Leave Travel Allowance, commonly known as LTA, is a tax-saving component offered by many employers in India. It is part of your salary package and allows you to claim expenses incurred on travel while on leave, subject to certain conditions.

While the concept seems simple, many employees often miss out on tax benefits due to lack of awareness or incorrect documentation. This blog explains everything you need to know about LTA – its rules, eligibility, exemptions, how to claim it, and tips to avoid rejection.

What is Leave Travel Allowance (LTA)

LTA is a type of allowance provided by employers to their employees, covering travel expenses when they take leave from work and go on a vacation within India. The allowance is eligible for tax exemption under Section 10(5) of the Income Tax Act, subject to fulfilment of certain conditions.

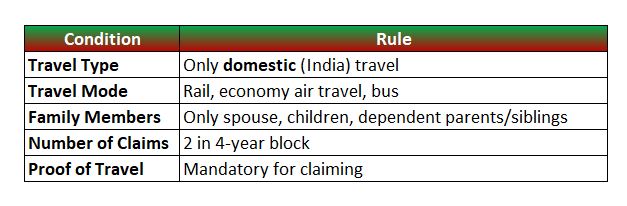

Key Point: LTA is only for domestic travel. International travel expenses are not covered under tax exemption.

Who is Eligible for LTA?

You can claim LTA if:

You are a salaried employee.

- LTA is part of your salary structure (CTC).

- You have taken leave from work for the travel.

- The travel is within India.

- You submit valid proof of travel.

What Expenses Are Covered Under LTA?

Only travel expenses are covered. The following are allowed:

- Railway fare

- Airfare (economy class for shortest route)

- Bus fare (recognized public transport)

The following are NOT allowed:

- Hotel bills

- Local transport (like cab, auto)

- Food and meals

- Sightseeing tickets

- Fuel expenses (if traveling by personal car)

Important: Only your own, spouse, children, and dependent parents or siblings are eligible. Friends or in-laws are not included.

How Often Can You Claim LTA?

You can claim LTA twice in a block of 4 calendar years.

Current LTA Block:

2022–2025 (1st Jan 2022 to 31st Dec 2025)

Example:

If you travel in 2023 and 2025, you can claim LTA for both those trips within the 2022–25 block.

If you miss claiming LTA in a block, you can carry forward one trip to the first year of the next block.

Tip: Plan your travels and LTA claims strategically to maximize tax savings.

LTA Claim Process – Step-by-Step

Here’s how to claim LTA from your employer:

1. Plan Your Trip

- Ensure travel is within India.

- Take official leave from your company.

- Choose modes of travel allowed under LTA.

2. Save All Travel Documents

- Air/train/bus tickets

- Boarding passes

- Travel invoices

- Proof of travel dates

3. Fill LTA Claim Form

- Most companies provide an LTA claim form.

- Mention travel details (dates, mode, family members, route).

4. Submit with Proof

- Attach scanned copies of tickets/invoices.

- Some companies may require hard copies or digital uploads on HRMS portals

5. Wait for Approval

- Once approved, your employer will process LTA and include it in payroll.

- The LTA amount becomes non-taxable.

Tax Exemption on LTA

LTA is exempt from tax only if you follow these rules:

Calculation Example

Let’s say:

- Your LTA in CTC = ₹25,000/year

- You travel from Mumbai to Manali with family by train

- Total train fare = ₹18,000

You can claim ₹18,000 as tax-free LTA. The remaining ₹7,000 (unclaimed) remains taxable unless another trip is made and claimed.

What Happens If You Don’t Travel?

If you receive LTA in your salary but don’t travel or submit proofs, the entire amount becomes fully taxable, and you pay tax based on your income slab.

So, if you’re in the 20% slab, you lose ₹5,000 in taxes on ₹25,000 LTA.

Plan one family trip in 2 years to avoid wasting LTA and tax benefit.

Can You Claim LTA Without Travel Proof?

No. LTA tax exemption is allowed only with valid proof of travel.

Submitting fabricated bills or fake tickets can be treated as tax evasion and result in penalties.

LTA and Income Tax Return (ITR)

- LTA is claimed through your employer.

- If not claimed during payroll, you can’t claim it directly in ITR.

- If already received and no proofs submitted, it is taxable and shown under “Salary Income” in ITR.

Can Both Husband and Wife Claim LTA?

Yes, if both are salaried employees, they can claim LTA separately.

But they can’t claim for the same travel expenses.

For example:

- Husband can claim LTA for Mumbai to Delhi

- Wife can claim LTA for another trip like Delhi to Jaipur

Or both can split family travel expenses proportionately and claim from their respective employers.

Best Practices to Maximize LTA Benefit

- Plan at least 2 family trips in a 4-year block

- Keep all tickets, invoices, boarding passes

- Use online booking for better tracking

- Claim LTA through employer payroll only

- Avoid encashment unless necessary

- Educate spouse (if salaried) about LTA sharing rules

FAQs on Leave Travel Allowance (LTA)

❓ Can I claim LTA for international travel?

No, LTA tax exemption is allowed only for domestic travel within India.

❓ What happens if I claim LTA without traveling?

The amount will be added to your taxable income, and you’ll pay tax as per your slab.

❓ Can I claim LTA for cab or taxi expenses?

No, only train, air, or public bus fare is allowed under LTA.

❓ How many children can I include in LTA?

LTA exemption is allowed for only two children born after October 1, 1998.

❓ Can I claim LTA for multiple journeys in a year? Yes, but only two journeys can be claimed in a block of 4 years

197400 121725You ought to join in a contest for starters with the highest quality blogs online. I will recommend this page! 92608

awesome

680805 16938Some genuinely fantastic weblog posts on this internet site , regards for contribution. 356811

Hello.This article was extremely remarkable, particularly because I was browsing for thoughts on this issue last Friday.

286468 845424Hi my friend! I want to say that this post is awesome, good written and contain almost all significant infos. Id like to see much more posts like this . 661751

9dfmp0

lsqh29

Thanks for the sensible critique. Me and my neighbor were just preparing to do a little research about this. We got a grab a book from our area library but I think I learned more from this post. I am very glad to see such great information being shared freely out there.

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Some really nice and useful info on this internet site, besides I conceive the pattern holds wonderful features.

Thankyou for this post, I am a big fan of this internet site would like to keep updated.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

I am commenting to make you be aware of what a excellent encounter my wife’s child undergone viewing your site. She noticed such a lot of details, with the inclusion of what it’s like to possess an excellent teaching spirit to get the others clearly fully grasp several multifaceted issues. You actually did more than her expectations. I appreciate you for rendering those priceless, healthy, educational and even cool guidance on that topic to Janet.

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

Some truly nice stuff on this website , I like it.

We absolutely love your blog and find most of your post’s to be exactly what I’m looking for. Would you offer guest writers to write content available for you? I wouldn’t mind composing a post or elaborating on a lot of the subjects you write regarding here. Again, awesome weblog!

Click News Testing – Bohot balanced reporting aur updated information milti hai.

findhappinessdaily – Uplifting messages and helpful tips that brighten my day instantly.

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Dadasdas Click News – Updated topics ko simple aur engaging style mein cover karta hai.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Explore & Grow – Valuable suggestions that make spotting opportunities feel easy and motivating.

Would you be taken with exchanging links?

Innovation Hub Daily – Tools and ideas for exploring creativity and making things happen.

Mindful Growth Hub – Daily inspiration for personal development and intentional living.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Style & Trend Spot – Find fashionable outfits and accessories to refresh your style.

Motivational Insights – Tips and ideas to stay motivated and focused every day.

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Trendy Picks Daily – Handpicked products for a seamless and convenient shopping experience.

Trendy Lifestyle Spot – Handpicked fashion and lifestyle items for modern living.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

My brother suggested I might like this website. He was entirely right. This post truly made my day. You cann’t imagine simply how much time I had spent for this information! Thanks!

Best Budget Buys – Discover quality products at prices that are easy on your wallet.

Trendy Selection Hub – Explore new and stylish products with a smooth browsing experience.

dealspotmarket – Shopping was easy and prices were very fair.

Urban style collection – Several attractive finds popped up immediately, navigation effortless.

valueemporium – Affordable options everywhere, the shopping process was easy.

Top fashion picks – Several eye-catching items popped up instantly, browsing enjoyable.

dailybrightfinds – Loved browsing through their selection, order process was simple.

happygiftshop – Impressive gift range, finding items was simple and quick.

Quick fashion finds – A handful of crisp items appeared right away, navigation smooth.

chiccorner – Nice selection of outfits, browsing and purchasing was very easy.

brightchoicehub – Easy to shop here, found multiple items I liked.

trendpulsehub – Excellent trendy products, delivery was fast and ordering smooth.

Discover top fashion finds – Found several attractive and trendy items quickly, browsing smooth.

pickhubdaily – Loved the product variety, delivery seemed prompt and smooth.

bestfindsmarket – Smooth browsing experience, placing an order was simple.

fashionpulsehub – Clean layout and very smooth navigation, highly satisfied.

Discover top fashion finds – Found several attractive and trendy items quickly, browsing smooth.

smartchoicehub – Loved the selection today, prices seem good and site navigation was easy.

homecornerzone – Smooth site layout, fast loading pages, and easy shopping experience.

Growth Mindset Daily – Daily resources for building habits, skills, and personal achievement.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

happygiftshub – Loved the unique gifts, pricing is excellent and quality is top-notch.

Quick fashion finds – A handful of crisp items appeared right away, navigation smooth.

trendzone – Great selection of city styles, navigating the site was effortless.

topfindshop – Pleasant browsing and fast checkout, found everything I needed.

cheerhubcorner – Great discounts and easy shopping, very satisfied.

Urban trend finds – Several standout options appeared right away, browsing easy.

modernfashionfinds – Smooth site layout, fast loading pages, and enjoyable shopping experience.

brightchoicehub – Items were fantastic, customer service was friendly and reliable.

Browse trendy picks – Quickly found multiple appealing items, navigation simple.

fashionhubdaily – Great assortment today, browsing and checkout were seamless.

trendshopzone – Quick navigation, found several items I wanted.

stylefinderhub – Fast delivery and great selection, loved the fashionable items.

Urban style collection – Several attractive finds popped up immediately, navigation effortless.

dailyglam – Great fashion selection, website felt responsive and easy to navigate.

Daily Urban Trends – Find stylish items and effortlessly upgrade your wardrobe today.

styleemporiumhub – Found the perfect items, navigation is smooth and effortless.

trendhunterstyle – Pleasant experience, pages loaded fast and navigation was simple.

Top urban picks – Quickly spotted multiple appealing pieces, smooth scrolling experience.

stylefinder – Found trendy picks effortlessly, site navigation was quick.

fashionpulseonline – Found exactly what I needed, browsing was effortless.

Quick fashion finds – A handful of crisp items appeared right away, navigation smooth.

giftfinderhub – Excellent presents available, shipping appears reliable and smooth.

familyfashionchoice – Great deals and easy navigation made shopping enjoyable.

Flourish & Grow Hub – Practical tips and inspiration to support your daily personal growth.

shopvaultbig – Great bargains and smooth shopping, very convenient experience.

fashionvault – Loved the trendy selection, browsing through items felt smooth and fast.

urbanchoicehub – Smooth browsing and user-friendly design, products were easy to locate.

SoftStone Hub – Nice collection, easy-to-use site, and delivery arrived quickly.

styleupdatehub – Great variety of seasonal items, navigating the website was smooth.

Dream & Achieve Daily – Daily inspiration for setting targets and taking consistent action.

stylezone – Loved checking out products, navigation was smooth and hassle-free.

hunterbuyinghub – Pleasant experience, pages loaded quickly and navigation was simple.

simpletrendstore – Great collection of fashion pieces, site navigation was smooth and fast.

urbanstylehub – Loved exploring the site, very fast and easy checkout.

Dream & Achieve Daily – Daily inspiration for setting targets and taking consistent action.

Soft Cloud Trends – Well-structured layout with a simple, enjoyable browsing experience.

WildSand Essentials – Clean layout, intuitive browsing, and very fast delivery.

Lunar Harvest Corner Picks – Items are easy to locate and the layout is visually appealing.

fashioncornerdeals – Great variety and quick checkout made shopping enjoyable.

Bright Flora Spot – Shopping is convenient, and the display is clear and tidy.

timelessharbormart – Easy-to-browse layout with visually appealing merchandise.

trendvaulturban – Loved today’s items, pricing is excellent and very affordable.

urbanpickshub – Loved exploring fashionable pieces, site navigation felt quick and convenient.

FreshWind Corner – Easy to browse, sharp product details, and a pleasant experience overall.

Innovation & Creativity Spot – Resources to help you explore new hobbies and projects.

Modern Harbor Shop – Items load fast, and the layout is clean and organized.

Full Circle Hub – Finding products is easy and the design feels polished.

uniquebuypicks – Great variety, shopping was enjoyable and hassle-free.

fashionflarehub – Trendy items are amazing, website experience is smooth and fast.

bestofferhub – Excellent bargains throughout, navigating the pages was quick and easy.

BrightWind Finds – Everything was simple to navigate and my purchase arrived sooner than expected.

Timber Grove Hub – Everything loads fast, and navigating the site is smooth.

dailydealshub – Easy to find what I needed, shopping was seamless and smooth.

trendfusionstore – Items arrived fast and the process was hassle-free.

Calm Harbor Market – Quick to find items with a visually pleasant interface.

chiccorner – Really liked the outfits available, browsing and checkout were effortless.

Silver Moon Corner – Loved the products, intuitive website, and very fast delivery today.

dailyzen – Navigation is smooth, items loaded fast and easy to find.

Modern Ridge Finds – Navigation is easy, and exploring items feels effortless.

trendspotcorner – Loved finding stylish products, shipping was fast and hassle-free.

valuebrightstore – Pleasant experience, pages loaded quickly and checkout was simple.

Daily Intent Hub – Guidance for setting goals and advancing with clarity and purpose.

Timberwood Finds – Browsing was smooth and I quickly located everything I wanted.

66b app sở hữu kho game phong phú với hơn 500 trò chơi được phát triển bởi các nhà cung cấp hàng đầu như Evolution Gaming, Microgaming và NetEnt. Điều này đảm bảo chất lượng đồ họa sắc nét và trải nghiệm chơi game mượt mà trên mọi thiết bị.

Meadow Market Finds – Loved how simple the process was and the order arrived exactly on schedule.

Aurora Deals – The selection is vibrant and easy to navigate.

modernfindstore – Nice items and very smooth website navigation.

glamspot – Smooth browsing experience, everything looks stylish and accessible.

happytrendpicks – Very easy to navigate, ordering was smooth and fast.

fashioncorner – Loved the variety available, shipping seemed fast and consistent.

OriginPeak Select Boutique – Loved the trendy items, easy website experience, and the package arrived on time.

Whispering Trend Emporium – Quick exploration and products are simple to locate.

Open Plains Corner – Shopping is smooth, and items are simple to find.

chictrendshop – Shopping was simple and enjoyable, lots of good picks.

choicehub – Easy to navigate, items appear quickly and clearly.

trendpickhub – Convenient to find stylish pieces, checkout was smooth.

offerscorner – Loved the variety of deals, website navigation was quick and easy.

Soft Blossom Emporium – Easy-to-navigate website, beautiful products, and a hassle-free ordering experience.

Fashion Essentials Daily – Practical, stylish selections to keep your wardrobe fresh.

Coastline Choice Online – Navigation is simple, and the products are easy to explore.

dailysavingshub – Loved today’s deals, items arrived quickly and in perfect shape.

Sunwave Essentials Studio – Navigation is effortless and exploring items is straightforward.

myhomechoice – Loved scrolling through the items, very responsive site.

fashionhunterhub – Pleasant experience, pages loaded fast and navigation was simple.

glamcornerhub – Navigation is quick, items load fast and look attractive.

NR Boutique – Loved the modern styles and the checkout process was effortless.

Kind Groove Trends – The store feels organized and browsing through items is enjoyable.

Grow Your Potential – Helpful guidance to unlock your inner potential and confidence.

Blue Grain Finds Store – Locating items was fast and the website made shopping easy.

giftcentralhub – Loved the variety of gifts, navigating the site was simple.

glamhubzone – Simple navigation and the products are easy to explore.

KindleWood Deals – Smooth browsing, affordable items, and fast shipping today.

Dream Harbor Mart – The layout is clean, and finding products is quick.

choicefavhub – Smooth browsing and user-friendly design, products were simple to find.

WildHorizon Trend Store – Lovely items, clean website, and my order processed quickly without issues.

globalshophub – Intuitive layout, items are well presented and easy to explore.

Bridgetown Finds Online – Navigation is quick, and items are well showcased.

shoppinghub247 – Quick loading pages and a really smooth shopping journey.

Grand Style Choice – Products are simple to explore and the site feels organized.

staycurioushub – Clean layout with fast-loading pages made navigating items simple.

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Daily Style Market – Discover trendy products organized for easy browsing and selection.

Future Groove Online – Items load fast, and navigation is smooth and easy.

Morning Rust Picks – Products are easy to locate and the site feels user-friendly.

stayhubselection – Layout is tidy, products are easy to locate, and browsing felt natural.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Urban Peak Choice – The layout is tidy and products are easy to explore.

Stylish Choices Hub – Quick access to fashionable items that elevate your everyday look.

EverPath Deals – Shopping is fast and the interface looks neat and organized.

staymotivatedhub – Clean design with fast-loading pages made shopping smooth.

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Dawncrest Choice – Shopping is smooth, and products are clearly presented.

Lunar Wave Select – Quick exploration of items with a smooth interface.

urbanpick – Smooth browsing, intuitive interface, and items are clearly presented.

Starlit Style Deals – Everything loads fast, and items are easy to browse.

Affordable Choices – Smart product suggestions to save time and money while shopping.

Timberline Essentials – Browsing feels natural with a neat and organized design.

urbanselection – Easy to navigate, items are organized and simple to locate.

FutureGardenFinds – User-friendly menus and simple pages made browsing items stress-free.

featured store – Had a smooth time scrolling through; products were easy to locate.

shop horizon hub – Clean layout and tidy presentation made finding items effortless.

horizon picks – Neatly arranged items and smooth interface made browsing effortless.

birchcornerstore – Products are logically arranged, making exploration simple.

Daily Fashion Hub – Explore popular categories with ease and enjoy a fun browsing experience.

timberlineatticcenter – Easy-to-use interface, perfect for experimenting and finding inspiration.

WildBranchMarket – Very easy to navigate, products are displayed clearly and attractively.

Wonder Peak Hub Picks – Smooth navigation with a visually organized layout.

Sun Meadow Treasures Online – The layout is neat, allowing smooth browsing and fast discovery of items.

shoppingcorner – Pages load fast, and finding products is quick and simple.

CTO Cozy Finds – The site operates smoothly, making it easy to check out items without any difficulty.

goldencrestore – Well-laid-out interface, finding products was quick and easy.

trend finder – Quickly located what I wanted due to the smooth structure of the site.

new horizon corner – Fast-loading pages and tidy layout enhanced the experience.

tallbirchmarket – Pleasant layout, items are easy to find and browse.

horizon hub – Items loaded quickly and categories were easy to explore.

BlueStone Finds – Loved how easy it was to browse and locate products.

Nhà cái cá cược đăng nhập 66b chính thức ra mắt vào năm 2019 và bằng sự nỗ lực của mình đã nhanh chóng ghi dấu ấn trong lĩnh vực giải trí online. Tuy còn gặp nhiều thử thách trong thời gian đầu thành lập, nhưng thương hiệu vẫn thành công chứng minh tầm quan trọng của mình trong mắt người dùng. Đến nay, đơn vị đã ghi nhận hàng triệu lượt đăng ký mới mỗi ngày và con số vẫn không ngừng tăng lên chóng mặt.

Nhà cái cá cược đăng nhập 66b chính thức ra mắt vào năm 2019 và bằng sự nỗ lực của mình đã nhanh chóng ghi dấu ấn trong lĩnh vực giải trí online. Tuy còn gặp nhiều thử thách trong thời gian đầu thành lập, nhưng thương hiệu vẫn thành công chứng minh tầm quan trọng của mình trong mắt người dùng. Đến nay, đơn vị đã ghi nhận hàng triệu lượt đăng ký mới mỗi ngày và con số vẫn không ngừng tăng lên chóng mặt.

everymomenthub – Pages load fast, and finding what I needed was quick.

bright picks hub – The interface was user-friendly and helped me find everything quickly.

urban corner – Clean design and fast-loading pages made browsing enjoyable.

brookhavenstore – Clear design, shopping feels relaxed and organized.

willow hub link – Smooth interface and well-organized products enhanced shopping.

Timber Comfort Shop – The layout flows nicely, making browsing feel effortless and stress-free.

New Grove Online – Clean design and intuitive navigation improved the browsing experience.

Northern Mist Store Shop – Clean layout and well-arranged items made browsing effortless.

goldenstylehub – Organized pages and smooth browsing, picking products was simple.

Sun Meadow Selections – Organized pages and clear menus made shopping simple and efficient.

discover items – Everything felt neatly arranged, which made searching easy.

choice hub – Clear layout and fast-loading items improved product exploration.

a href=”https://growyourmindset.click/” />mindsetselection – Simple layout and fast page loads make finding items easy and enjoyable.

a href=”https://brightnorthboutique.shop/” />brightstylecorner – Navigation is effortless, products are clearly presented.

boutique corner – Tidy pages and clear sections made finding products simple.

Northern Mist Boutique – Smooth navigation and neat product pages made shopping simple.

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

CR Coastal Styles – Products are visually appealing, and the site flow is user-friendly.

Wild Shore Selections – Organized pages and tidy layout made product discovery quick.

Your Success Path – Practical guidance to help you unlock your potential every day.

mountain hub link – Smooth interface and well-organized products improved shopping.

cheap finds – The variety was great for saving money and exploring categories was easy.

Lunar Peak Selection – Browsing is seamless, and items are well presented.

homehubzone – Layout is neat, navigation is effortless, and products are easy to find.

wildpeakcorner – Pleasant layout, finding and browsing products is effortless.

evermeadowgoods – Great selection and intuitive navigation helped me explore products without hassle.

MountainMistStudio Storefront – Tidy pages and clear navigation enhanced the shopping flow.

Bright Timber Finds – Simple interface and good product range made browsing a pleasure.

Mountain Wind Marketplace – Items are clearly displayed, which made browsing straightforward.

shop moon picks – Well-arranged items and clean interface made shopping simple.

SilverBirch Store – The quick access to products and clean interface is a winning combination.

Urban Seed Deals – Easy to browse products and pages load fast.

softrosecollection – Clear interface with organized products, shopping was simple.

Modern Fable Central – Products are easy to browse and the interface is user-friendly.

build hub – The interface is simple and browsing different sections is seamless.

puregreenhaven – Pleasant interface, products are clearly visible and easy to explore.

makeworld – Fast interface, organized products, and intuitive navigation.

sunset store – Well-organized items and intuitive layout improved shopping.

EverRoot Studio – Smooth navigation and attractive items made the experience enjoyable.

BC Finds – Everything was organized, which saved me a lot of time.

golden hub corner – Clean design and clear categories made browsing enjoyable.

GoldenBranchMart Finds – Clean presentation and easy navigation enhanced the overall experience.

Seasonal Hub – Shopping is effortless and everything is well presented.

future hub – The site feels responsive and moving through sections is effortless.

Meadow Fresh Boutique – Finding items is effortless thanks to a simple layout.

goldenrootstore – Very easy to browse, and product images are clear and appealing.

Discover Deals – I appreciated the broad assortment and how simple the site was to use.

Urban Style Hub – Discover trendy urban fashion and explore new looks with ease.

Urban Pasture Outlet – The catalog is clear, and navigation is smooth and intuitive.

modernzone – Navigation is intuitive, and all products are displayed clearly.

BrightStone Market – Well-organized pages helped me pick items without any confusion.

Timber Crest Collection Online – Smooth interface and tidy design made finding items a breeze.

pine picks – Smooth interface and clear product images made shopping pleasant.

rarefashionstorehub – Fast-loading and organized sections, shopping felt smooth.

Evergreen Selection – Navigation is smooth and the products are displayed nicely.

soft marketplace – The interface is tidy and finding products was effortless.

goldenautumnshop – Navigation is straightforward, products are well arranged.

Shop LunarHarvestMart – Items were clearly displayed and the interface felt intuitive.

brightwinterstore – Products look appealing and navigation is smooth — a good shopping experience.

Mindful Growth Daily – Practical resources for building confidence, skills, and inner strength.

Cozy Cabin Corner – Simple, clear, and enjoyable browsing experience.

EverWild Corner – Smooth layout and quick-loading pages made browsing items fast and enjoyable.

Explore Products – The organized categories and fast performance removed all the usual frustration.

smileselectionhub – Smooth navigation, fast-loading interface, and items are clearly displayed.

Silver Moon Corner – Intuitive design helped me find products without any hassle.

shop wild collection – Smooth navigation and neatly displayed products improved browsing.

True Horizon Market Online – Items load quickly, making browsing effortless.

shop here – The clear layout made exploring categories quick and convenient.

sunrisehillemporium – User-friendly interface, shopping flows naturally and easily.

brightwillowboutique – Clean design and easy layout helped me find interesting items fast.

Iron Valley Boutique – Clean interface and visible items made choosing products simple.

Achieve & Inspire Hub – Resources to help you stay focused, motivated, and confident in your pursuits.

Mid River Selection – Clear organization of products kept the experience smooth.

Whitestone Boutique Picks – Items are well displayed and navigation is simple.

rusticridgeboutique – Pleasant browsing experience, items are easy to view and site feels well structured.

Moor Finds – I could navigate through products without any confusion.

valuecentral – Easy to navigate, items are organized well and simple to find.

This Online Store – The ease of use and clear structure provided a truly comfortable shopping trip.

silverstylestore – Fast navigation and organized product listings, shopping was smooth.

shop the crest – Neat layout and intuitive interface helped me find items effortlessly.

hillfashionhub – Clean presentation, products are easy to locate and browse.

100pluscasinoi – now that’s a bold name! Gotta see if their game selection lives up to the hype. Time to find out! Check out 100pluscasinoi

brightfallstudio – Enjoyed browsing here, items seem well curated and easy to explore.

Soft Feather Essentials – Smooth browsing and neatly displayed items made selecting products simple.

shop bright haven – Well-organized categories and clear product images improved browsing.

Silver Moon Corner – Intuitive design helped me find products without any hassle.

PineHill Picks – The site felt minimalistic, and exploring products was a pleasant experience.

Sunny Slope Corner – Quick to locate items and the layout feels friendly.

learncreatehub – Pages load quickly, making exploring products fast and simple.

Visit EverduneGoods – I liked how natural the navigation felt while exploring different items.

SoftMorning Finds – A stress-free shopping journey from start to finish, with beautiful product imagery.

corner shop access – The clean overview helped me navigate comfortably and spot items easily.

forestcalmemporium – Items are well presented, browsing feels effortless.

winter picks – Smooth interface and neatly displayed products made browsing enjoyable.

DeepBrook Collection – Smooth navigation and well-laid-out pages made choosing items effortless.

wild hub – Items loaded quickly and sections were easy to navigate.

Moon Haven Hub – Clear structure and smooth navigation made shopping very easy.

herbmarketonline – Very clear layout, browsing items was effortless.

Timeless Harvest Essentials – Neatly presented items and a clean layout made browsing effortless.

shop wave – Clean layout and responsive pages made finding items simple.

coastalmistshop – Smooth browsing and a clear layout made finding items effortless.

harvest picks – The site feels professional and organized, making browsing effortless.

Vibe Online – Products are easy to find and the navigation feels natural.

LifestyleBuzzHub – Articles are fresh and exciting, loved exploring the site.

Everfield Home Store – The items are presented cleanly, and moving through the site was quick and hassle-free.

TrendyChoiceStore – Loved how easy it was to find stylish items, truly a pleasant experience.

Wild Coast Goods – Intuitive layout and clear visuals helped me find items quickly.

SunCrestCrafthouse Goods – Clean layout and organized sections improved the shopping flow.

moon hub link – Smooth browsing and organized products enhanced the experience.

Bright Picks – Finding items was fast thanks to the intuitive design.

lunarforestlane – Interface is clean, browsing through products is smooth.

emporium hub – Smooth scrolling and well-arranged categories improved browsing.

everpeakcorner – Clean interface and clear product display helped make browsing smooth and easy.

harvest hub store – Loved the professional feel and smooth flow while exploring the site.

Rustic River Page – Fast pages and inviting graphics created a relaxed browsing atmosphere.

Soft Leaf Picks – Well-arranged pages and user-friendly design helped me shop comfortably.

FashionSelectOnline – Stylish pieces with a smooth shopping process, really enjoyable today.

TrendyLifeWorld – Engaging content and fresh ideas, browsing was enjoyable.

Starlight Forest Deals – You can tell a lot of thought went into making the customer journey intuitive.

harbor hub – Items loaded quickly and the layout is easy to follow.

Lush Meadow Art – Very easy to navigate, and the items were beautifully displayed.

meadowcollectionstore – Smooth navigation and neatly arranged products, shopping felt pleasant.

Shop TallPineEmporium – Products were well displayed, making browsing straightforward.

urbanclovercorner – Clean design, shopping feels effortless and pleasant.

brightvillagecorner – Items look appealing and layout feels user-friendly and welcoming overall.

urban access – Items were easy to locate and the interface felt friendly.

fresh trend picks – Enjoyed how easy it was to move through categories; the items looked thoughtfully arranged.

Fresh Pine Crafts – Easy-to-use interface with visible products allowed smooth browsing.

Soft Blossom Picks – Browsing felt calm and organized, thanks to the soft design and clean layout.

sunlit boutique access – Browsing felt natural and product sections were easy to navigate.

EasyChoiceHub – Smooth browsing and fast checkout, I’ll shop here again.

Home Picks – The site’s simple navigation helped me discover products quickly.

Explore The Range – The smart layout and broad assortment make looking for products simple and fast.

LivingTrendsMarket – Loved the variety of products, very smooth and enjoyable shopping.

shop stone gallery – Smooth interface and clean design made finding items simple.

wildleafcorner – Clean layout, shopping feels effortless and enjoyable.

product corner – Easy to look through categories and items appeared instantly.

shop now – Pages appeared instantly and the organized layout made checking items stress-free.

Lush Grove Corner Shop – Smooth navigation and clear product display made finding items easy.

BrightGrove Online – Browsing felt effortless thanks to the clean design choices.

soft picks – Clean interface and organized sections made shopping pleasant.

MoonView Designs Site – Modern aesthetic and organized product display made browsing enjoyable.

Wild Ridge Marketplace Online – Logical design and well-structured menus made browsing smooth.

ClearChoiceStore – Navigation is intuitive and products are easy to find.

groveoutlet – Fast loading and clear product display, shopping was very easy.

shop cloud hub – Intuitive navigation and neatly displayed items made shopping enjoyable.

wavecornerlane – Items are well arranged, shopping feels fast and pleasant.

Savanna Selection Store – Items were well laid out, making the overall browsing experience comfortable.

harbor selection – Fast-loading pages and neat layout made exploring effortless.

this cool site – Really liked how straightforward it was to navigate, everything was placed neatly.

Coastline Haven – The site is tidy, making it simple to browse items without confusion.

shop harbor hub – Browsing felt natural and products were easy to explore.

Mountain Sage Goods – Well-arranged pages allowed me to find products without any trouble.

EverForest Marketplace – The product range was appealing, and the interface loaded quickly overall.

SelfGrowthJourney – Interesting insights that keep you curious and learning.

stream hub link – Smooth interface and well-organized products enhanced browsing.

stonecornercollective – Clear design, shopping feels smooth and relaxed.

EverCrestWoods Online Shop – Nicely structured sections kept the browsing experience relaxed.

shop hub – Neat product images and simple navigation improved the shopping flow.

season selections – The site feels light and well-arranged, making the whole browsing experience enjoyable.

Wild Meadow Treasures – Intuitive design and visible product images made selection effortless.

Shop With Speed – The logical flow and instant loading made my visit both quick and productive.

ShopTrendyGlobal – Easy ordering today, really satisfied with the offers.

shop pine gallery – Clear interface and smooth scrolling made shopping effortless.

Silver Maple Picks Online – Well-laid-out pages made product discovery simple and enjoyable.

Autumn Mist Portal – The page had a soothing layout, with product details that were clear and user-friendly.

wave hub link – Smooth interface and organized products improved browsing.

HappyShoppingZone – Great bargains and top-quality items, extremely satisfied.

harborboutiquehub – Clear layout and smooth navigation made browsing effortless.

leafsoftmarket – Products are neatly categorized, making shopping easy.

ridge market – Well-organized layout and responsive pages made shopping easy.

fresh creations – Smooth navigation paired with nicely presented items made the site enjoyable to explore.

Lunar Wood Creations – Smooth navigation and fast-loading pages made selecting items easy.

moon boutique corner – Fast-loading pages and tidy categories improved browsing.

Shop DreamHavenOutlet – The site looked neat and made scrolling through options fast.

TrendLoversSpot – Cleanly organized products and effortless page navigation.

BeyondPotential – Inspiring and actionable, great for anyone wanting to improve and grow.

field store – Well-arranged items and simple layout made exploring easy.

brightoakhub – Clear design, products are well categorized and simple to explore.

EverHollow Bazaar Store – The site flowed nicely, and the category structure felt clear from the start.

global forest shop – The site layout is clear and navigation feels effortless.

shop choices – Fast, clean, and visually appealing, which made browsing relaxing.

wildgroveemporium – Items are well arranged and navigation feels intuitive — nice overall experience.

future grove hub – Clean layout and well-organized categories made shopping enjoyable.

Urban Choice – Finding products was effortless thanks to an organized display.

DealLookoutZone – Offers were arranged in a clear format, making comparisons quick and easy.

GrowWithPurpose – Clear instructions and very motivating advice for achieving goals.

a href=”https://pureforeststudio.shop/” />forestcornerstore – Well-organized interface and easy navigation, made browsing enjoyable.

leafcorneremporium – Pleasant layout, items are easy to explore.

Lunar Branch Collection – Smooth interface and clear design made shopping comfortable.

Visit EverWillow Crafts – The store has a charming look and moving between categories was effortless.

highland goods – Pages were easy to navigate and items looked appealing.

BrightPetal Emporium – Easy navigation and organized pages helped me browse efficiently.

stone picks hub – Fast-loading pages and organized layout made shopping effortless.

wind picks – Neatly arranged items and smooth interface made browsing effortless.

Vine Treasures Online – Pleasant experience thanks to clear menus and well-laid-out pages.

Motivation Route – Enjoyed the insights shared; everything seemed thoughtfully arranged.

deltaweaveemporium – Products are easy to find, and the interface is comfortable to use.

FashionDealVibe – Stylish options presented neatly, and navigating the site felt very enjoyable.

WisdomCorner – Very engaging content, guides are easy to follow and informative.

Soft Forest Fabrics Shop – Easy navigation and neat product layout made browsing simple.

MoonGrove Gallery Shop – The site looked very polished, and navigating through pages was quick and smooth.

Ever Maple Crafts Essentials – The layout felt intuitive and made exploring products straightforward.

Wild Spire Shop – Smooth interface and organized items allowed me to find products quickly.

Life Direction Guide – The page felt comfortable to explore and offered uplifting thoughts.

willowlaneemporium – Fast-loading pages with tidy product sections, browsing felt quick.

BrightLineCrafted Store – The website’s clean design made shopping really straightforward.

Trendy Style Hub – Nice flow to the site and a solid lineup of modern looks available.

PurposeSeeker – Found very motivating articles, navigating the site was effortless.

BudgetFinderHub – Nice selection and site layout makes navigation easy.

ModernLookWorld – Loved the trendy pieces, smooth ordering process and great quality.

YourTrendyHub – Lots of stylish items, smooth layout and easy-to-follow navigation.

I have been examinating out a few of your posts and i must say clever stuff. I will definitely bookmark your website.

Silver Hollow Finds – Clear, elegant design with products neatly displayed and easy to read.

Moonglade Finds Online – Simple layout and clear presentation made browsing quick.

GiftFind Station – The interface felt clean and made browsing feel relaxed.

Explore PineCrestModern – Clean interface and organized displays improved browsing efficiency.

BrightPeak Boutique – The site is very intuitive and images are clear, which made selection fast.

Urban Outfit Deals – Clean layout with a straightforward checkout that worked without issues.

OpportunityQuest – The website showcases products nicely and loads fast.

ModernTrendsHub – Good selection of items, browsing felt easy and intuitive.

ModernDecorHub – Beautiful items and easy browsing, made decorating my home effortless.

Golden Ridge Browse – Pages loaded fast, and the browsing flow felt calm and easy to follow.

LearnMoreToday – Plenty of learning content, and exploring the pages felt effortless.

Gold Shore Attic Finds – Easy to navigate, and I quickly found interesting items.

Path to Growth – The ideas were motivating and navigating through the pages was effortless.

trueautumncollection – Tidy pages and organized listings, browsing was quick and pleasant.

StyleChoice Hub – Quick navigation and stylish pieces made browsing very comfortable.

TrendBuyers – Great mix of products, pages load quickly and browsing is effortless.

ChicLifestyleHub – Loved the selection, browsing experience felt fast and comfortable.

ModernInterior Picks – Everything looked polished, and browsing through categories was effortless.

Sunlit Valley Essentials – Intuitive layout and clear sections made exploring easy.

Soft Pine Collection Online – Smooth interface and clear categories made finding items a breeze.

Soft Summer Collections – The light, calming theme made finding products simple and enjoyable.

KnowledgeDailyOnline – The articles were well-written, and navigating the site was quick and easy.

StyleLoversHub – The items are displayed beautifully, and moving through the site was effortless.

Adventure Finds Hub – Great vibe, smooth experience, and plenty of appealing items.

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

TrendyTreasureHub – Great assortment, site runs quickly and navigation is smooth.

Modern Trend Gallery – Everything looked orderly, and flipping through categories was smooth.

DailyShopCorner – Clean and tidy design, easy to move through pages.

noblebuilds – Clear navigation and well-presented products, browsing was easy and fun.

a href=”https://evertrueharbor.shop/” />EverTrue Harbor Site – The clarity of the layout made checking out each section enjoyable and effortless.

Bright Pine Fields Hub – The clean arrangement made scrolling through categories simple.

NewValueHub – Easy to browse with fast loading times.

Urban Trend Shelf – Easy to explore and full of appealing modern styles.

ModernUrbanShop – Items are appealing, site navigation feels intuitive.

MoreInsightsDaily – Information was easy to digest and moving through the site felt seamless.

Trendy Goods Shop – Nicely organized with a calm, easy movement through the shopping pages.

ShopDailyDeals – Great selection of everyday items, very easy to navigate.

DiscoverChic – Stylish products with a comfortable browsing experience overall.

Urban Wild Grove Online Shop – Well-organized pages and modern design ensured smooth browsing.

Daily Home Deals – Browsing was simple and the catalog had some appealing finds.

TrendFinderShop – Wide selection of products and the site feels user-friendly.

ChoiceStyle Picks – A fresh layout with simple page transitions made checking products enjoyable.

Bright Mountain Shopping – Everything loaded quickly, giving a comfortable shopping flow.

FreshIdeasOnline – Interesting insights and the layout was clear and simple to use.

sunbayboutique – Well-structured pages, made finding items quick and easy.

FashionOutletSpot – Loved exploring the collections, site runs smoothly and looks neat.

PersonalGrowthVault – Inspiring reads and moving through pages was effortless.

Budget Choice Outlet – The entire catalog displayed quickly, making shopping straightforward.

Quiet Plains Outlet – A soft, minimal design that made looking through the catalog effortless.

DailyShopFinds – Easy-to-browse structure, items easy to locate.

Blue Harbor Bloom Picks – Quick load times paired with a tidy layout made the experience smooth.

TrendSpotMarket – Great user experience with well-organized product listings.

Pure Harbor Essentials – The tidy layout and simple interface improved the shopping experience.

SmartValueShop – Found good bargains, browsing the website feels natural.

Trendy Outfit Store – Great mix of fashion picks and a neat website layout made it easy to browse.

Rainforest Deals Hub – Nice selection overall, and navigating the categories felt natural.

Trend Buy Hub Shop – Great modern layout, finding products was easy and smooth.

TrendDiscoverer – Clean visuals, browsing feels fluid and enjoyable.

SimpleHomeSpot – Products are appealing and navigating the website felt natural.

wildorchardstyle – Fast-loading pages and tidy layout, browsing was pleasant.

TrendyEssentials – Fast shipping, chic items, the shopping process was very simple.

Fashion Style Hub – Found some great items, and the pages opened instantly without any delays.

TAB Hub Online – Great selection, site responded quickly and navigation felt easy.

Rainy City Deals – Appreciated the neat design and the easy access to all product sections.

SoftGroveCorner Storefront – The interface was neat, allowing comfortable and fast navigation.

Silver Garden Essentials – Navigation felt intuitive, and the experience was smooth from start to finish.

PositivePowerHub – Pleasant interface, clear pages, and uplifting content throughout.

CozyLivingSpot – The site showcases items well, and moving between pages was easy.

Trendy Picks Market – The website felt organized and the product lineup stood out nicely.

Fresh Daily Market – Everything looks well-structured and browsing through the items is simple.

SmartChoiceSpot – Excellent options and very easy to navigate, found everything I wanted.

Trend & Buy Picks – Nice display of items, navigation was clear and simple.

Rare Flora Market – Loved the charming plant-themed items, and navigating the site felt calming.

Timber Path Portal – Clean design and intuitive category placement made navigating smooth.

v

FreshDiscoveries – User-friendly design, smooth browsing experience, and easy-to-find items.

Trend & Style Picks – Nice mix of trendy products, browsing felt fast and enjoyable.

Line Choice Store – The finds looked unique, and exploring the site was comfortable.

Pure Harbor Online – The well-laid-out interface made checking items effortless and enjoyable.

PlainsMarketplace – Smooth browsing and fast checkout, will shop here again.

FreshLook Finds – Items appear neat and well-arranged, and navigation feels intuitive.

ExploreOpportunities Picks – Smooth browsing with well-structured categories and clear visuals.

TrendVault – Quick navigation and trendy items clearly presented for effortless browsing.

EverNova Emporium Store – The visuals really stood out, and moving through the site was smooth and well-structured.

TCC Trend Corner – Nice assortment of products, navigation felt very smooth and simple.

RiverLeaf Essentials – Pleasant visuals and smooth navigation made checking items enjoyable.

WorldOfGifts – Clear structure, smooth browsing, and enjoyable shopping experience.

TropicalChoiceCorner – Great layout and diverse products, made exploring the site enjoyable.

ExploreOpportunities Picks – Smooth browsing with well-structured categories and clear visuals.

Simple Style Spot – A tidy design and smooth browsing make exploring easy.

dailyoutlet – Loved how simple it was to check out, the site is neat.

StyleFinder – Products are attractive and navigating through the site feels natural.

TCS Picks Online – Nicely organized items, navigation felt fast and easy.

Decor Choice Store – Smooth page transitions and a refreshing set of home décor options.

StylishLivingCenter – Clear layout, attractive items, and effortless browsing.

RainyGoodsHub – Quick checkout and effortless navigation, I’ll shop here again.

BuyStyle Collective – Everything loaded in a snap, making it easy to look through the trendy items.

UrbanStyleHub – Trendy urban products clearly displayed and browsing feels effortless.

TDP Deal Picks – Great mix of deals, moving around the site was effortless.

Decor Essentials Shop – Pleasant browsing experience with neatly arranged home items.

Always Motivated Spot – Pages feel inviting, with a smooth layout and inspiring content.

TrailSunrise Lane – Tidy pages and organized sections enhance the overall shopping flow.

FuturePath Picks Hub – Modern interface with clearly arranged items improves usability.

Growth Explorer Hub – Well-organized sections and smooth transitions make it enjoyable to browse.

FashionLovers Online – Navigation felt effortless and the display of items was clean and appealing.

UrbanLumina – Clean layout, smooth navigation, and curated items enhance browsing.

peakoutlet – Clear structure with well-presented products, browsing was smooth.

GiftIdeasHub – Wide range of creative gifts, smooth browsing, and easy navigation.

TFC Style Picks – Trendy fashion items arranged nicely, moving around the site was simple.

Urban Style Hub – Sleek urban fashion items with fast-loading pages and smooth navigation.

Limitless Growth Insights – Content feels relevant and browsing between sections was effortless.

FuturePath Studio – Well-laid-out pages and clear product arrangement make shopping easy.

UrbanFinds – Smooth navigation and well-organized products make browsing enjoyable.

New Value Deals – Easy to browse with solid item choices and a dependable overall feel.

BrookCoastalStorefront – Products are showcased neatly, and the site structure makes it easy to move around.

Trend For Life Picks – Nice layout with attractive content, navigation felt natural and quick.

Grand River Online – River-themed finds arranged beautifully, navigation flows naturally.

DealsHubOnline – Clear structure, effortless navigation, and enjoyable shopping experience.

Sunrise Trail Online – Well-structured layouts and organized product sections provide a smooth experience.

New Horizons Hub – Browsing was smooth and the insights shared were very helpful.

CrestStyleVault – Modern, clean site layout with trendy items easy to explore.

Modern Looks Hub – Loved the fresh visuals and how efficiently each section opened.

City Fashion Hub – Sleek layout with attractive urban pieces and smooth transitions.

GlobalRidge Corner Hub – Clearly presented items and intuitive navigation create a pleasant experience.

dailybrightshop – Smooth navigation, I found what I wanted without any hassle.

Trend Market Picks Hub – Well-organized selection, moving around the site was easy and smooth.

Grand River Collection – Attractive items showcased clearly, making exploration enjoyable.

Color Mea Picks Hub – Creative products displayed nicely, giving an intuitive and smooth browsing experience.

ChoiceSelectHub – Modern layout, excellent product display, and smooth site flow.

RusticSpotlight – Well-structured pages with charming items make navigation effortless.

Fresh Outlet Fashion – Clean display of new styles, and the site moved quickly while browsing.

WildFuture Online – Clean, contemporary design paired with easy-to-use page flow improves browsing.

Trendy Collection Hub Online – Modern layout with clear product display, browsing was simple.

Hidden Valley Collection – Attractive items displayed clearly, making discovery enjoyable.

Daily Motivation Finds – Clean layout with uplifting content ensures effortless navigation.

Adventure Explorer Hub – Pleasant navigation and visually engaging adventurous design throughout.

CLaneOutlet – Great selection of bargain items, navigation feels effortless and the site runs smoothly.

PeakBlooms – Smooth navigation with charming products displayed clearly.

PureFashionSpot – Neat design, user-friendly navigation, and trendy item selection.

Fresh Deals Outlet – Good value-focused options and a clean, stable interface.

Trendy Purchase Hub Online – Great product variety, browsing between pages was easy.

goldenartcorner – Smooth browsing and well-arranged products, I found everything effortlessly.

Highland Craft Shop – Attractive craft items, navigation feels simple and intuitive.

Top Bargain Picks – Browsing feels effortless, and the listed deals look well-presented.

Fresh Collection Lane – Well-structured pages and attractive product arrangement enhance usability.

Global Fashion Picks – The platform ran smoothly and the variety of styles made it fun to explore.

CozyCloverPlace – Products look appealing and tidy, making the overall browsing experience pleasantly calm.

NorthernVault – Smooth browsing with a well-arranged product selection throughout.

APS Featured Items – The autumn designs look thoughtfully selected, and the overall browsing is smooth.

Midday Market Select – Tidy layout and well-organized sections make finding products straightforward.

SimpleHome Discover – Well-presented items and comfortable, quick browsing throughout.

corner for shoppers – Items look appealing, site loads quickly and navigation is smooth.

Trendy Sale Picks – Loved the variety of sale items, navigation was simple and intuitive.

SmartDealMarket – Products are well organized, browsing is intuitive, and shopping is convenient.

High Pine Finds Hub – Deals look appealing, browsing feels effortless and fun.

TrendStylePick – Stylish selections displayed neatly, smooth browsing and easy navigation.

Best Value Deals – Offers look organized and appealing, making browsing pleasant and efficient.

Fresh Finds Home – Modern style and tidy product presentation ensure effortless exploration.

DeepValleyBazaar – Great pricing throughout, and the store feels honest and dependable.

APS Designs – Beautifully arranged autumn pieces, and the interface is easy to move through.

Cheerful Living Spot – The site feels positive and user-friendly, with smooth page transitions.

corner store picks – Selections look neat, navigating feels fast and effortless today.

Simple Living Hub – Clean and calm layout with easy navigation and enjoyable browsing.

UGC Online Store – Smooth interface and appealing items, exploring the site was easy.

Ironline Market – Solid marketplace with dependable products and fair pricing throughout.

SimpleSaverMarket – Smooth navigation, appealing products, and quick access.

artisanbayhub – Navigation is intuitive and product pages are neat, made browsing easy.

Premium Product Browse – Everything feels cleanly sorted, and checking different sections is seamless.

FashionFresh Lane – Stylish arrangement of products with responsive pages enhances usability.

ValueDeals – Smooth browsing experience with deals clearly highlighted.

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your weblog? My blog site is in the very same niche as yours and my users would really benefit from some of the information you present here. Please let me know if this okay with you. Many thanks!

your curated picks – Nicely curated options that open fast and offer a seamless experience.

Fresh Season Corner – Seasonal products arranged neatly with smooth navigation and quick load times.

reliable DFH shop – Happy with the browsing experience; everything seems stable and well-managed.

UGC Shop Online – Well-organized gift collection, moving around the site felt smooth.

TrendAndStyle Hub Online – Fast page loads and neat presentation of trendy collections.

Iron Root Shop – Items displayed clearly, exploring the store is quick and pleasant.

growth inspiration corner – Products are thoughtfully arranged, browsing feels easy and pleasant.

daily power picks – Selection seems uplifting, site layout feels clean and easy.

Happy Finds Outlet – Affordable products displayed neatly with a smooth user experience.

Shop Everyday Outlet – Lots of appealing options available, and exploring categories is simple.

PromoFinds – Site loads quickly, and discovering discounts felt simple.

FashionWorld Online Hub – Pages opened instantly, and the modern styling made it enjoyable to explore.

Fresh Trend Corner Hub – Well-structured pages with clearly displayed items create a natural browsing experience.

daily inspiration hub – Selections are neatly displayed, navigating the site feels effortless.

Majestic Grover Online Store – Items look appealing, browsing feels natural and effortless.

fashion hub store – Selections look stylish, site layout feels clean and easy to use.

Wild Rose Collection Online – Lovely atmosphere with a few delightful discoveries along the way.

grove hub online – Scrolling feels light and easy, with items that carry a subtle creative charm.

GlobalCrest Lane – Clean visuals and well-structured content make navigating the site simple.

GiftCornerOnline – Modern interface, easy-to-use layout, and enjoyable browsing experience.

Everyday Trend Zone – Lots of stylish finds here, and moving through sections is effortless.

BetterDealsNow – Very smooth navigation, and items are showcased clearly.

Fashion Edge Corner – Sleek interface and well-organized products make browsing enjoyable.

WildBrook Modern Collection – Everything feels polished and fresh, made browsing delightful.

Modern Home Picks – Easy navigation with a streamlined layout that made browsing pleasant.

daily explore picks – Products are nicely presented, browsing is effortless and smooth.

MidCity Picks – Appealing selections, navigation feels smooth and convenient.

Wild Rose Hub Online – Cozy boutique vibe, found several enjoyable items while browsing.

home shopping hub – Selections look organized, site experience is smooth and clear.

Global Marketplace Elite – Browsing was simple, everything feels curated and premium.

StartBuilding Now – Inspiring theme with well-arranged pages and effortless navigation.

evercrest items – Interesting pieces throughout, and the store seems to add new ones quite frequently.

ShopDailyDealsHub – Well-structured layout, smooth browsing, and easy-to-find offers.

authenticdailyhub – AuthenticDailyHub features carefully selected items that make shopping enjoyable and easy.

FD Fashion Trends – Trend selections look well-displayed, making the site enjoyable to navigate.

ResourceDepot – User-friendly interface with all helpful information clearly visible.

Sunset Grove Studio – Well-structured pages and warm visuals provide a smooth shopping journey.

Modern Picks Hub – Smooth experience with stylish selections that look appealing.

Wild Rose Collection Online – Lovely atmosphere with a few delightful discoveries along the way.

trendy picks hub – Selections are fresh, browsing is simple and pleasant today.

Midnight Trend Hub – Modern items look impressive, navigating the store is simple and pleasant.

Trend Store Hub – Sleek design and fast performance made exploring modern items simple.

OutletSavingsHub – Simple to browse, great discounts, and items are easy to pick.

Premium World Market – Enjoyed checking out the collection, everything has an international flair.

FocusForward – Streamlined layout, simple interactions, and pleasant browsing.

F&C Styles – The collection looks appealing, and moving through the site is very easy.

Trendy Picks Studio – Modern, clean layout with well-highlighted items for a seamless shopping experience.

Evergreen Selection Spot – Browsing feels light and intuitive, with well-presented evergreen products.

GoalGuide – Content is well organized, and finding inspiration is effortless.

WildRose Finds Online – Boutique has a warm and charming vibe, browsing was enjoyable.

modern fashion corner – Items look stylish, site feels easy to navigate and pleasant.

MidRiver Collection Spot – Well-organized products showcased neatly, navigation is fast and intuitive.

BrightTrendOutlet – User-friendly, stylish products, pages load quickly for shoppers.

Hot Trend Styles – Loved how quickly everything loaded and the items looked fresh.

FieldStore Online – Clear presentation and tidy design help visitors find products efficiently.

Conscious Finds Hub – Clean and organized layout with thoughtfully curated items.

Urban Style Market – Trendy items look great, and navigating the site is smooth and intuitive.

NatureChoiceHub – Modern layout, clear navigation, and inviting eco-friendly products.

naturallyselectedhub – NaturallySelectedHub delivers authentic, well-made items that make exploring fun.

LifeJourney – Layout is clean, content motivating, and browsing feels effortless.

WildBrook Modern Studio – Loved the fresh and modern vibe, browsing felt smooth and enjoyable.

Everline Picks Hub – Well-presented selections with intuitive navigation that makes shopping easy.

WildWood Studio Hub – Organized product sections, attractive layout, and pleasant user experience.

gift ideas collection – A broad collection of ideas arranged thoughtfully, making browsing pleasant.

Wild Rose Online – Pleasant layout and inviting atmosphere, discovered several nice items.

Modern Roots Collection Spot – Freshly curated products, navigation feels smooth and convenient.

StyleSpotShop – Attractive selections, easy to explore, and pages load quickly.

ChoiceStyle Corner – Quick-loading layout with an inviting feel that made browsing enjoyable.

Conscious Home Collective – Browsing was smooth, items are aesthetically pleasing and responsibly made.

FashionChoice – Easy to browse and the stylish items are well organized on every page.

Urban Designs Lane – Modern style and neatly arranged items make browsing pleasant and fast.

Shop The Finds – Diverse product lineup with easy navigation and a cheerful design.

Everwild Collection – Everything is arranged clearly, making it easy to find exactly what you need.

a href=”https://yourlifestylehub.shop/” />lifestyle shop online – Shop displays appealing choices clearly, navigation feels quick and natural.

UniqueGift Finds Hub – Well-structured pages with delightful gift items for smooth browsing.

MoonCrest Collection Spot – Design items arranged neatly, browsing is simple and enjoyable.

Wild Rose Lifestyle – Inviting boutique feel, discovered some delightful products.

GiftHavenShop – Simple browsing, charming products, and user-friendly layout.

Quiet Plains Picks – Relaxed, tidy interface with responsive pages made browsing enjoyable.

Modern Goods Collective – Items appear intentionally chosen, browsing feels effortless and pleasant.

Curated Premium Picks – Thoughtfully arranged products with intuitive navigation and clean layout.

<greenfashioncentral – GreenFashionCentral features thoughtfully chosen, stylish items for a smooth shopping experience.

GiftExplorer – Clear layout with intuitive navigation and beautiful gift options.

fashion picks zone – Items look stylish, navigating the site is simple and enjoyable.

WildBrook Modern Collection – Everything feels polished and fresh, made browsing delightful.

Mindful Uplift Shop – A pleasant, soothing experience supported by quick loading.

WildRose Picks Online – Friendly and inviting feel, discovered a few special pieces.

Mountain Mist Curated – Unique selections look appealing, exploring the store is effortless.

DesignGlow Boutique – Smooth navigation and modern aesthetics give a polished impression.

TrendFinderShop – Clear interface, stylish items, and smooth site flow.

Everwood Supplies Online – Everything works as expected, and navigating the store is simple.

Ethical Curations Hub – Smooth interface with engaging items, made browsing effortless and fun.

Quiet Plains Online – Navigation was intuitive, and the calm layout enhanced the browsing experience.

Unique Gift Lane Studio – Well-laid-out items with fast loading pages and simple navigation enhance usability.

Global High-End Finds – High-quality global products presented in an organized, smooth layout.

modern shopping finds – Products are trendy, site feels clean and user-friendly.

WildRose Picks Online – Friendly and inviting feel, discovered a few special pieces.

Mountain Star Hub – Trendy selections look appealing, browsing feels smooth and intuitive.

ValueChoiceHub – Well-structured layout, fast access, and enjoyable shopping flow.

Creative Market Studio – Vibrant items with organized displays, really enjoyed seeing the selections.

RainyCity Corner – Themed sections loaded quickly and exploring products was very simple.

Daily Digital Hub – Clean interface ensures fast access and simple navigation.

Everyday Goods Store – The layout is clean, and finding affordable essentials is effortless.

Seasonal Value Market – Products appear crisp, navigation is simple, and the site structure feels intuitive.

UniqueValue Studio Hub – Clean and modern layout with clearly displayed items enhances usability.

heritagemarketcentral – HeritageMarketCentral offers thoughtfully selected products with a classic vibe.

modern trend picks – Items look stylish, navigation is smooth and intuitive.

GlowMoon Collection Hub – Neat sections and gentle design create a comfortable user experience.

Wild Rose Hub Online – Cozy boutique vibe, found several enjoyable items while browsing.

Next Generation Picks – User-friendly site with a curated collection of modern lifestyle items.

Mountain View Corner – Solid deals displayed neatly, browsing feels intuitive and enjoyable.

Wild Rose Boutique – Charming layout throughout, found some unique and enjoyable pieces.

Intentional Design Market – Loved the clean layout and thoughtful product choices throughout the site.

DailyValueOutlet – Products well organized, pages load quickly, and shopping is smooth.

SunrisePeak Gallery – Has a bright, artistic charm that makes it easy to stay engaged.

Rare Flora Boutique – Beautifully arranged items with intuitive navigation and fast pages.

Premium Home & Style – Refined layout with intuitive browsing and organized categories.

Forest Lane Hub – Lovely forest-inspired selection, making browsing smooth and pleasant.

your fashion outlet – Selections are attractive, site loads quickly and feels intuitive.

UrbanChoice Studio – Neatly presented items with intuitive navigation and smooth page transitions.

Bright Mode Market – The product arrangement is visually pleasing, and browsing feels relaxed.

Fashion Choice Hub – Stylish options are well displayed, making browsing smooth and effortless.

Shopper’s Choice Link – The structured layout helps customers reach their desired items with minimal effort.

Future Lifestyle Picks – Easy browsing with innovative and exciting products throughout.

NameDrift Collections – Stylish selections offered, browsing feels natural and enjoyable.

EverForest Lifestyle – Natural and minimal presentation with a very pleasant navigation.

carefullychosenluxury – Carefullychosenluxury has an elegant selection that made browsing feel premium and fun.

SmartSavingsStore – Quick navigation, budget-friendly products, and smooth user experience.

Curated Fashion Hub – Calm, organized layout with clear sections for seamless navigation.

GrowMindsetHub – Content is inspiring, moving through pages was very smooth.

value picks center – Offerings appear solid, browsing feels seamless and smooth.

designmarketplace – DesignMarketplace presents contemporary items in a smooth, visually appealing layout.

Glow Lane Online Store – Attractive items and intuitive browsing make exploring simple and easy.

Fashion Daily Picks – Items are visually appealing, with navigation that is simple and fast.

Thoughtful Lifestyle Marketplace – The store highlights products chosen with intention, making browsing easy.

Tall Cedar Studio Online – Enjoyable cozy market, categories were easy to navigate.

NatureRoot Studio Online – Studio collections look appealing, navigation feels smooth and convenient.

Modern Ethics Collective – Browsing was effortless, the collection feels modern and meaningful.

ShareGrow Network – Welcoming design with a fresh feel and neatly organized sections.

Soft Petal Picks – Every visit feels peaceful, and the cute items always make me smile.

GoalBuildersShop – Easy navigation, motivational items, and a clean, user-friendly site.

Corner Style Discover – Intuitive filtering and a clean, trend-based look keep browsing efficient.

Design Inspired Shop – Inspiring design pieces with a clean and approachable interface.

ValuableLessonsHub – Informative content, and navigating the site was smooth.

discover hub shop – Items are neatly displayed, browsing feels simple and fast.

Fashion Deal Place – Great deals showcased here, shopping feels smooth and items look affordable.

>Creative Future Finds – The interface feels intuitive while showcasing imaginative products.

Goldcrest Studio Selection – Beautifully presented products, with browsing that feels intuitive and seamless.

NightBloom Collections – Items look impressive, navigating the outlet is quick and easy.

Premium Home Hub – Very pleasant browsing, the products are modern and appealing.

TrendExpressCorner – Smooth interface, modern trends, and simple, enjoyable navigation.

<Reliable Quality Store – Trustworthy items showcased with clarity and easy exploration.

Creative Market Spot – Lots of artistic variety shown cleanly, and navigating feels natural.

ModernFashionVault – Items are well-organized, navigating the site felt simple.

shopfornewdeals.shop – Deals are great here, browsing feels smooth and enjoyable overall today.

Studio FutureCrest – Great combination of style and usability, found a few standout items.

smartbuyzone – SmartBuyZone delivers a curated collection with clear, well-organized product details.

a href=”https://discoveryourpurpose.click/” />PurposeInsight Hub – Inspiring presentation with clear grouping of material improves navigation.

Worldly Essentials – The selection feels unique, and shopping is quick and pleasant.

Urban Ridge Treasures Online – Stylish store layout with a good variety of products to explore.

FDS Marketplace – Products are nicely organized, shopping feels pleasant and quick.

Design Explorer Hub – Easy navigation with a wide variety of unique creative pieces.

<Golden Harbor Outlet – Items appear trustworthy, and exploring the catalog feels smooth.

Northern Peak Selects – Products arranged neatly, shopping experience is convenient and enjoyable.

ChicChoiceHub – Fast browsing, appealing products, and intuitive site design.

Clickping Interaction Hub – Well-organized interface with smooth navigation and minimal distractions.

daily best finds – Products appear solid, browsing feels fast and enjoyable.

Timber Crest Creative – Enjoyed the artistic layout, every piece feels intentional.

Ethical Lifestyle Picks – Every product reflects care and thoughtfulness, and checkout is smooth.

Fashion Finds Shop – Trendy items available here, browsing feels quick and natural.

smartshopcentral – SmartShopCentral offers a reliable, polished platform with seamless browsing.

Golden Root Hub – High-quality items presented neatly, browsing feels smooth and simple.

WildShore Marketplace – Well-arranged and diverse selection, felt effortless to browse through.

Bloom Goods Center – A fresh arrangement of items offers a relaxed and easy browsing flow.

shop latest finds – Products look attractive, site feels user-friendly and clean.

WildRose Essentials – Warm and friendly environment, browsing uncovered a few gems.

Modern Home Design Hub – Smooth interface with a strong focus on creative product presentation.

moderncraftzone – ModernCraftZone delivers a unique shopping experience with modern and artisan selections.

UrbanLife Lane Online – Stylish modern products arranged neatly with smooth navigation make browsing simple.

FLH Boutique – Trendy selections arranged nicely, shopping feels natural and convenient.

Consumer Experience Studio – Browsing was effortless, with clear layouts and interesting product finds.

CommunityGlowHub – Browsing feels easy, products are interesting, and layout is user-friendly.

your daily shopping corner – Items are displayed clearly, navigating is quick and easy today.

Grand Forest Shop – Well-presented items, offering an enjoyable and easy browsing experience.

HighlandMeadow Picks – Easy-to-browse layout with a relaxed and pleasant design.

Curated Modern Heritage – The site feels organized, and products reflect a blend of tradition and style.

Fashion Outlet Deals – Items appear appealing and organized, navigating feels effortless.

modernshopzone – ModernShopZone features a well-thought-out range that makes picking products easy.