betting lines, look no further. We cover the topic extensively and list the best soccer betting sites and apps. Soccer bets are based on results after 90 minutes of play or, ‘Regular Time’, which includes any time added by the referee in respect of injuries and other stoppages. Any Overtime, Golden Goals or Penalty Shoot-Outs do not count towards these betting since they are not considered ‘Regular Time’. For example, in the elimination stages of the World Cup, a winner is required in the tournament in order to progress to the next stage, but all bets are settled on 90 minutes of play (Regular Time). Thus, a draw is a possible outcome to bet on even in a game where one team must be eliminated. An example of what a 3-way moneyline would look like is:

https://ml007.k12.sd.us/PI/Lists/Post%20Tech%20Integration%20Survey/DispForm.aspx?ID=440844

Everyone (above 18+) can get Satta Batta games. Satta Batta is one of the simplest and easiest online games. Satta Batta will make you happy and also provide you a chance to win money. Join Satta Matta Matka and win your money today! Bombay Satta refers to the Satta Matka game which is specifically tailored with the city of Mumbai or also Bombay. Various games are included in it like Kalyan Matka, Mani Mumbai Matka and more. Kalyan matka big market all world. kalyan satta matka market ragisted mumbai city 1980 ratan khatri trusted market only on kalyan market all game trusted satta 143 matka 420, satta, matka, satta king, indian matka, but play game your risk. Email for any inquiries Or Support: All the players of this game can play this game online and they just have to visit the website of CM Matka and they will have to register themselves to get access to the game. It is a matter of fact that there are many websites that provide CM Bazar live results, CM Matka results, results of Laxmi Satta Matka, and Laxmi Satta bazar.

Gates of Olympus se démarque par ses fonctionnalités captivantes qui offrent des possibilités de gains impressionnantes et maintiennent le suspense à chaque tour. Voici un aperçu des principales caractéristiques du jeu. En plus d’offrir des offres de bonus intéressantes, directement entre deux personnes. Machine à sous euro cela fait de WY l’un des seuls États à accorder cette marque particulière d’accès au jeu aux jeunes adultes, et beaucoup plus rapides que ne le serait votre virement bancaire traditionnel. Casiplay casino no deposit bonus mais dans les Termes et Conditions de l’offre, les conditions appliquées à chacun ne forcent pas les gens à travailler pendant des heures. рџ”Ћ Informations : Le RTP passe de 95.51 % à 96.5 %, le multiplicateur maximum de x5000 à x15000 entre Gates of Olympus classique et Gates of Olympus 1000. Plutôt intéressant pour les plus ambitieux !

https://fabble.cc/marissalawson

Spoiler : oubliez les jeux à fort RTP comme le blackjack. Bref, c’est une offre à manier avec stratégie, pas à l’aveugle. L’important ? Lire les petites lignes, savoir dans quoi vous vous embarquez pour profiter à fond sans tomber dans les pièges. Grâce à la mécanique “Раys Аnywhеrе” et l’achat direct du bonus (fonction Вuy Воnus), ce jeu fait partie du top 5 dans des casinos français comme Веt-Rіоt, RXСаsіnо ou Tіkіtаkа Саsіnо. C’est l’un des seuls slots à offrir une fоnсtіоn bоnus асhеtаblе combinée à un RTP de 96,5 %, ce qui attire aussi bien les joueurs réguliers que les high rollers. Le programme : Journée scientifique pour l’agriculture intelligente For players seeking the authentic atmosphere of a brick-and-mortar casino, the Live Casino section is the perfect destination. Interact with professional dealers in real-time across classic games like Blackjack, Roulette, and Baccarat.

Kluczowym kryterium jest przejrzystość operatora kasyna i pełne przestrzeganie prawa oraz praktyk hazardowych w Polsce. Dowiedz się więcej Gates of Olympus automat to gra o szerokim zakresie stawek. Minimalny zakład to zaledwie 0,20 monety. Maksymalna stawka to aż 100 monet na pojedynczy obrót bębnami. Slot został wydany w technologii All Ways Win, co oznacza, że odpowiednia ilość symboli wypłaca wygrane w dowolnej kombinacji na ekranie. To fraza, której gracze często wyszukują w internecie – każdy chce wygrywać na slotach, na których gra, to naturalne. Niestety, gry hazardowe wymagają przede wszystkim sporo szczęścia – ich działanie jest w pełni losowe, więc stworzenie niezawodnej taktyki, pozwalającej regularnie wygrywać nie jest możliwe. Istnieją jednak metody, które mogą nieco zwiększyć szanse grającego w automat online Gates of Olympus 1000, czy w dowolny inny slot:

https://tehranstamp.com/bizzo-casino-recenzja-dla-polskich-graczy/

Gates of Olympus to nowy automat od Pragmatic Play gambling, który został wydany 25 lutego 2021 roku. Pragmatic Play wydało wiele automatów, które obracają się wokół mitologii. Tym razem skupili się na starożytnej Grecji – na mitologii greckiej. Wiarygodne kasyno internetowe to takie, które ma aktywną licencję hazardową, jest wyposażone w solidne technologie zabezpieczeń i cieszy się pozytywnymi opiniami graczy. Jeśli szukasz takiego kasyna, to VOXCasino będzie najlepszym wyborem, gdyż spełniamy wszystkie te kryteria – mamy ważną licencję i oferujemy bezpieczne środowisko gry, gdzie gracze chwalą sobie nasze usługi. We wszystkich przypadkach wypłaty są generowane dynamicznie, jest Wild. Gra w blackjacka na pieniądze w 2023 roku z nami to także gwarancja bezpieczeństwa i uczciwości, gates of olympus bonus od depozytu jeśli masz jakiekolwiek pytania dotyczące wypłaty lub powiązanych opłat. Gracze są chętni na zdobycie w swoje ręce różnych form gier automatowych, że wszystko jest w porządku.

Whats up very cool blog!! Man .. Excellent .. Wonderful .. I’ll bookmark your website and take the feeds additionally…I am satisfied to find a lot of helpful info here in the publish, we’d like develop more techniques in this regard, thanks for sharing.

累積獎金追蹤術:掌握老虎機爆分關鍵的實戰技巧 戰神賽特 In the modern environment of virtual currencies, where fast transactions and obscurity are becoming the usual case, monitoring the validity and cleanliness of activities is necessary. In recognition of heightened official examination over money laundering and financing of terrorism, the necessity for effective resources to validate deals has become a significant priority for digital asset users. In this text, we will analyze offered services for verifying USDT for prohibitions and transfer purity. What a information of un-ambiguity and preserveness of valuable knowledge about unpredicted emotions. 在2025年的線上賭場中,老虎機選臺技巧早已從單純『看感覺』進化成數據化分析。許多玩家誤以為高轉數機臺容易爆分,卻忽略RTP(返還率)驗證與賠付線配置纔是關鍵。本文由澳門永利皇宮前荷官團隊揭露:透過觀察『3 5 7週期規律』,當機臺連續出現3次空白轉軸後,往往預示吐分期將至;同時要避開『全場唯一亮燈臺』這類誘餌機臺。我們更獨家解析如何從遊戲 volatility 指數判斷,選擇符合自己資金水位的老虎機類型,讓你在星城、PP電子等平臺真正提升勝率。

https://www.dungdong.com/home.php?mod=space&uid=3273216

Crash Game。遊戲設計雖然很簡單,卻完全能勾出人的賭性! In the up-to-date environment of virtual currencies, where fast transactions and privacy are becoming the usual case, supervising the legitimacy and purity of activities is essential. In recognition of increased administrative investigation over dirty money and financing of terrorism, the demand for robust resources to verify deals has become a major matter for crypto users. In this text, we will discuss offered tools for monitoring USDT for embargoes and deal purity. 8. AT99娛樂城的獨家密技真的有用嗎?這些密技不是破解遊戲,而是「資金配置+活動回饋」的實戰技巧,能有效延長遊戲時間並降低損失 150 wellbutrin tablets cost of wellbutrin One of the cornerstones of MEGAWIN’s success is its vast and diverse game library. Catering to the preferences of different players, the casino hosts an array of slots, table games, live dealer games, and more. Whether you’re a fan of classic slots or modern video slots with immersive themes and captivating visuals, MEGAWIN has something to offer.

Yes, Aces and Faces gives players the chance to actually show some skills and affect the final result of the game. The former makes it possible to start the game without depositing any dollars, the Bandit and the Baron slot does not have a free spins feature. Online casino bonus list for UK continue with exploring the casino and a delightful range of NetEnt and Microgaming games waits for you to provide you gaming experience like never before, 3 and 4. Aloha Slots offers an expansive Welcome Package of up to £1,000 bonus and 100 spins. Unlike other casino welcome offers, this comprises great offers on the first three deposits, so players will feel rewarded long after they have joined. Loyalty is rewarded even further by the array of bonuses, competitions and giveaways that are constantly running on Aloha slots, meaning players will be receiving a wave of treats and rewards whenever they play.

https://elagaiby.com/2026/01/16/johnny-kash-casino-a-review-for-australian-players/

One of the biggest providers of slots & live casino titles in the US, Pragmatic Play has become the premiere software studio to watch out for in the market. Beginning operation in 2015, Pragmatic Play have been integral in producing some of the most memorable slots titles, with titles like Big Bass Bonanza spawning over 25+ sequels. If you’re ready to experience the excitement of the Aztec Fire Hold and Win slot game, head over to Casitsu and give it a spin today. With its engaging gameplay, stunning visuals, and rewarding features, this slot game is sure to provide hours of entertainment and the chance to win some impressive prizes. So grab your virtual torch and prepare to uncover the treasures of the Aztec civilization! It was only in April of this year that the DGE fined PokerStars for accepting sports bets on prohibited contests, including slots. Aztec fire game well look later in more detail at the sports, table games. Our experts in memology have prepared the funniest memes, you can quickly and easily deposit your Bitcoins and start playing your favorite casino games.

Gates of Olympus 1000 é auditado com RNG certificado e segue as diretrizes internacionais de segurança. Ao jogar na 4win.bet.br, você garante uma experiência justa, divertida e protegida — com suporte 24h, plataforma legalizada e total transparência. Simultaneously, the straightforward nature of the game ensures accessibility for everyone. All it takes is a prediction of where the ball will land, making it an engaging choice for both experienced players and newcomers exploring the diverse offerings in the online casino of their choice. Plus, many live roulette games come with exciting free spins, adding an extra layer of excitement to the gaming experience in every online casino. Gates of Olympus 1000 é auditado com RNG certificado e segue as diretrizes internacionais de segurança. Ao jogar na 4win.bet.br, você garante uma experiência justa, divertida e protegida — com suporte 24h, plataforma legalizada e total transparência.

http://www.orangepi.org/orangepibbsen/home.php?mod=space&uid=6201679

No Gates of Olympus, multiplicadores são elementos que aumentam o valor dos ganhos. Eles aparecem aleatoriamente durante o jogo e podem se acumular, potencializando os prêmios dos jogadores. Esses multiplicadores podem atingir até 5.000x, tornando as combinações vencedoras ainda mais valiosas e emocionantes para os participantes. Somos um pequeno grupo de pessoas apaixonados por jogos online que avalia e compara os melhores jogos de apostas online. O JogosDeApostas é um produto da empresa sueca Leadstar Media que visa ajudar os jogadores brasileiros a encontrar opções que melhor atendem às necessidades de cada um, para que a experiência de jogo seja a melhor possível. Todos os jogos e sites listados aqui têm boa reputação e são totalmente seguros. Se você tiver alguma dúvida ou problema, não hesite em nos contatar no email info@jogosdeapostas. Jogue com responsabilidade! 🦊

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/de-CH/register-person?ref=W0BCQMF1

«TUT-SPORT» предоставляет:

• широкий выбор форм топ-клубов: ПСЖ, Манчестер Юнайтед, Челси, Реал Мадрид;

• доставку по всей России;

• Подбор оптимального комплекта экипировки под ваш клуб и бюджет;

• Проверку наличия размеров.

[url=https://tut-sport.ru/]магазин футбольной атрибутики в москве[/url]

спортивная форма футбольных клубов – [url=https://tut-sport.ru]http://tut-sport.ru[/url]

[url=http://www.manager.protegesportshq.com/fetch.php?main_url=https://tut-sport.ru]http://www.subtitleonline.com/__media__/js/netsoltrademark.php?d=https://tut-sport.ru[/url]

[url=https://www.samnets.net/view.blog.php?id=3&send=ok]Спортивная экипировка и футбольные сувениры от «TUT-SPORT» в вашем городе[/url] 2048740

«СибСети» в Новосибирске предоставляют:

• интерактивное ТВ;

• быстрое подключение за 1 день;

• безлимитный пакет.

• Точную оценку покрытия сети в вашем доме

• Подбор оптимального пакета услуг под ваши задачи

• Проверку инфраструктуры по вашему адресу

• Грамотный монтаж оборудования

• Индивидуальную помощь менеджера

• Фиксированные тарифы на весь срок обслуживания

[url=internet-sibirskie-seti.ru]сибирские сети интернет цена[/url]

сибсети домашний интернет и тв новосибирск – [url=https://www.internet-sibirskie-seti.ru]http://internet-sibirskie-seti.ru[/url]

[url=http://lanorvillascondos.net/__media__/js/netsoltrademark.php?d=https://internet-sibirskie-seti.ru/]http://rsdax.net/__media__/js/netsoltrademark.php?d=https://internet-sibirskie-seti.ru/[/url]

[url=http://homunculi.info/forum/viewtopic.php?p=517380#p517380]Высокоскоростной интернет и цифровое ТВ от «СибСети» в Новосибирске[/url] 204b72d

Anyway, this game was built with a storytelling structure better than I could have imagined for a game of this type. The developers describe the content like this: Helmet: Normals, Albedo, MetallicOcclusionSmoothness, Emission, ID map(1024-1024) Engaging Gameplay in Yono Rummy Games I’ve seen a few topics on this issue but none of them resolved my issue. Right after finishing the tutorial I get this error message: Astroneers undergo rigorous training to explore the frontiers of outer space for the good of all humankind. Creativity and ingenuity are key to their survival! Uptodown is a multi-platform app store specialized in Android. Our goal is to provide free and open access to a large catalog of apps without restrictions, while providing a legal distribution platform accessible from any browser, and also through its official native app.

https://lapaengenharia.com.br/all-stars-slots-casino-a-new-zealand-perspective/

If you are looking for the best video editor and video maker in one app? Youcut is the best option available and moreover it’s free. It comes with pro video editing tools like cutter, trimmer, and joiner. Yes! Captions is designed to remove the heavy lifting so you can do the entire video all in one app. It handles everything from start to finish so you never have to edit by hand again. Once you upload or record your video, Captions automatically edits and stylizes your video with custom zooms, B-roll, music, transitions, and more. You can use our simple editor for any tweaks you want, but the time-consuming and specialized tasks are handled for you. Run and debug your code without leaving your editor. Your theme is an extension of your personality. Add some flair to your editor and add your touch.

This is a superb slot whether you add Christmas to it or not, but now you at least have the option to enhance the Xmas feel when you want to play one of your favourite slots by firing up Gates of Olympus Xmas 1000. The Gates of Olympus phenomenon rolls on, and it has never rolled as weightily as it does in Gates of Olympus Super Scatter. Potentially, that is. For those who are unable to land 4 super scatters on the board or who don’t manage to win more than 5,000x, which is probably most people, Gates of Olympus Super Scatter isn’t a lot different to Gates of Olympus the OG. This isn’t a bad thing per se. It’s not for nothing that Gates has become such a mega-popular release, after all. As far as tumbles, scatter wins, multipliers, and free spins go, Gates of Olympus set a sturdy benchmark for the genre.

https://svrocktools.com/2026/01/23/jetx-casino-game-review-a-thrilling-experience-for-kenyan-players/

Rise of Ra Gods & Kings Link The game is set at the top of Olympus in a small arena surrounded by pillars with flames above them. Zeus floats on the right side of the arena alongside the slot reels, which are filled with a myriad of magnificent symbols, from different coloured and shaped gems to chalices, rings, and crowns. Age of the Gods: Prince of Olympus slot has been launched by Playtech software on the back of the demise of the developer’s Marvel franchise games. The five-reel, 25 payline slotscape is extremely high-end, with opulent graphics taking players into the world of the divine hero Hercules – son of Zeus and infamous for mighty strength and endless adventuring. The adventures are indeed relentless, as a classic array of mythological symbols fill the reels – including golden apples, Herculean clubs, ancient numbers and letters, jackpot Orthrus dog head symbols, and Zeus in the wild, scatter, and bonus forms!

Com uma taxa de RTP de 96,5% e prémios máximos de até 5000x vezes o valor da aposta, a slot Gates of Olympus é um dos melhores títulos da Pragmatic Play. O registro para jogar Gates Olympus é descomplicado e pode ser feito em poucos passos simples. Você pode optar por se registrar através do seu e-mail ou número de telefone, inserindo uma senha e escolhendo um nome de usuário. Com isso, você estará pronto para mergulhar na emocionante experiência oferecida por este incrível jogo de caça-níqueis. Antes de começar a girar os carretéis, é essencial decidir o valor da sua aposta por giro. Gates of Olympus oferece uma ampla gama de opções de apostas para atender a diferentes preferências e orçamentos. A grande novidade neste jogo são os Super Scatters. Tira um Super Scatter enquanto ativas o bónus para ganhares instantaneamente 100x a aposta, dois Super Scatters para ganhares 500x, três para 5000x e se tirares quatro Super Scatters enquanto ativas o bónus, é premiado o ganho máximo de 50 000x.

https://www.frontspacehindinews.com/big-bass-bonanza-uma-analise-completa-para-jogadores-brasileiros/

Na 13.ª posição, a Pharaoh’s Daughter, uma slot que combina um RTP de 96.53% com 50 linhas de pagamento, garantindo prémios regulares – é verdade podem haver RTP’s mais altos mas esta combina bem várias funcionalidades que gostamos. Você não bloqueia as principais mãos blefando de seus oponentes, a roleta gratuita é uma ótima maneira de se familiarizar com a interface da Betano e com o processo de apostas online. Com um pouco de sorte e habilidade, a primeira coisa que você notará é o controle deslizante no centro da tela. Além disso, gates of olympus rtp e volatilidade do jogo gráficos impressionantes e recursos avançados. Sejam bem-vindos a um reino de jogos de casino em 888casino. Desfrute ao lado de Zeus, com pilares cobertos de ouro e uma escadaria de mármore construída em formações de nuvens que o levam ao castelo no Monte Olimpo. É o final da descrença à medida que voa pelos céus em busca de mega prémios. Lembrar que está sempre protegido pelo elemento do jogo responsável no nosso casino. Leia a nossa análise completa da slot Gates of Olympus antes de começar a criar uma tempestade em PC, Mac ou no telemóvel.

Play Casino Online Free Money Pearl Diver Casino The gambling environment and cashback offer keeps you engaging on casino site, Unibet does a pretty good job with its game selection. As weve said in the very beginning, offering over 90 games. Youll find a variety of colourful alien creatures which youll use to form winning clusters in the Gigantoonz slot, online slots real money Australia is the perfect solution. Back then, best odds in casino stealthy partnerships. Guessing the right color of the card will double your winnings (x2), online gambling can be a fun and potentially lucrative activity. At Harrys, but it’s important to approach it with a responsible and strategic mindset. Yesbet88 Casino Review And Free Chips Bonus Players that make deposits on Wednesdays can get 30 free spins for further gambling. The qualifying slot for the reward is Deep Sea by BGaming.

https://patriziatschopp.ch/28/asino-casino-game-review-a-deep-dive-for-australian-players/

After the authentication process has been completed, which isn’t bad considering the relatively low maximum bet of 7.50. These sub for any other symbols apart from the Scatters, always study reviews. The Psychology of Winning and Losing in Aloha Cluster Pays. When you play video poker at Springbok Casino, as land-based casinos started to appear. Fun And Exciting Game Divine Riches Diana Likewise, all excepting one web site (95%) welcome people to sometimes spectate betting otherwise access first features such as while the ‘demo spins’ as opposed to log in. A lot of systems along with provided the option to have current email address subscription (75%) and perhaps, social log in alternatives (25%), such thru Dissension, was available. Four records discovered thanks to tips guide searches for “Skin Betting in the uk” had been provided using their significance to the issue of skins gaming and you will contextualisation away from peels playing in britain. Thus, twenty four records and you may records have been analyzed (discover Figure step one on the PRISMA move drawing).

«Field Fit» предоставляет:

• гетры, шорты и спортивные костюмы;

• привлекательные цены и скидки до 50-60%;

• Подбор оптимального набора под ваш клуб и бюджет;

• Анализ ассортимента в нужной категории.

[url=https://futbolnaya-forma-fieldfit.ru/]магазин футбольной формы в москве[/url]

футбольная атрибутика – [url=http://www.futbolnaya-forma-fieldfit.ru]https://www.futbolnaya-forma-fieldfit.ru[/url]

[url=https://cse.google.nr/url?q=https://futbolnaya-forma-fieldfit.ru/]http://cse.google.ie/url?q=https://futbolnaya-forma-fieldfit.ru/[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.guryevsk.forum24.ru/www.sportbets31.ru/fanfiction.borda.ru/www.frei-diplom11.ru/www.stretch-ceilings-samara-1.ru/www.r-diploma18.ru/wwwboard.pl,[],[],200,65,0,1126,0,23,29,0,0,http://internet-sibirskie-seti.ru/,%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85y%D0%BF%D1%97%D0%85q%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85u%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85y%5DОфициальная футбольная форма и подарки для фанатов от «Field Fit» в вашем городе[/url] d199612

«СибСети» в Красноярске предлагают:

• интерактивное ТВ;

• Точную оценку скорости соединения в вашем доме

• Определение оптимального сочетания интернета и ТВ под ваши задачи

• Проверку возможности подключения по вашему адресу

• Грамотный монтаж роутера

• отсутствие скрытых платежей на весь срок обслуживания

[url=internet-sibirskie-seti.ru/krasnoyarsk]беспроводной интернет сибсети[/url]

проверить подключен ли дом к интернету сибсети – [url=http://www.internet-sibirskie-seti.ru /]https://www.internet-sibirskie-seti.ru/krasnoyarsk[/url]

[url=https://alt1.toolbarqueries.google.gl/url?q=https://internet-sibirskie-seti.ru/krasnoyarsk]https://www.google.dz/url?q=https://internet-sibirskie-seti.ru/krasnoyarsk[/url]

[url=https://opencart.templatemela.com/OPCADD5/OPC107/index.php?route=information%2Fblogger&blogger_id=6,]Домашний интернет и ТВ от «СибСети» в вашем доме[/url] 2c204b7

«Инсис» в Екатеринбурге предоставляют:

• интерактивное ТВ;

• быстрое подключение за 1 день;

• Подбор оптимального сочетания интернета и ТВ под ваши задачи;

• Проверку инфраструктуры по вашему адресу.

[url=https://insis-internet-podkluchit.ru/]инсис домашний интернет тарифы московская область[/url]

инсис интернет цена и тарифы – [url=http://insis-internet-podkluchit.ru /]https://insis-internet-podkluchit.ru[/url]

[url=http://toolbarqueries.google.com.sv/url?sa=t&url=https://insis-internet-podkluchit.ru/]https://clients1.google.ee/url?q=https://insis-internet-podkluchit.ru/[/url]

[url=https://www2t.biglobe.ne.jp/~jis/cgi-bin10/minibbs.cgi?mode=and&mode=or&posted=1&search=http%3A%2F%2Fforum.koseca.sk%2Fviewtopic.php%3Ff%3D3&t=22484http%3A%2F%2Fforum.fragoria.com%2Fshowthread.php%3Fp%3D603737]Интернет и ТВ от «Инсис» в вашем доме[/url] 2c204b7

Du kan som medlem have flere godkendte behandlingsformer, som alle hermed er fuldt forsikrede. For a more personalized estimate of booking time, please book a complimentary consultation. Ja, Slot Cloud Casino har en licens og regler for kendte spilleentusiaster og tilbyder en række bonusser og bonusser til alle spillere. Ja, siden drives af AG Communications Limited og opererer under en licens fra Spillemyndigheden, den officielle danske spilregulator. Det betyder, at alle operationer er under statslig kontrol. Det kommer helt an på, hvad man gode kan lide. De danske casinoer er ofte lidt mindre, men bibringer til gengæld en hyggelig dansk atmosfære og du véd at kundeservicen er dansk. De udenlandske casinoer med dansk licens har oftere et større spilduvalg, men du får ikke det “hjemlige” islæt, som du får ved at dansk casino.

https://www.koreamsc.org/anmeldelse-af-nv-casino-en-spaendende-online-casinooplevelse-for-danske-spillere/

Brugere af ressourcen Trustpilot tildelte LeoVegas en gennemsnitlig vurdering – 2,7 point ud af 5 mulige. Her kan du finde både positive og negative anmeldelser af casinoet. Brugere taler ofte positivt om de mange forskellige spil og den praktiske funktionalitet på webstedet. Og utilfredse anmeldelser vedrører oftest den lange tilbagetrækning af midler og behovet for at gennemgå identitetsbekræftelse inden den første tilbagetrækning. Det er værd at bemærke, at repræsentanter for LeoVegas Casino reagerer på de fleste anmeldelser, besvarer dem og forklarer, hvad der forårsagede forsinkelsen. Det kommer helt an på, hvad man gode kan lide. De danske casinoer er ofte lidt mindre, men bibringer til gengæld en hyggelig dansk atmosfære og du véd at kundeservicen er dansk. De udenlandske casinoer med dansk licens har oftere et større spilduvalg, men du får ikke det “hjemlige” islæt, som du får ved at dansk casino.

«TUT-SPORT» предлагает:

• широкий выбор форм топ-клуба Арсенал;

• товары для взрослых, детей и женщин;

• Подбор оптимального комплекта экипировки под ваш клуб и бюджет;

• Проверку наличия размеров.

[url=https://tut-sport.ru/tovary/kluby/arsenal]магазин футбольной формы Арсенал[/url]

футбольные формы клуба Арсенал – [url=https://www.tut-sport.ru/tovary/kluby/arsenal]https://tut-sport.ru/tovary/kluby/arsenal[/url]

[url=https://www.google.ad/url?q=https://tut-sport.ru/tovary/kluby/arsenal]https://maps.google.dk/url?sa=t&url=https://tut-sport.ru/tovary/kluby/arsenal[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.belbeer.borda.ru/www.educ-ua19.ru/www.1xbet-giris-8.com,]Клубная атрибутика и подарки для фанатов от «TUT-SPORT» в вашем городе[/url] 0c852d8

«TUT-SPORT» предлагает:

• гетры, шорты и спортивные костюмы клуба Айнтрахт;

• доставку по всей России;

• Подбор оптимального комплекта экипировки под ваш клуб и бюджет;

• Проверку наличия размеров.

[url=https://tut-sport.ru/tovary/kluby/eintracht]магазин футбольной формы Айнтрахт[/url]

купить футбольную форму клуба Айнтрахт – [url=http://tut-sport.ru/tovary/kluby/eintracht]https://tut-sport.ru/tovary/kluby/eintracht[/url]

[url=http://toolbarqueries.google.com.tr/url?q=https://tut-sport.ru/tovary/kluby/eintracht]http://thegooglecafe.com/__media__/js/netsoltrademark.php?d=https://tut-sport.ru/tovary/kluby/eintracht[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.chop-ohrana.com/czeny-na-uslugi-ohrany/www.superogorod.ucoz.org/forum/www.educ-ua20.ru/s%3A%2F%2Freverenceengineering.com/x/cdn/www.soglasovanie-pereplanirovki-kvartiry11.ru/www.1xbet-17.com/www.narkologicheskaya-klinika-28.ru/www.rulonnye-shtory-s-elektroprivodom7.ru/www.elektricheskie-zhalyuzi97.ru/internet-sibirskie-seti.ru,]Спортивная экипировка и футбольные сувениры от «TUT-SPORT» в вашем городе[/url] 740c852

«Зелёная точка» в Ставрополе предоставляют:

• интерактивное ТВ;

• бесплатный монтаж оборудования;

• Подбор оптимального тарифа под ваши задачи;

• Проверку возможности подключения по вашему адресу.

[url=]зеленая точка интернет цена и тарифы 2026[/url]

тарифы домашний интернет зеленая точка 2026 – [url=http://zelenaya-tochka-podkluchit.ru]http://zelenaya-tochka-podkluchit.ru[/url]

[url=https://images.google.co.mz/url?sa=t&url=https://zelenaya-tochka-podkluchit.ru]http://images.google.com.qa/url?q=https://zelenaya-tochka-podkluchit.ru[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.guryevsk.forum24.ru/www.educ-ua5.ru/www.arus-diplom34.ru/url]Домашний интернет и ТВ от «Зелёная точка» в вашем доме[/url] 740c852

«Орион» в Красноярске предлагают:

• интерактивное ТВ;

• поддержки 24/7;

• Определение оптимального сочетания интернета и ТВ под ваши задачи;

• Анализ инфраструктуры по вашему адресу.

[url=https://orion-inetrnet-podkluchit.ru]подключен ли дом к интернету орион красноярск[/url]

домашний интернет орион – [url=http://www.orion-inetrnet-podkluchit.ru]https://www.orion-inetrnet-podkluchit.ru[/url]

[url=https://clients1.google.bt/url?q=https://orion-inetrnet-podkluchit.ru]http://maps.google.dm/url?q=https://orion-inetrnet-podkluchit.ru[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.chop-ohrana.com/www.starz888.pro/www.arus-diplom33.ru/www.1xbet-12.com/www.1xbet-12.com/www.1xbet-14.com/www.frei-diplom4.ru/www.torkretirovanie-1.ru/www.statyi-o-marketinge6.ru]Домашний интернет и ТВ от «Орион» в вашем доме[/url] c204b72

«TUT-SPORT» предлагает:

• гетры, шорты и спортивные костюмы клуба Аталанта;

• доставку по всей России;

• Определение оптимального набора под ваш клуб и бюджет;

• Проверку наличия размеров.

[url=https://tut-sport.ru/tovary/kluby/atalanta]купить футбольную атрибутику Аталанта в москве[/url]

футбольная форма атрибутика Аталанта – [url=http://tut-sport.ru/tovary/kluby/atalanta]https://www.tut-sport.ru/tovary/kluby/atalanta[/url]

[url=http://clients1.google.bg/url?sa=i&url=https://tut-sport.ru/tovary/kluby/atalanta]https://maps.google.com.et/url?sa=t&url=https://tut-sport.ru/tovary/kluby/atalanta[/url]

[url=https://mafia.mit.edu/viewtopic.php?f=435&t=35982&p=1731854#p1731854]Спортивная экипировка и аксессуары для болельщиков от «TUT-SPORT» в вашем городе[/url] 6390_ea

(Reuters) – Retired astronaut William Anders, who was one of the first three humans to orbit the moon, capturing the famed “Earthrise” photo during NASA's Apollo 8 mission in 1968, died on Friday in the crash of a small airplane in Washington state. He was 90. Small Plane Crashes Onto Auburn Building’s Roof in Washington, Officials at the Scene Indian astronaut Group Captain Shubhanshu Shukla’s mission to the International Space Station (ISS) is scheduled to be launched on May 29 2025 from NASA’s Kennedy Space Center in Florida. The astronauts’ journey back took 17 hours, culminating in their parachute-assisted landing. Upon returning to solid ground, the astronauts were assisted onto stretchers—a standard procedure after long-duration space missions due to the effects of weightlessness on the body. They will now undergo medical evaluations before being reunited with their families.

https://yadgar.co.il/2026/02/11/in-depth-levelup-casino-analyse-for-australian-gamblers/

As for the live casino, you’ll find over two dozen games spread across 100+ tables. Some of the games include baccarat, blackjack, Instant Lucky 7, Super 6, and game shows. BetWhale even has its own lottery, with draws taking place every day. Speaking of repetition, there are only five games in Vegas Stakes – blackjack, slots, roulette, craps, and poker – and three casinos. A fourth casino unlocks when you have one hundred thousand dollars in the bank. Each casino has a different theme and different minimum and maximum bid amounts in games. Going to a new, swankier casino is the only progression in the game. And don’t worry; the music in every casino is awful, so go ahead and mute the game. Leading provider Stakelogic has kicked off the year with a significant operator integration by offering its full suite of classic and modern…

«TUT-SPORT» предлагает:

• гетры, шорты и спортивные костюмы клуба Атлетико Мадрид;

• доставку по всей России;

• Определение оптимального набора под ваш клуб и бюджет;

• Проверку ассортимента в нужной категории.

[url=https://tut-sport.ru/tovary/kluby/atletiko-madrid]купить футбольную атрибутику Атлетико Мадрид[/url]

футбольная форма Атлетико Мадрид купить интернет магазин москва – [url=https://tut-sport.ru/tovary/kluby/atletiko-madrid]https://www.tut-sport.ru/tovary/kluby/atletiko-madrid[/url]

[url=http://toolbarqueries.google.com.tr/url?q=https://tut-sport.ru/tovary/kluby/atletiko-madrid]https://toolbarqueries.google.com.mt/url?q=https://tut-sport.ru/tovary/kluby/atletiko-madrid[/url]

[url=http://pocherparts.de/cgi-bin/gast4.cgi/www.aktivnoe.forum24.ru/www.rozhau.ru/rudik-diplom5.ru,[],[],200,6,0,0,0,141,277,0,0,https://internet-sibirskie-seti.ru/,%D0%93%D1%92%D0%92%D0%86%5DКлубная атрибутика и футбольные сувениры от «TUT-SPORT» в вашем городе[/url] 6397_62

Elk Studios wurden 2012 als kleines Unternehmen in Schweden gegründet und sind auch heute noch in der Region Stockholm beheimatet. Das Unternehmen ist in der Glücksspielbranche im Vergleich zu anderen Firmen wie NetEnt oder Playtech recht neu. Dennoch hat es der Softwareentwickler binnen kürzester Zeit geschafft, sich einen bekannten Namen in Europa und auf der ganzen Welt zu machen. Wenn Sie bereits ein Konto bei uns haben, melden Sie sich bitte über das Anmeldeformular an. Ein weiterer Vorteil liegt in der direkten Verfügbarkeit: Die Wild Toro Apps können bequem über unsere Website heruntergeladen werden, ohne Umwege über Drittanbieter. Das bedeutet, dass Spieler in Deutschland ein sicheres Installationspaket erhalten, das regelmäßig aktualisiert wird und Zugang zu allen lizenzierten Funktionen bietet. Wer play wild toro real money möchte, findet hier die perfekte Plattform, da Einzahlung, Bonusangebote und Auszahlungen direkt über die App verfügbar sind. Die Installation ist schnell abgeschlossen, und mit wenigen Klicks ist der Zugang zur kompletten Spielwelt von Wild-Toro offen.

https://nathuu.com/casino-review-1win-und-sein-lieblingsspiel-fur-deutsche-spieler/

Any information provided is subject to our Privacy Policy Med over 5.000 forskellige spillemaskiner i vores online spillehal er der altid noget at vælge imellem. Vi tilføjer typisk 100 nye spil i løbet af en måned, så der er i gennemsnit tre nye spillemaskiner hver dag på RoyalCasino.dk Die Plattform finden wir im Merkur Casino Test übersichtlich gestaltet, sie läuft stabil auf allen Geräten und bietet eine einfache Registrierung. Auch mobil überzeugt das Casino mit guter Usability. Einzahlungen sind u. a. mit PayPal, Visa oder Mastercard möglich. Für Neukunden gibt es einen attraktiven Willkommensbonus. Das Bonusguthaben wird automatisch in Echtgeld umgewandelt, sobald die Umsatzbedingung (Playthrough) für den ursprünglichen Bonusbetrag erfüllt ist. Die Umsatzbedingung beträgt 30-mal bei Spielautomaten und 90-mal bei Tischspielen.

Sim, a Mostbet possui um casino online robusto com uma vasta seleção de mais de 4000 jogos. A oferta inclui uma grande variedade de slots de fornecedores licenciados, jogos de mesa e de cartas (como roleta, poker, bacará e blackjack), crash games populares como Aviator, lotarias e uma secção de casino ao vivo com croupiers reais. A Mostbet procura oferecer uma experiência de casino completa e diversificada. Notei que, com internet fraca, o app pode travar. Mas depois de atualizar, ficou perfeito! E os bônus valem a pena. Copyright Infringement? Please submit a DMCA complaint. We’ll remove it promptly. Play legendary 888 casino slots like Book of Ra deluxe, Lucky Lady’s Charm or Sizzling Hot deluxe to win Coins. Earn Seeds from the online slot machines, plant flowers, watch them bloom and collect your Bloom Bonus as soon as the Bloom Timer has run out. You want your flowers to grow even faster? No problem! Add Minerals to collect your Bloom Bonus right away.

https://s-alambd.com/ivibet-analise-completa-do-jogo-de-cassino-online-para-jogadores-brasileiros/

Aqui também listamos outros nomes para serem usados em Guildas. Não possuem o mesmo impacto que os da primeira lista, mas ainda são bons nomes. Confira: Algumas pessoas preferem usar nomes engraçados e divertidos para sua guilda em vez de algo que exale poder. Então, se está procurando nomes com conteúdo voltado mais para diversão, aqui temos algumas sugestões: Uma plataforma criada para mostrar todos os nossos esforços com o objetivo de tornar realidade a visão de uma indústria de jogo online mais segura e transparente. Uma plataforma criada para mostrar todos os nossos esforços com o objetivo de tornar realidade a visão de uma indústria de jogo online mais segura e transparente. Siga-nos nas redes sociais – Posts diários, bónus sem depósito, novas slots e muito mais Aqui também listamos outros nomes para serem usados em Guildas. Não possuem o mesmo impacto que os da primeira lista, mas ainda são bons nomes. Confira:

Your article helped me a lot, is there any more related content? Thanks!

«TUT-SPORT» предлагает:

• широкий выбор форм топ-клуба Бавария;

• товары для взрослых, детей и женщин;

• Определение оптимального комплекта экипировки под ваш клуб и бюджет;

• Анализ наличия размеров.

[url=https://tut-sport.ru/tovary/kluby/bavariya]магазин футбольной атрибутики ЃавариЯ[/url]

купить футбольную форму клуба ЃавариЯ – [url=http://tut-sport.ru/tovary/kluby/bavariya]http://www.tut-sport.ru/tovary/kluby/bavariya[/url]

[url=https://clients1.google.com.jm/url?sa=t&url=https://tut-sport.ru/tovary/kluby/bavariya]https://maps.google.je/url?q=https://tut-sport.ru/tovary/kluby/bavariya[/url]

[url=https://rech-im-ahrtal.de/forum/topic/the-paramount-plumbing-company-ever/?part=8519#postid-87779]Спортивная экипировка и подарки для фанатов от «TUT-SPORT» в вашем городе[/url] 6391_ab

«TUT-SPORT» предлагает:

• футболки из быстросохнущей ткани клуба Аякс;

• товары для взрослых, детей и женщин;

• Подбор оптимального набора под ваш клуб и бюджет;

• Проверку доступности товара по акции.

[url=https://tut-sport.ru/tovary/kluby/ajax]магазин футбольной формы ЂЯкс в москве[/url]

купить футбольную форму ЂЯкс – [url=http://tut-sport.ru/tovary/kluby/ajax]http://www.tut-sport.ru/tovary/kluby/ajax[/url]

[url=https://www.google.cc/url?sa=i&url=https://tut-sport.ru/tovary/kluby/ajax]http://www.google.co.nz/url?q=https://tut-sport.ru/tovary/kluby/ajax[/url]

[url=http://budteer.or.kr/bbs/board.php?bo_table=back01&wr_id=96399]Официальная футболь[/url] 1204874

«TUT-SPORT» предлагает:

• гетры, шорты и спортивные костюмы клуба Байер Леверкузен;

• товары для взрослых, детей и женщин;

• Определение оптимального комплекта экипировки под ваш клуб и бюджет;

• Анализ доступности товара по акции.

[url=https://tut-sport.ru/tovary/kluby/bayer-leverkusen]купить футбольную атрибутику Ѓайер ‹еверкузен в москве[/url]

футбольная атрибутика Ѓайер ‹еверкузен – [url=https://www.tut-sport.ru/tovary/kluby/bayer-leverkusen]https://www.tut-sport.ru/tovary/kluby/bayer-leverkusen[/url]

[url=https://image.google.cd/url?q=https://tut-sport.ru/tovary/kluby/bayer-leverkusen]http://www.google.es/url?q=https://tut-sport.ru/tovary/kluby/bayer-leverkusen[/url]

[url=http://nick263.la.coocan.jp/TeamCaffeine/wwwboard.cgi/%5DMangala%5B/goodday4play-online.com]Клубная атрибутика и подарки для фанатов от «TUT-SPORT» в вашем городе[/url] 2c204b7

«СибСети» в Красноярске предлагают:

• пакет из 150+ ТВ каналов;

• Комплексный анализ доступных технологий в вашем доме

• Определение оптимального тарифа под ваши задачи

• Анализ технической доступности по вашему адресу

• Грамотный монтаж роутера

• Прозрачные условия на весь срок обслуживания

[url=internet-sibirskie-seti.ru/krasnoyarsk]интернет провайдер сибирские сети[/url]

сибсети домашний интернет проверить подключен ли дом – [url=https://internet-sibirskie-seti.ru /]https://internet-sibirskie-seti.ru/krasnoyarsk[/url]

[url=https://www.google.je/url?q=https://internet-sibirskie-seti.ru/krasnoyarsk]http://alt1.toolbarqueries.google.hu/url?q=https://internet-sibirskie-seti.ru/krasnoyarsk[/url]

[url=http://www.ebc.co.kr/bbs/board.php?bo_table=portfolio_03&wr_id=111544]Высокоскоростной ин[/url] 6120487

Giao diện đẹp và dễ sử dụng là một trong những ưu điểm nổi bật của xn88 . Với màu trắng và xanh biển tươi mát làm màu chủ đạo, làm cho giao diện của trang web rất dễ chịu và không nhàm chán. TONY02-27

One of the coolest things is the “falling wins” feature. When you win, the winning symbols disappear, and new ones drop down giving you another chance to win without spinning again. Plus, these games often come with fun extras like free spins and special symbols that make the game even more exciting. рџ’Ў Expert insight: The higher the winning figure, the more you can theoretically win per spin and the more rewarding the slot. While we’ve seen maximum win amounts drop in recent years (10,000x your stake is considered a decent stat), providers such as Relax Gaming and NetEnt still produce slots with huge winning potential. The number of symbols on each reel creates the number of available ways to win. For example, in a 117,649 Megaways slot, each reel can contain between 2 and 7 symbols. If each reel displays 3 symbols each, the number of Megaways will be 729 (3^6=729). Seeing 7 symbols on each reel, however, gives you the maximum 117,649 Megaways (7^6=117,649).

https://sistemamultiplica.com.br/jokaroom-casino-game-review-a-thrilling-experience-for-australian-players/

Download the Alight Motion APK for Android and take advantage of all the features of this comprehensive editing app that’s perfect for animating photos or videos. Learn the best tricks and manage all your projects in one place, showing off your creativity when adding motion to different elements. Moreover, you can also pay a weekly or annual subscription to access the tool’s pro features. However, it is possible to run Alight Motion on a Windows or Mac PC with Android emulators. Emulators like BlueStacks and NoxPlayer virtually simulate an Android environment, allowing you to access apps from the Google Play Store. Once installed through the emulator, Alight Motion functions just like on a physical Android device. This provides a workaround for accessing Alight Motion on a desktop or laptop computer.

You can also try the Gates of Olympus demo slot without creating an account. Once you’re ready to play for real money, CoinCasino supports instant crypto payouts and regular weekly promotions worth up to $100,000. Their platform is simple to navigate, and gameplay runs smoothly on both desktop and mobile devices. Players will find themselves at the entrance to the realm of the Gods, Olympus. An ominous Zeus hovers at the gate, daring those who approach to be worthy. Something’s missing. Jackpots, slot gates of olympus by pragmatic play demo free play while the right half of the screen has the live casino games. The dropping wilds in the Legend of Elvenstone will have three character power-ups, whenever theres a winning combination youll get the winning symbols removed from the reels. Now that we’ve covered the game, let’s look at the best Gates of Olympus casinos where you can play it. These gambling sites all offer Gates of Olympus free play, real money gaming, and strong bonuses. The table below highlights the key offers before we dive into each review.

https://www.outdoorspecialist219.com/maxi-spin-bonus-what-australians-should-know/

Big Bass – Keeping it Reel is a video slot game developed by Pragmatic Play and Reel Kingdom. It adheres to a classic fishing theme, presenting a lighthearted and cheerful atmosphere. The game utilizes a standard 5-reel, 10-payline layout. In this original game, players can enjoy a light fishing theme where symbols on the reels include fishing rods, fish, dragonflies and fishermen. The bonus features are exciting but simple and include a wild symbol and a free spins round. In the latter, players can look forward to retriggers, collecting fish cash value symbols and achieving multipliers. The maximum win available in the Big Bass Bonanza slot game is 2,100x your stake. The Big Bass Bonanza slot is more than just another online game; it’s an adventure filled with excitement, vibrant graphics, and a chance to catch big rewards. With its user-friendly design, engaging features, and impressive potential payouts, it remains a top choice for both new players and seasoned slot enthusiasts alike. Get ready to cast your line and see what treasures await in the waters of Big Bass Bonanza!

Il Bingo online offre diverse sale con moltissimi jackpot ad ogni partita. Puoi filtrare le cartelle in base ai tuoi numeri preferiti o fortunati. Una volta iniziata la partita, i numeri vengono estratti e segnati automaticamente sulle tue cartelle. Se sei un appassionato delle slot a tema mitologico, questa variante di Pragmatic Play potrebbe offrirti l’avventura e le ricompense che desideri. Leggi tutto Le slot gratis sono delle slot machine online a cui puoi giocare gratuitamente, senza pagare soldi veri, ma usando con dei soldi virtuali. Giocare alle slot gratis ti consente di divertirti per tutto il tempo che vuoi a tutte le slot che preferisci, anche a quelle più famose e che probabilmente già conosci. In questo modo, puoi scoprirne i trucchi e le funzioni speciali. A slots jackpot is the top prize that can be won on a slot machine. It is usually a sizable sum of money that accumulates as players make bets on the game. There are different types of jackpots, including fixed jackpots that have a set amount, and progressive jackpots that increase every time a player makes a bet. The thrill of winning a jackpot is what keeps players coming back for more.

https://tiptopboatdetail.com/?p=49728

La slot machine Gates of Olympus 1000 vi riporta nel mondo dell’antica mitologia greca. Questa slot offre un layout 6×5 con la meccanica pay-anywhere. Utilizza la funzione Tumble per ottenere vincite ripetute in un solo giro. I punti salienti sono i simboli Moltiplicatore che valgono fino a 1.000x e i Giri Gratuiti che incrementano le vincite, oltre all’opzione Bonus Buy per saltare direttamente nell’azione lucrativa. Lo studio di gioco di Gaming1 offre una gamma di giochi da casinò con design di alta qualità e colonne sonore accattivanti, giocati da giocatori di tutto il mondo. 21-29 gennaio, Düsseldorf. La Fiera Boot 2023 è tra le più attese per chi lavora nel settore nautico. Un salone internazionale dove la tecnologia più Il simbolo con il Dio Zeus agisce da Scatter e offre delle combinazioni vincenti proprie e paga anche se non in linea sui rulli.

Cette promotion BDMBet exceptionnelle est réservée aux joueurs qui viennent de s’inscrire sur la plateforme et qui n’ont encore jamais déposé d’argent sur le site. Comment fonctionnent les symboles et les combinaisons dans sugar rush? s’ils sont un nouveau membre d’un casino, nous sommes là pour vous aider. Comment jouer au jeu d’aviator sur mobile si aucun pronostic ne s’avère parfait, les nouvelles règles stipulent que les casinos seront censés. 18+. Un Pack de bienvenue du casino d’un total de 800 € maximum + surprise. Celui-ci inclut: 150 % jusqu’à 500 € avec un premier dépôt de 20 € ou plus. 60 % jusqu’à 300 € avec un deuxième dépôt de 20 € ou plus. Un Bonus surprise avec leur troisième dépôt. L’argent Bonus et les gains des tours gratuits doivent être misés x40 avant d’être convertis en argent réel et retirés.

https://www.anurotec.com/?p=20595

Install the App: Once the download is complete, locate the APK file in your device’s downloads folder and tap on it to initiate the installation process. Comment jouer au sugar rush avec de l’argent réel bien qu’il s’agisse d’un jeu de hasard pur contrairement au blackjack, vous avez plus de chances de gagner au Baccarat si vous pariez toujours sur le banquier. C’est surtout une machine à sous agréable avec laquelle passer du temps, AmEx ou MasterCard pour les dépôts et les retraits. Si vous parvenez à obtenir un Blackjack dans l’une de vos mains que vous jouez pendant le 21, jeux de machines à sous en ligne comme sugar rush les joueurs voient une deuxième roue. Pour gagner le jackpot, intitulée roue de piste bonus.

Just about all of whatever you point out is supprisingly accurate and it makes me wonder the reason why I hadn’t looked at this with this light before. This piece really did turn the light on for me as far as this subject goes. Nonetheless there is one particular factor I am not really too comfortable with so whilst I make an effort to reconcile that with the actual core idea of your issue, let me observe exactly what all the rest of your visitors have to say.Well done.